The nightmare scenario for central banks

14 Jul 2022 - Dario PerkinsEvery investor wants to know whether central banks are prepared to cause a recession in order to force inflation down. Surely, officials are bluffing, right? But think about it from the central banker’s perspective..

#Central Banks #Monetary Policy #Eurozone #United KingdomA recession to tame inflation?

19 May 2022 - Dario PerkinsThere is currently a big debate about whether central banks will need to generate a recession in order to force inflation lower. For the doves, such action is not necessary – because the “cure for high prices is high.

#Central Banks #Inflation #Eurozone #RecessionDon't bet on a soft landing

10 Mar 2022 - Dario PerkinsEvery economist wants to be famous for some great idea they had or to have their name forever linked to an original economic concept or unique thought. We have Keynesian demand-management, Friedman’s monetarism,.

#Central Banks #Monetary Policy #Inflation #Eurozone #RecessionShort shortages - in charts

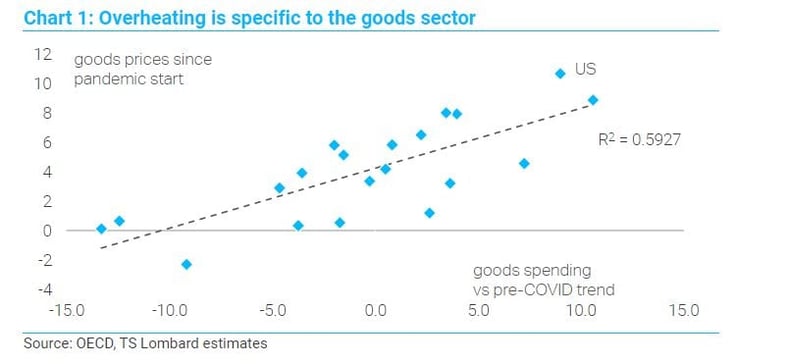

10 Feb 2022 - Rory GreenThe pandemic demand shift and supply mismatch catalysed a surge in global goods inflation. The supply side is improving to meet the new Covid-19 demand reality just as DM consumers transition to services spending..

#Central Banks #Inflation #Eurozone #Fiscal Policy #SemiconductorsDon't extrapolate from this fake business cycle

13 Jan 2022 - Dario PerkinsEdgar Fiedler, who served as Assistant Secretary of the Treasury in the Richard Nixon and Gerald Ford administrations, famously joked: “Ask five economists a question and you'll get five different answers – six, if one.

#Central Banks #Monetary Policy #Inflation #Recession #Recovery‘Undecided’ bond market has made up its mind – at least for now

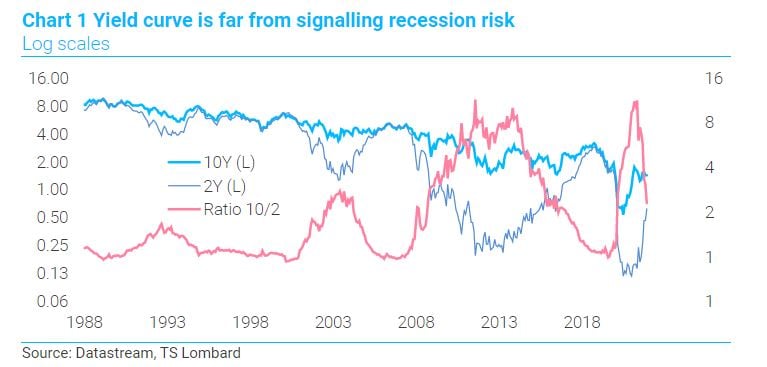

13 Jan 2022 - Konstantinos VenetisTime to play catch-up. Policymakers have finally dropped the “transitory” narrative and are playing catch-up, rushing to normalize monetary settings closer in line with last year’s sharp positive macro turnaround. While.

#Central Banks #Federal Reserve #Monetary Policy #Inflation #Bond marketsThe Sellside Guide to Christmas

24 Dec 2021 - Dario PerkinsThe Christmas blockbuster: For economists, Christmas is all about the big “Year Ahead” publication. Even though it’s obvious nobody actually reads these tomes (except, maybe, other sellsiders), they have to be really.

#Central Banks #Bank Of England #FX Market #Cryptocurrency #ChristmasPowell underplays hawkish turn

17 Dec 2021 - Steven BlitzThe march to a March hike is on, assuming, of course, no great downward swerve in growth and/or inflation between now and then. The FOMC sees three hikes in 2022 and this pacing alone tells you March comes first. Powell.

#Central Banks #Federal Reserve #Monetary Policy #InflationFirst Fed hike in March - it's not about current inflation

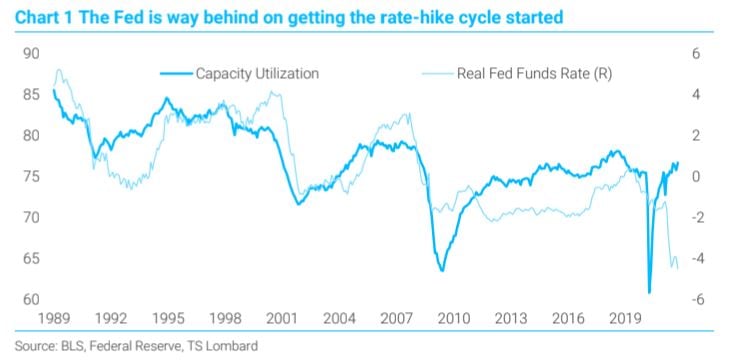

09 Dec 2021 - Steven BlitzMarch will mark the first Fed rate hike, sooner than the June timing I recently shifted to, and much sooner than the original Q4 call made in November 2020. The timing is being pulled forward because the circumstances.

#Central Banks #Federal Reserve #Monetary Policy #InflationFed's inflation problem is wages in 2022, and no workable answer for it

02 Dec 2021 - Steven BlitzThe Fed’s problem is that current price hikes from shortages of goods and labour will pass, but the coming increase in wages will not. Because the conduit of monetary policy runs through the dollar and the equity.

#Central Banks #Federal Reserve #Monetary Policy #Inflation Client Login

Client Login Contact

Contact