The cycle starts to bite

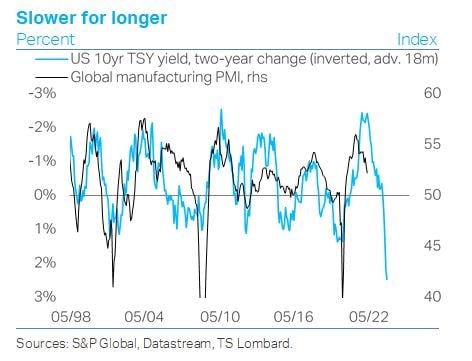

11 May 2022 - Konstantinos VenetisThe macro story of 2022 is “higher-for-longer inflation” that is forcing central bankers across the major DMs, led by the Fed, to tighten into slowing growth. Going into this year, a slew of high-frequency indicators.

#Federal Reserve #Inflation #China #Bond marketsYEN MOVES AND THE BOJ ‘TAPER’

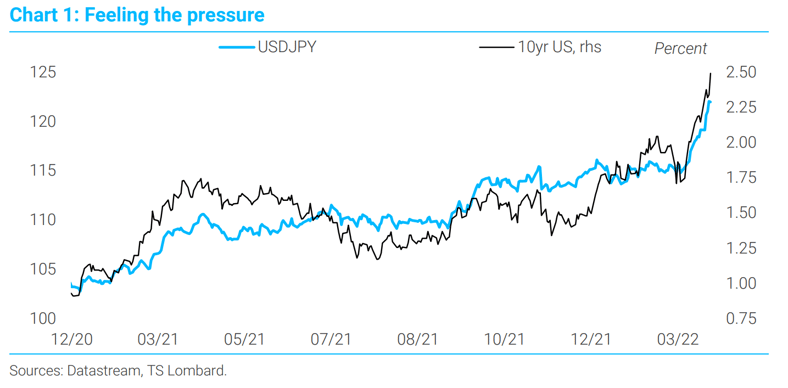

29 Mar 2022 - Konstantinos VenetisPronounced widening in JGB interest rate differentials, particularly versus US Treasuries, catalysed accelerated yen depreciation in March. Chances are that we are getting closer to a “taper” of Japanese monetary.

#Monetary Policy #Bond markets #Bank of Japan #FX Market‘Undecided’ bond market has made up its mind – at least for now

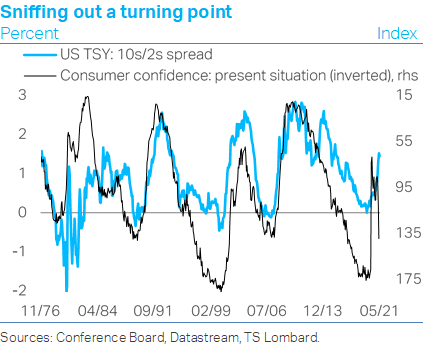

13 Jan 2022 - Konstantinos VenetisTime to play catch-up. Policymakers have finally dropped the “transitory” narrative and are playing catch-up, rushing to normalize monetary settings closer in line with last year’s sharp positive macro turnaround. While.

#Central Banks #Federal Reserve #Monetary Policy #Inflation #Bond marketsBonds are saying the market needs a new catalyst

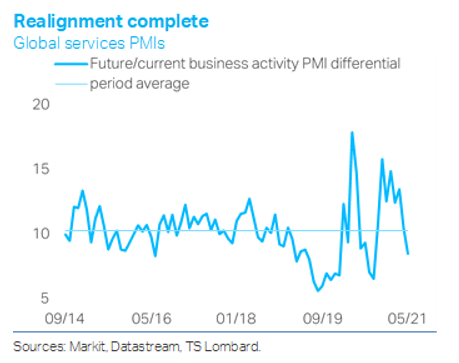

15 Jun 2021 - Konstantinos VenetisThe second quarter of 2021 is set to mark the peak in quarterly GDP growth for most of the major economies, which will give way to a still solid but slower pace of expansion as the transition from an early to a.

#Federal Reserve #Inflation #Bond markets #RecoveryMid-cycle transition means no more low-hanging fruit

11 May 2021 - Konstantinos VenetisThis economic cycle has matured very quickly, courtesy of a strong policy response and the speedy arrival of effective vaccines against Covid-19. Indeed, this has felt more like a bounce-back from a natural disaster.

#Federal Reserve #Inflation #Bond marketsThe Equity Market is now in charge

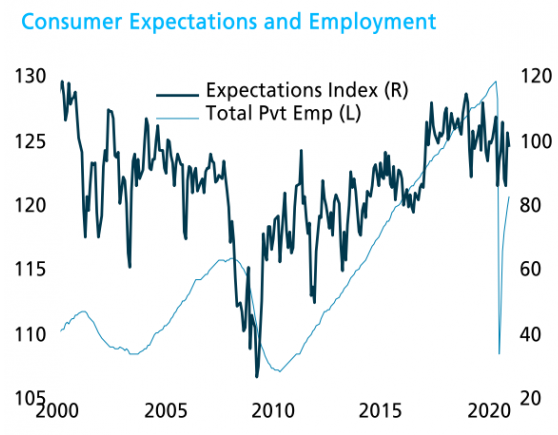

09 Nov 2020 - Steven BlitzBiden won, Trump lost, but lots of Republicans also won, and the October employment data help explain why – the population does not see the economy in crisis. The ongoing recovery in the labour market (906,000 private.

#Federal Reserve #Monetary Policy #Equities #Bond markets #US Economy #US ElectionPerma-frosts and fiery endgames

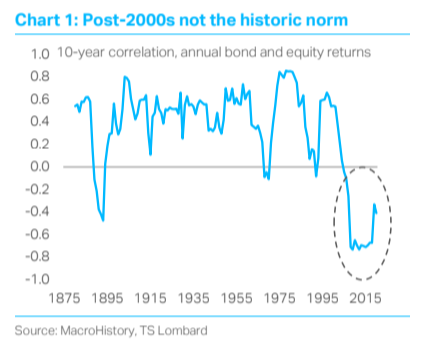

06 Nov 2020 - Dario PerkinsThe bond-equity correlation has gone mainstream in 2020, thanks in part to what happened in March when yields spiked even as equities crumbled (i.e. there was a POSITIVE correlation in returns). While this was.

#Central Banks #Equities #Bond marketsWorld Trade momentum

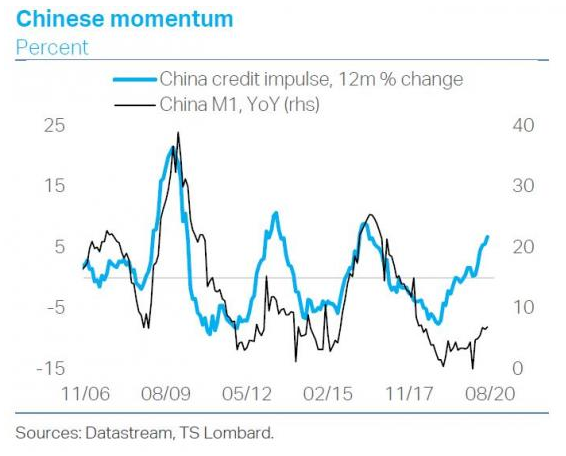

06 Oct 2020 - Konstantinos VenetisMacro momentum is easing but remains positive. Our Global Leading Indicator remains consistent with improving macro momentum, in line with the message from other widely followed high-frequency series like the OECD.

#Equities #China #Bond markets #Commodities #USDCOVID-19 and secular stagnation - the next business cycle

16 Jun 2020 - Dario PerkinsCOVID-19 has resolved our most popular client question of the last five years – “when will this cycle end?’ Even as the number of infections slows and the lockdowns end, most economies will reopen to a serious global.

#Federal Reserve #Monetary Policy #Equities #Bond markets #Covid19 Client Login

Client Login Contact

Contact