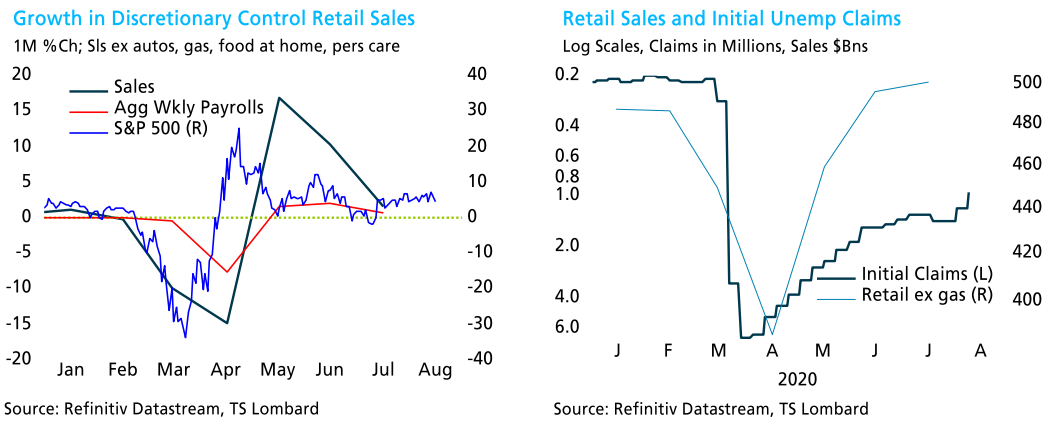

The $600 top-up in unemployment benefits is critical for those getting the funds, but its absence means less to overall retail spending than many opine. More critical to the revival in retail spending is the recovery in the equity market, a recovery itself owed to the Fed and the increase in overall employment as the economy reopened (see chart below left). It is, therefore, no surprise growth in retail spending slowed in July in line with the slower growth in hiring and the equity market. Looking forward, if the equity market simply churns around current levels through year-end, retail spending would be more attuned to employment trends,which we expect to see soften. As for unemployment and retail sales, spending is now above pre-virus nominal levels despite initial unemployment claims remaining well above normal recessionary levels (peak in 2009 was 665,000).

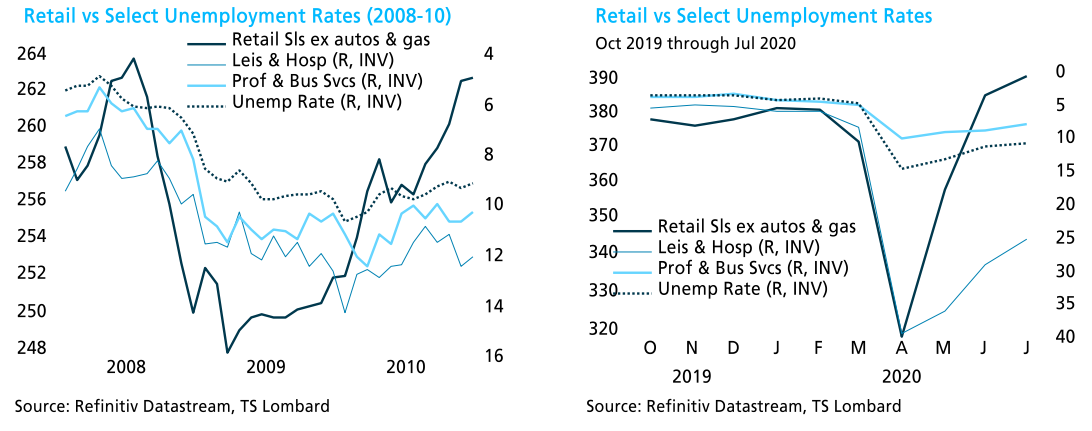

Staying with the unemployment / retail sales connection, we illustrate in the charts below the level of retail sales against the unemployment rate, and the unemployment rates for leisure and hospitality and for professional and business services. The chart below left covers the 2008-10 period. What stands out is retail sales bottoming with the equity market in March 2009 and fully recovered, nominally, by the end of 2010. Unemployment, however, continued to worsen and then crabbed sideways. Note too that the unemployment rate for business services was only modestly better than it was for hospitality services. Today, similar to 2008-10, the recovery in spending dovetails with the equity market (chart below right). The much higher unemployment rate for leisure & hospitality adds to retail’s bounce with stocks because unemployment is so concentrated among those with, by far, the lowest average hourly earnings and least contribution to overall discretionary spending.

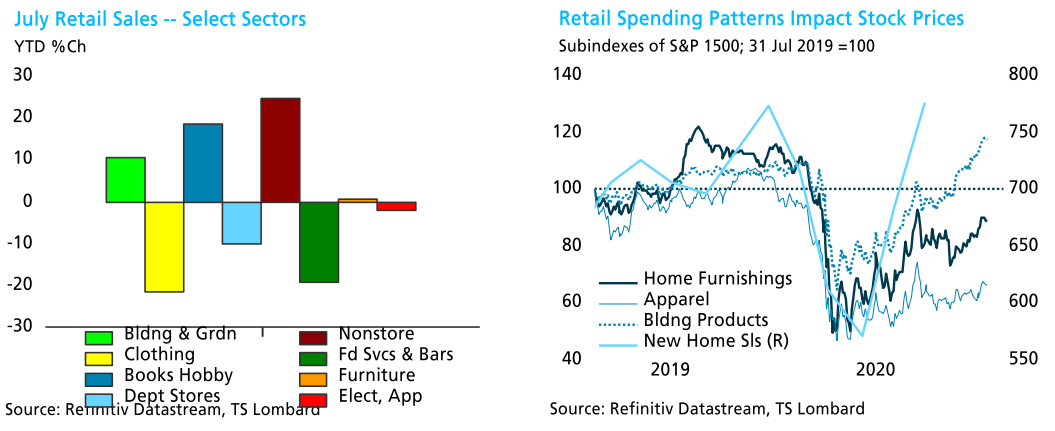

The breakdown of spending by sector year-to-date shows the bias to buy for the home, and to buy from local retailers (brick & mortar sales are back even with online). Spending at building and garden supply stores is up and spending at furniture and appliance stores is back to even on the year (chart below left). Spending at retailers selling books, sporting goods,hobbies, and musical instruments – hunkering-down at home items -- are still up on the year but fell 5% in July, testament to people heading back outside. The equity markets notice the shift in spending to favour the home (see chart below right).

In sum, the equity market rally, a product of the Fed and 50% of temporary unemployed back working, is behind the upturn in retail spending. The July slowdown in hiring and equity performance also slowed growth in retail spending. The tie between spending and equities warns fiscal and monetary policymakers to remain aligned in supporting the economy. If not,disappointment expressed in equity prices means a drop in retail sales will soon follow.

Client Login

Client Login Contact

Contact