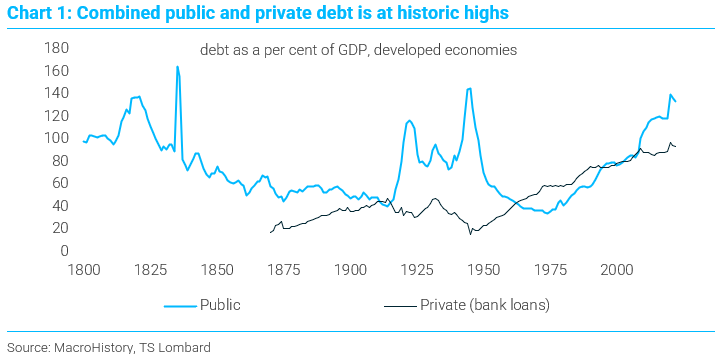

Inflation was always the Endgame

04 Nov 2022 - Dario PerkinsThere is beautiful irony in macroeconomics, a sort of inherent Minsky dynamic, or universal Goodhart law, that means that just when everyone thinks something is definitively true, it turns out to be spectacularly false..

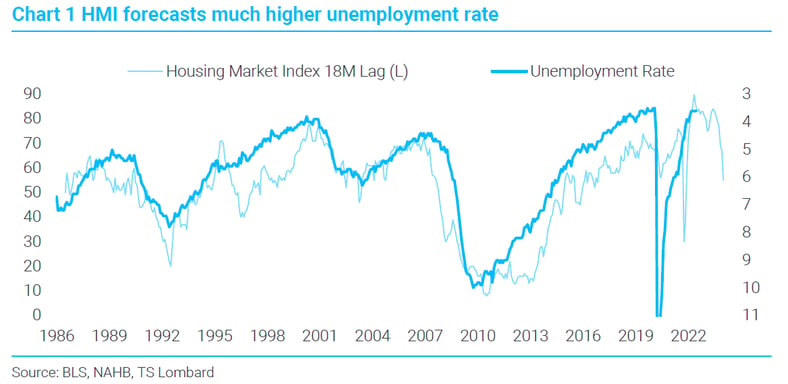

#Federal Reserve #Monetary Policy #Interest Rates #Recession #UnemploymentHow High for Unemployment in the coming US Recession

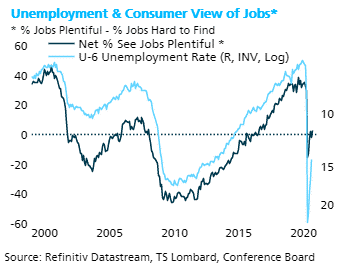

26 Jul 2022 - Steven BlitzThere are any number of ways to dissect the spread between the 7% job openings rate and 3.5% unemployment, but the needed drop in demand’s contribution to current inflation occurs when this spread turns negative..

#Federal Reserve #Monetary Policy #Interest Rates #Recession #UnemploymentReading through US unemployment

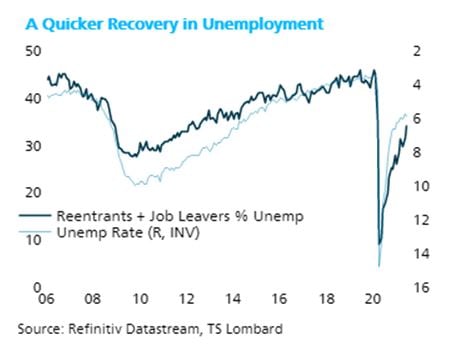

05 Jul 2021 - Steven BlitzThis was a healthy jobs report by most measures, and a read through of the unemployment data indicates the same. All of the increase in unemployment (household survey) came from a rise in people quitting their jobs and.

#Federal Reserve #Unemployment #RecoveryFed resets the betting table

21 Jun 2021 - Steven BlitzAt Wednesday 16th June’s meeting, the FOMC moved closer to my long-held view that the rate hike first comes at the end of 2022, with two hikes completed by the end of 2023. It was not a unanimous decision, but the.

#Federal Reserve #Unemployment #RecoveryDo consumers ever borrow again?

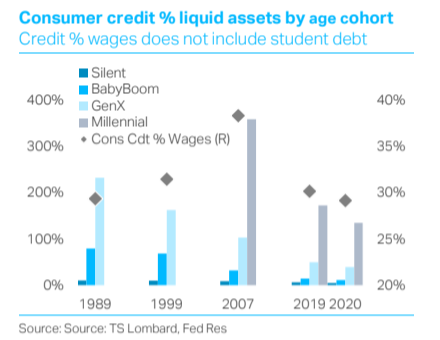

13 Apr 2021 - Steven BlitzIf the coming expansion is to be different from the last one, consumers will boost their borrowing relative to income – and there is good reason to believe they will. If they do, real growth gets a lift and so too.

#Federal Reserve #Inflation #US Economy #Debt #UnemploymentConsumer Confidence Rebound Confounds the Economic Narrative

30 Sep 2020 - Steven BlitzThe rebound in consumer confidence is just one more indication that the usual narrative from high unemployment fails. To be sure, the confidence levels from the summer still project a loss for Trump (as it would for any.

#Equities #Recession #US Economy #Unemployment #Labour MarketThe Covid-19 recession: L comes after K?

17 Sep 2020 - Dario PerkinsIt is a cliché to say everyone’s experience of the COVID-19 recession has been different, but no sell-side economist ever shies away from using cliché to construct a narrative. For some people – especially those on the.

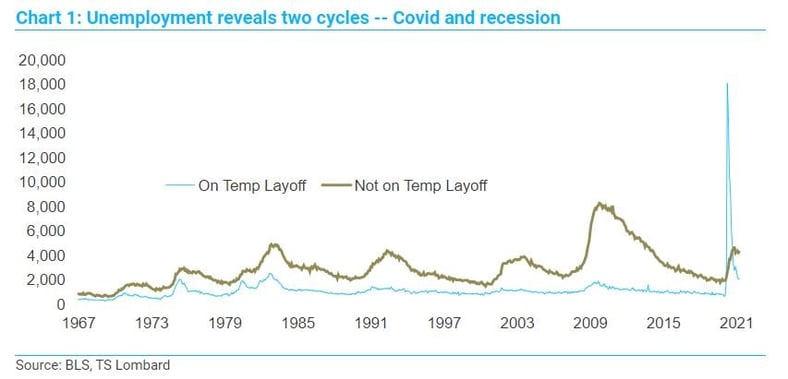

#Recession #Fiscal Policy #Covid19 #Unemployment #Macro PictureAugust Unemployment – The Recession Begins to Emerge

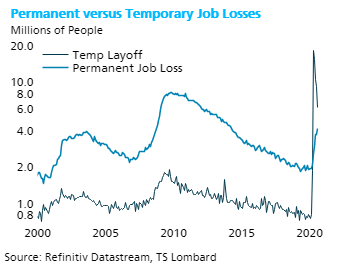

04 Sep 2020 - Steven BlitzNot that one could tell that from the strong headline job gains, but remember the critical aspect of understanding the economy’s dynamics is that there is the mandated shutdown and reopening overwhelming the data – and.

#Recession #US Economy #UnemploymentCan the world rebound from the Covid-19 recession?

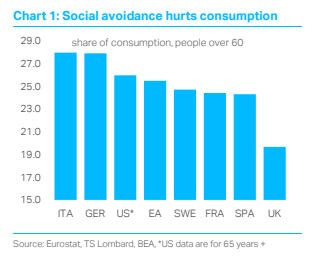

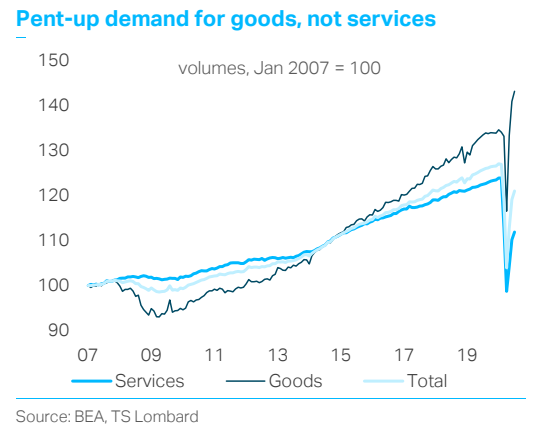

01 Sep 2020 - Dario PerkinsThe COVID-19 economic collapse was unlike anything we have seen before. This was not your classic recession. Yet it was actually easy to forecast. Given the nature of the shock – especially lockdowns and social.

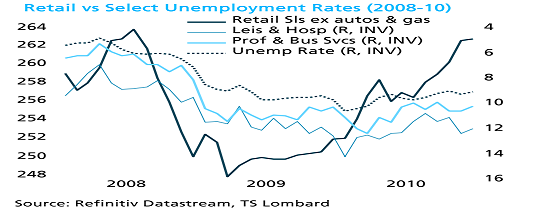

#Recession #Covid19 #Unemployment #Retail SalesRetail boosted by equities, not $600

17 Aug 2020 - Steven BlitzThe $600 top-up in unemployment benefits is critical for those getting the funds, but its absence means less to overall retail spending than many opine. More critical to the revival in retail spending is the recovery in.

#Equities #Covid19 #Unemployment #Retail Sales Client Login

Client Login Contact

Contact