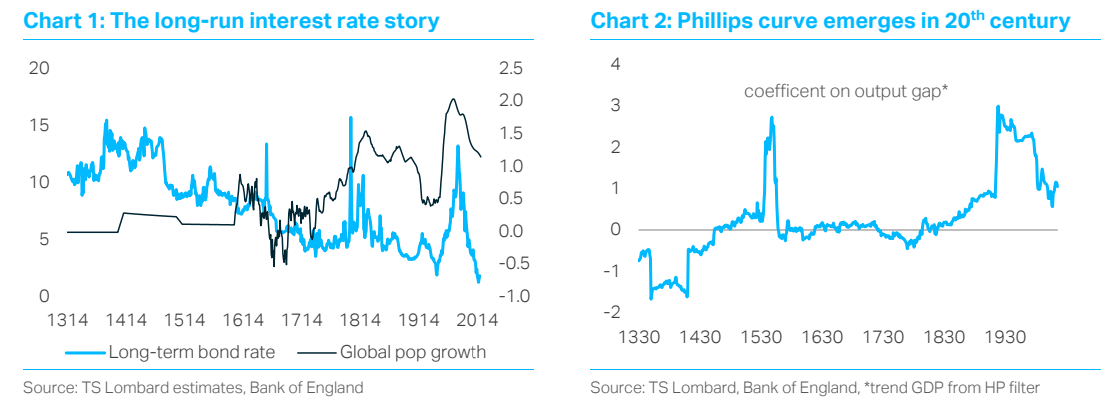

These days, economists tend to assess monetary policy relative to some deep underlying interest rate (the “equilibrium rate”, or r*) which depends on structural forces and is largely beyond the control of central banks. Slow-moving secular shifts in demographics, technology and globalization will alter the balance between savings and investment, causing this equilibrium interest rate to move around over time. But it is up to the monetary authorities to decide how to respond to r* and their actions will influence inflation outcomes. If they set interest rates above equilibrium, policy is too tight and inflation will drop. Keep monetary policy too loose and inflation will rise. This provides a useful framework to think about the “reflation narrative” that has now taken over in markets. (Note – it wasn’t always like this. There was a time when central banks had much less influence, with monetary conditions tied to the availability of precious metals. Interest rates responded to new discoveries of gold and inflation was statistically just “white noise”.)

"Easy monetary policy is necessary – not sufficient – for CPI breakout"

Everything changed in the 20th century. First, we had a powerful political backlash against inequality, globalization and two World Wars, which produced the modern welfare state, trade unions and the first socialist/progressive political parties. As bargaining power shifted to workers, the so-called Phillips curve started to emerge in most developed economies, where inflation seemed quite responsive to capacity utilization. Then, after World War II, the world experienced a massive demographic shift, with the emergence of the baby boomers. By the 1970s, these people had reached working age, creating a younger and more militant workforce. Throw in the energy crisis, growing social tensions (from the late 60s onwards) and President Nixon severing the link to gold and you have the perfect recipe for an extreme inflation outbreak. Returning to our inflation model, the equilibrium interest rate had risen, but central banks (with the exception of the Germans) didn’t respond. Perhaps they made an “honest” mistake in miscalculating supply potential, but – in a more sinister way – they were also the victims of “fiscal dominance”. Politicians, with their inherent inflation bias, wielded significant control over them.

The policy response to the 1970s was profound. It is easily forgotten, but back then regular people – not just central banks – hated inflation. It was regularly the number one source of financial anxiety for the general public. Over time, right-leaning governments responded by dismantling the institutions they thought had created runaway wage-price spirals, crushing trade unions, abandoning wage indexation and strengthening the independence of central banks. The authorities also set macro policy – both fiscal and monetary – in such a way that it always leaned against any potential inflation outbreak. This was the era of “opportunistic disinflation”. Governments resisted any temptation to use their balance sheets as a tool for macro stabilization, while central banks always erred on the side of running their economy “too cool” (a sort of perma-lukewarm), rather than allow dangerous overheating. Their approach was based on a philosophy that is becoming increasingly distasteful in today’s “cancel culture”, the idea that always keeping some people out of work was an acceptable way to ensure wage restraint.

"Central banks want to “run the economy hot”, but secular forces rule"

With Reagan/Thatcherite politics, steady globalization and rapid technological change crushing worker power, the world eventually ended up in a macro climate not unlike the “long depression” that had existed towards the end of the 19th century – a disinflationary environment of polarization and inequality – where economists could debate whether official GDP data were missing the latest productivity enhancements but to most people it didn’t really feel like a time of rapid progress. It is also notable that the two structural forces that seem to have done the most to reduce long-term interest rates – globalization and technology – where the same secular forces that had been so dominant in the second half of the 19th century. In both episodes, policy failed. Monetary policy was constrained and the fiscal authorities preferred “austerity”.

Why this long historical digression? Because history shows what central banks can and – more importantly in the current context – cannot achieve. The Fed, ECB etc. can all desire higher inflation – a welcome shift from their deflation bias of the last 30 years - but unless there is a secular increase in r*, they will struggle to achieve this outcome. The problem today is that it’s not entirely clear how those secular inflation forces will evolve. Demographics are changing, with an inflection point in the share of the population who are spenders rather than savers. Older people save less. But the “militancy” of the late-1960s/1970s isn’t going to return. Meanwhile, globalization looks set to give way to “de-globalization”, which – over time – might also restore worker “bargaining power”. There are even some politicians – including the new US administration – who talk about resurrecting the trade unions. But will this happen quickly, particularly in an era of continued rapid technological change? And unfortunately, we still have to work through the “hysteresis” of the previous low-interest-rate regime, particularly the overhang of public and private debt. The most compelling argument for a rise in r* is that governments are set to embrace perma-fiscal deficits, perhaps even a new MMT-regime. But are we sure about this? Massive fiscal easing was an absolute no-brainer when governments were forcing people to stay at home in 2020-21. Budget decisions will get trickier once the pandemic is over.

"The medium-term price outlook is fuzzy – inflation bets are premature"

There is no doubt there has been a profound shift in monetary objectives over the past 12 months. But history suggests this a necessary condition for higher inflation, not a SUFFICIENT condition. It seems seriously premature to think we are on the brink of a new inflationary era.

Client Login

Client Login Contact

Contact