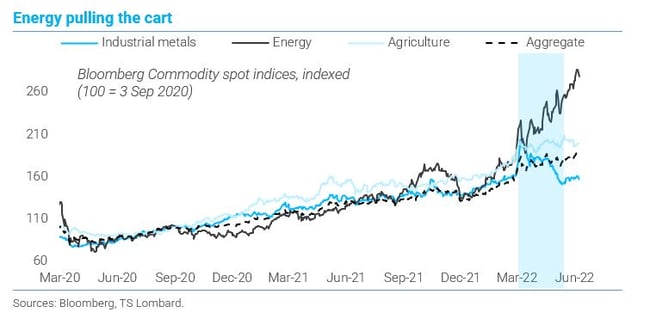

Commodity prices continue to trend higher but the breadth of the rally has narrowed: industrial metals have corrected lower in 2022 Q2, leaving energy prices to pull the cart. Where do we go from here?

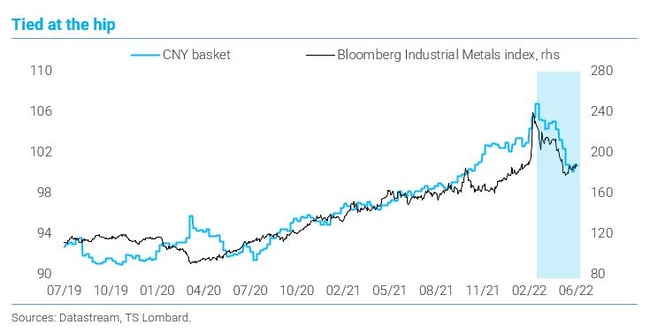

The case for a secular metals-led commodity bull remains valid, but from a cyclical standpoint the rally has looked increasingly vulnerable this year against the backdrop of receding macro tailwinds. Global industrial activity is slowing, the PBoC has changed tack on the CNY, dollar liquidity is tightening and investor sentiment has become more fragile – a combination that spells rising downside risks.

These have taken a toll on industrial metal prices over the course of 2022 Q2. Benchmark industrial metal indices have given back all their post-Ukraine gains, dragged by soaring US Treasury yields, CNY depreciation and sustained dollar strength.

Expectations for Fed tightening cooled following May’s FOMC meeting, capping the advance in US yields and pulling the dollar lower. With Shanghai lifting lockdown restrictions, the latest China manufacturing PMIs showing signs of improvement and Beijing ramping up stimulus efforts, CNY has stabilized under the 6.70 mark, allowing the price of copper and other key metals to find a firmer footing.

The question now is whether this is the beginning of another leg-up or just a short-term relief bounce. We expect the highs set in March to hold for the foreseeable future, with industrial metal prices moving sideways as the tug of war between cooling macro tailwinds and tight supply fundamentals continues.

The Chinese economy remains stuck between “zero Covid” and a desire to support real activity. We think that ultimately growth is what gives, raising the likelihood that CNY heads back to pre-Covid levels of 7-7.2 by yearend. Crucially, persistent Omicron risk will make any post-lockdown rebound sluggish, lowering the multiplier of the large infrastructure stimulus and continued monetary easing that we expect. Moreover, the “initial conditions” are less favourable than they were two years ago: back then, China bounced back from the pandemic outbreak thanks to the mix of very strong external demand, a booming property market and a relatively less infectious Covid strain; in 2022, diametrically opposite conditions apply.

Also, chances are that the dollar rally resumes as Eurasian growth shows clearer signs of deterioration and sticky US inflation keeps the Fed on its toes. All this points to a “soft landing” as the least likely path for the world economy, clouding the demand outlook for commodities. That said, the combination of deficient supply, low inventories and elevated risk premia on the prospect of Ukraine becoming another “forever war” is bound to keep propping up prices.

Also, chances are that the dollar rally resumes as Eurasian growth shows clearer signs of deterioration and sticky US inflation keeps the Fed on its toes. All this points to a “soft landing” as the least likely path for the world economy, clouding the demand outlook for commodities. That said, the combination of deficient supply, low inventories and elevated risk premia on the prospect of Ukraine becoming another “forever war” is bound to keep propping up prices.

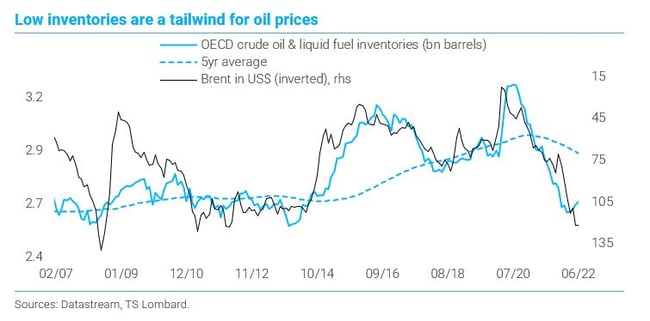

With industrial metals resetting lower and agricultural prices holding steady over the past three months, it is continued strength in energy that has single-handedly kept feeding the commodity bull. It is striking that we are at US$120 oil despite decelerating Chinese activity and intensifying worries about a global economic “hard landing”. This points to a fundamental backdrop of low inventories and sluggish supply (from both OPEC and non-OPEC producers) that has been exposed by a surge in demand as the world economy reopened.

Elevated geopolitical uncertainty has made what was already a tight market only tighter still. Refining capacity constraints, especially for diesel product, are amplifying the impact from output disruptions in the wake of the Russia-Ukraine conflict against the backdrop of chronic underinvestment. Crude in floating storage is down to its lowest since February while the latest price increase by Saudi Arabia for shipments of its crude to Asia came in higher than expected; prices for European buyers were raised, too, pointing to healthy global demand.

Elevated geopolitical uncertainty has made what was already a tight market only tighter still. Refining capacity constraints, especially for diesel product, are amplifying the impact from output disruptions in the wake of the Russia-Ukraine conflict against the backdrop of chronic underinvestment. Crude in floating storage is down to its lowest since February while the latest price increase by Saudi Arabia for shipments of its crude to Asia came in higher than expected; prices for European buyers were raised, too, pointing to healthy global demand.

Riyadh’s decision to bring forward OPEC+ supply increases planned for September into July and August is a welcome gesture, but it will not move the needle: many of the smaller cartel member have been struggling to meet their production targets and the loss of Russian supply as EU sanctions tighten could be much larger.

At this juncture, it looks like only a severe shock to demand can cool this oil market. High prices are the best cure for high prices, as rapid energy cost increases are, in effect, a tax on global growth. Looking at the rate of change in the Brent/copper ratio versus the global manufacturing PMI shows that when oil price outperformance relative to copper gathers pace, this tends to coincide with a downturn in the industrial cycle.

The million dollar question is what the world economy’s pain threshold is. We do not pretend to know the answer, but we note that the level from which demand slows matters. Our sense is that the outsized post-Covid snapback in global economic activity means it will probably take oil prices staying higher for longer than in previous cycles in order for material demand destruction to set in – just as the Fed feels it needs to be more aggressive about monetary tightening in order to bring demand closer in line with supply. We expect backwardation in the oil forwards to remain elevated over the next couple of months but to moderate from “both sides” as near-term premia ease while the longer end of the curve holds up better.

Client Login

Client Login Contact

Contact