The year of the payback

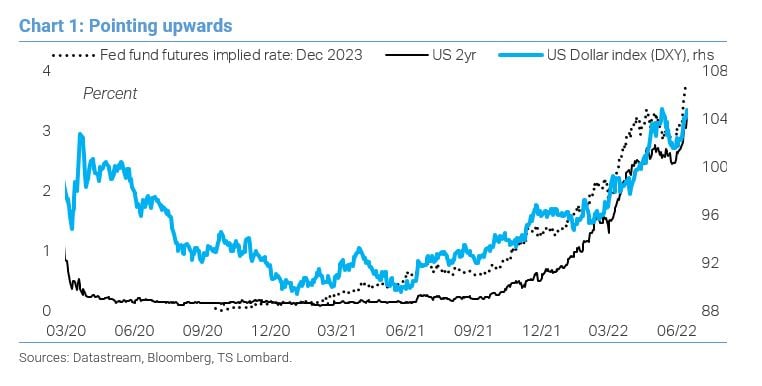

20 Jun 2022 - Konstantinos VenetisThe markets remain caught in the pincer movement between a hawkish Fed and slowing world growth: 2022 is “payback year” following the outsized gains of 2021. Inflation looks like it is about to peak but at the same time.

#Federal Reserve #Monetary Policy #Inflation #China #OPECAll eyes on oil as the commodity rally narrows

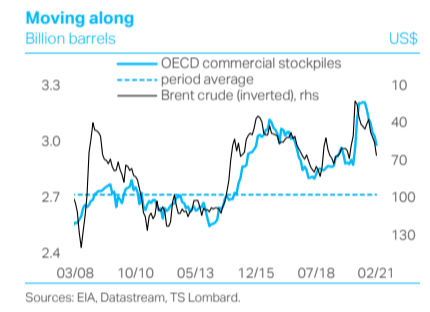

13 Jun 2022 - Konstantinos VenetisCommodity prices continue to trend higher but the breadth of the rally has narrowed: industrial metals have corrected lower in 2022 Q2, leaving energy prices to pull the cart. Where do we go from here? The case for a.

#Federal Reserve #OPEC #Commodities #OilOil: new playbook, same old cycle

05 Mar 2021 - Konstantinos VenetisWe have often made the argument that although the nature of the Covid shock makes this macro cycle unique, it is important not to lose sight of the fact that this remains a cycle. The same is true of the oil market..

#Inflation #OPEC #Commodities #OilChip Famine and the new OPEC

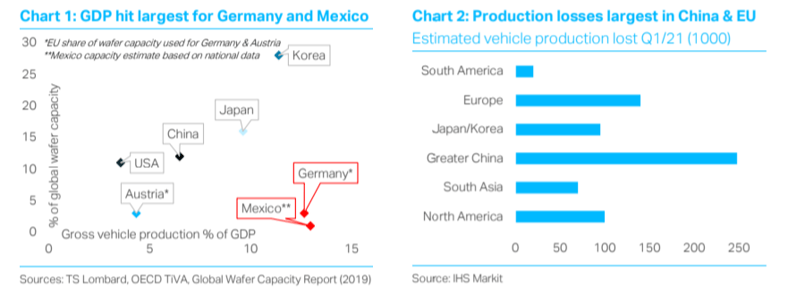

19 Feb 2021 - Rory GreenSurging demand for semiconductors is putting pressure on vehicle production and US-China relations. Taiwan and Korea are the prime beneficiaries, insatiable demand for their exports and rising prices adds conviction to.

#Trade War #China #Technology #OPEC #Semiconductors #GeopoliticsGeopolitical Spotlight shifts to semiconductors - the new oil

10 Feb 2021 - Rory GreenThe structural shift in demand for semiconductors moves the focus of global geopolitics and finance from the Persian Gulf to the South China Sea. The rapid acceleration of the “internet of things”, to-date and to-come,.

#China #Oil & Gas #OPEC #Semiconductors #Geopolitics Client Login

Client Login Contact

Contact