June’s MPC meeting delivered no surprises, but the debate within the Committee is becoming more nuanced. A closer look at the minutes reveals early signs of a rift between 1) those members on alert for imminent signs of broadening and persistent underlying inflationary pressures; and 2) those pointing to the merits of waiting to see what labour market slack will look like once the furlough scheme and other government support measures get withdrawn.

There is no question that the nature of the recent jump in inflation is predominantly transitory, spurred by the combination of a snapback in demand with low inventories, Covid-related supply bottlenecks, shortages in key production inputs and strong base effects. All these can be expected to dissipate over time as the intensity of returning demand diminishes and supply disruptions ease. With UK lockdown restrictions extended for another month; and with no evidence of destabilization in longer-term household inflation expectations, the MPC’s bias to “both lean strongly against downside risks to the outlook and ensure that the recovery was not undermined by a premature tightening in monetary conditions” is reasonable.

Still, this need not imply static policy. Maintaining essentially the same stance as in November 2020 sends a ‘whatever it takes’ signal that was appropriate during the height of the pandemic but has become much less relevant now that the UK economy is transitioning from early- to mid-cycle.

The MPC’s cautious approach goes hand-in-hand with a commitment to stay behind the curve on inflation in order to facilitate the economy’s return to full employment. While in principle there is nothing wrong with this mindset, in practice it faces two main criticisms.

First, it is conditioned on the experience of the post-GFC macro environment. What has emboldened the BoE and other major central banks to formally opt for running their respective economies hot is the lack of inflationary pressures over the previous decade despite unprecedented amounts of monetary easing. However, there are good reasons to think that the macro regime is changing, and this is something that policymakers cannot afford to be turning a blind eye to.

A key difference with the 2010s is the brewing paradigm shift in DM fiscal policy. The UK along with the rest of the G7 governments appear minded to keep the spending taps loose beyond this crisis as part of a broad push to “build back better”. In short, monetary easing is no longer the only game in town.

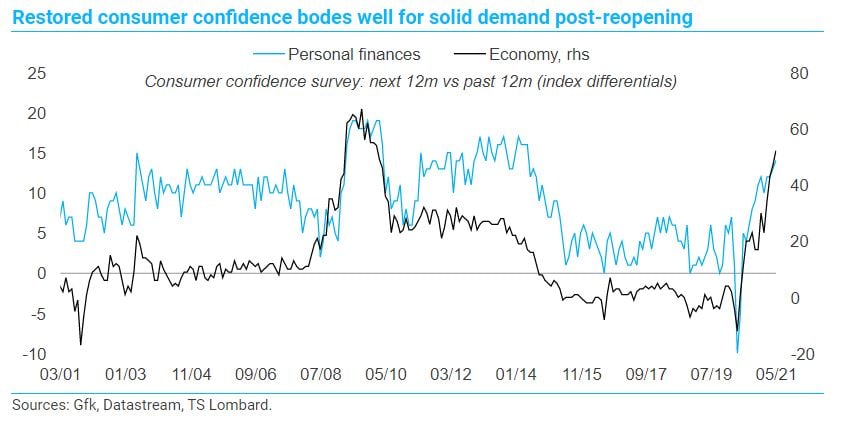

Further, the combination of elevated household saving rates and recovering labour incomes implies a potentially very powerful tailwind for private consumption. Buoyant consumer sentiment, buttressed by pro-growth fiscal policy and a booming property market, could set in motion a virtuous cycle between household spending and corporate profits. In other words, it raises the odds that the UK economy achieves “escape velocity”, translating to solid demand beyond the post-Covid reopening. What is more, upward pay pressures could be amplified by Brexit as the end of free movement will effectively restrict labour supply, especially in the service sector.

All this suggests that what is effectively a shift from a forward-looking to a backward-looking monetary policy orientation has been mistimed.

Second, policymakers like to stress that they have the tools to bring inflation back down if necessary. The hard part, however, is doing so smoothly, without unduly disrupting the cycle. This is a matter of getting ahead of the curve, not behind it, i.e., it implies the need for taking into account shifts in the balance of risks, not just past data.

The MPC would therefore do well to start early on dialing back monetary accommodation from (what is currently still) emergency mode to something less extreme, if only for communication purposes. Departing Bank chief economist Andy Haldane’s proposal for a £50bn reduction in the target stock of gilt purchases would be one way of doing it; a ‘normalization hike’ (from 0.10% to 0.25%) that is not necessarily the start of a tightening cycle would be another.

Either of these would still be consistent with a policy stance that 1) is loose enough to guard against downside risks; 2) acknowledges the much-improved macro outlook; and 3) does not constitute a meaningful tightening in financial conditions. Importantly, these policy tweaks would make sense irrespective of how persistent the rise in inflation proves to be – if anything, they could be viewed as a way to ‘take insurance’ against the risk of sustained/intensifying price pressures.

To sum up – there is a mismatch developing between 1) what looks like a nascent macro regime change, underscored by a departure from austerity-minded fiscal policy; and 2) the inclination of the BoE and other major central banks to be late on inflation. From a risk-management standpoint, this raises the likelihood that policymakers end up not seeing the forest for the trees, i.e. being too timid/slow on adjusting policy while waiting for the inflation noise to clear. The risk is that the MPC eventually needs to tap on the monetary brakes too hard, unsettling the economic recovery and injecting volatility into financial markets. But this is a story for next year.

Client Login

Client Login Contact

Contact