Today, in the middle of this cycle, the straight path is lost -- the Fed is hoping for relief from abroad because it fears the chase that inevitably leads to lost jobs and wealth. Seeing the Fed play for time, markets invert inflation risk without tightening financial conditions and this has opened the way for equities to rally. Eventually, either the world ramps up real yields through slower growth lowering inflation, or the Fed decides to confront its fears and act accordingly. Until then, the economy rhymes with 1978 – since some calendar reference always seems necessary.

In 1978, the nominal curve inverted but only the inflation premium rose. Real growth slowed but inflation did not, and equities advanced. The economy eventually needed credit controls and the funds rate pushed up another 600bp after the initial 700bp increase to finally get real yields high enough to create the deep recession that ended the great inflation. There are more reasons why today is not like 1978 than why it is, but it is true that all curve inversions eventually need high enough real rates to go along with it to curb growth and contain inflation and this is far from where the economy is today. All of which says that the Fed has a lot of catching up to do to tighten financial conditions if the world is not going to come to its rescue. As for where the threshold lies when real rates slow growth, the answer is only known after the Fed passes the mark.

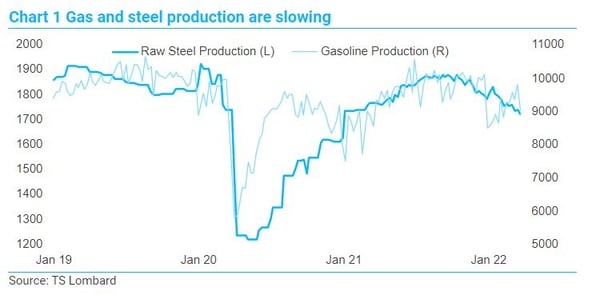

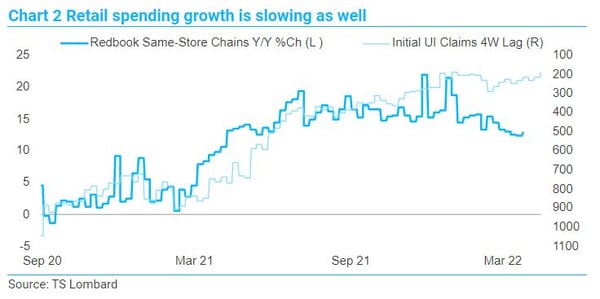

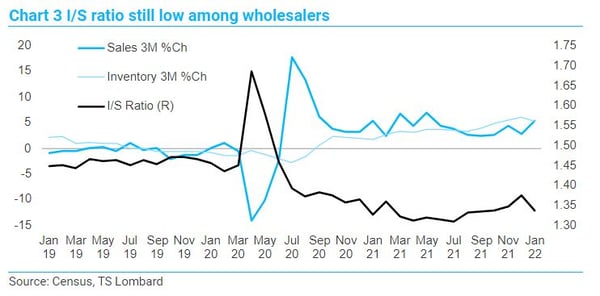

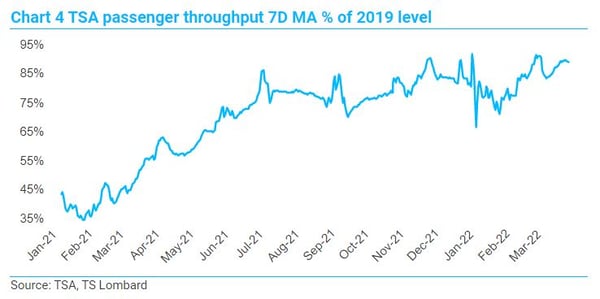

Taking a quick look at high frequency data, the economy is slowing but not signalling recession. Production of steel and gasoline are both slowing (Chart 1) from peak levels hit last summer, and Y/Y nominal retail spending growth has also begun to tail off even though unemployment claims continue to improve (Chart 2). As for an inventory overhang, typical reason for recession, inventory is still short among wholesalers excluding oil and autos (Chart 3). Further, travel is one of the first things to fall away when people sense a slowdown, and this is not evident in air travel (Chart 4) – quite the contrary. As for housing, it should slow in the coming months, but recent data indicate still strong demand through much of the country during early March. In the end, it will take a sharp, sustained reversal in consumer spending to turn GDP growth negative. I expect weak spending in Q2, 1.5% Q/Q real GDP growth following 1.5% in Q1, followed by a pickup in the second half.

Taking a quick look at high frequency data, the economy is slowing but not signalling recession. Production of steel and gasoline are both slowing (Chart 1) from peak levels hit last summer, and Y/Y nominal retail spending growth has also begun to tail off even though unemployment claims continue to improve (Chart 2). As for an inventory overhang, typical reason for recession, inventory is still short among wholesalers excluding oil and autos (Chart 3). Further, travel is one of the first things to fall away when people sense a slowdown, and this is not evident in air travel (Chart 4) – quite the contrary. As for housing, it should slow in the coming months, but recent data indicate still strong demand through much of the country during early March. In the end, it will take a sharp, sustained reversal in consumer spending to turn GDP growth negative. I expect weak spending in Q2, 1.5% Q/Q real GDP growth following 1.5% in Q1, followed by a pickup in the second half.

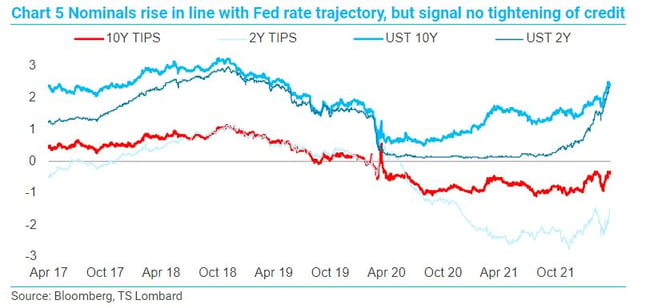

What are yield curves signalling? Not the same thing as in 2018, when the nominal and real curves turned negative (Chart 5). Not only did both curves flip in 2018, but real yields hit their peak, moving over 1%, and that was high enough for the equity market to reverse course until the Fed signalled it would do the same. This time around, real yields remain decidedly negative and the curve positive (although I think the shape of real curve matters less than the level). Markets are making a statement over the course of inflation (higher now, lower later) and that credit conditions are not tight.

What are yield curves signalling? Not the same thing as in 2018, when the nominal and real curves turned negative (Chart 5). Not only did both curves flip in 2018, but real yields hit their peak, moving over 1%, and that was high enough for the equity market to reverse course until the Fed signalled it would do the same. This time around, real yields remain decidedly negative and the curve positive (although I think the shape of real curve matters less than the level). Markets are making a statement over the course of inflation (higher now, lower later) and that credit conditions are not tight.

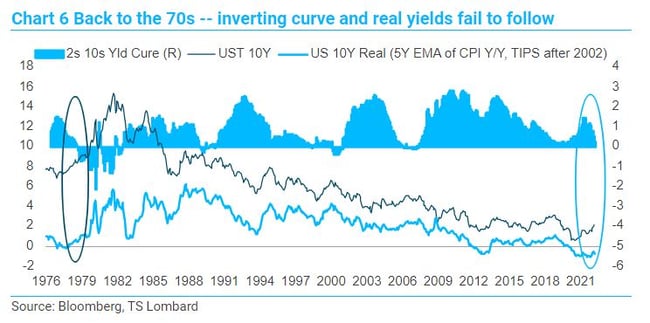

The last time the nominal curve flattened, and nominal yields rose, but real yields did not was 1978 (Chart 6). The inverted nominal curve did slow growth, along with the OPEC II, but the slowdown was insufficient to slow inflation. In came Volcker, up went rates and his first round of increases were still not enough. Today’s Fed faces nothing like the late 1970s, but the spread between nominal and real rates is going to have to narrow if rates are going to slow growth enough to drive inflation lower. In other words, like Volcker but to a far lesser extent, Powell is going to have to work to drive up real yields. QT, shrinking the balance sheet, is how it will be executed, and the FOMC tells us in May how serious that are in fact about tightening financial conditions, rather than in words.

The last time the nominal curve flattened, and nominal yields rose, but real yields did not was 1978 (Chart 6). The inverted nominal curve did slow growth, along with the OPEC II, but the slowdown was insufficient to slow inflation. In came Volcker, up went rates and his first round of increases were still not enough. Today’s Fed faces nothing like the late 1970s, but the spread between nominal and real rates is going to have to narrow if rates are going to slow growth enough to drive inflation lower. In other words, like Volcker but to a far lesser extent, Powell is going to have to work to drive up real yields. QT, shrinking the balance sheet, is how it will be executed, and the FOMC tells us in May how serious that are in fact about tightening financial conditions, rather than in words.

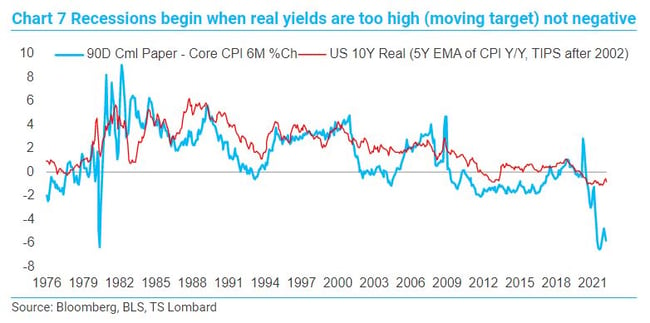

Fact is, no recession has begun with negative real rates. Firms can still borrow through inflation even after tacking on their credit spread. At the short end, inventory financing (commercial paper rates) remains well below inflation (Chart 7). The economy slows when the cost of short-term financing exceeds inflation – and rates are very far from that right now.

Fact is, no recession has begun with negative real rates. Firms can still borrow through inflation even after tacking on their credit spread. At the short end, inventory financing (commercial paper rates) remains well below inflation (Chart 7). The economy slows when the cost of short-term financing exceeds inflation – and rates are very far from that right now.

In sum, inverted nominal curves start to create recessions because they shift financial allocations away from risk, on the margin at first. Inverted nominal curves are necessary but not sufficient, real yields also need to be positive and their curve inverted–the cost of short-term financing rising above inflation causes firms to liquidate inventory. This is the first time since 1978 that the nominal curve inverted, and real yields failed to follow in kind. The Fed will consequently become more aggressive in hiking real rates, and they get this done by how it shrinks the balance sheet (they should sell 10-year T-notes, we will see). How high do real yields need to go to curb growth? I will stick with 100bp because that worked the last time. The Fed needs to raise its actions to the level of its rhetoric or risk the asset cycle of the past 10 years turning into a credit cycle and then1978 won’t seem so long ago.

In sum, inverted nominal curves start to create recessions because they shift financial allocations away from risk, on the margin at first. Inverted nominal curves are necessary but not sufficient, real yields also need to be positive and their curve inverted–the cost of short-term financing rising above inflation causes firms to liquidate inventory. This is the first time since 1978 that the nominal curve inverted, and real yields failed to follow in kind. The Fed will consequently become more aggressive in hiking real rates, and they get this done by how it shrinks the balance sheet (they should sell 10-year T-notes, we will see). How high do real yields need to go to curb growth? I will stick with 100bp because that worked the last time. The Fed needs to raise its actions to the level of its rhetoric or risk the asset cycle of the past 10 years turning into a credit cycle and then1978 won’t seem so long ago.

Client Login

Client Login Contact

Contact