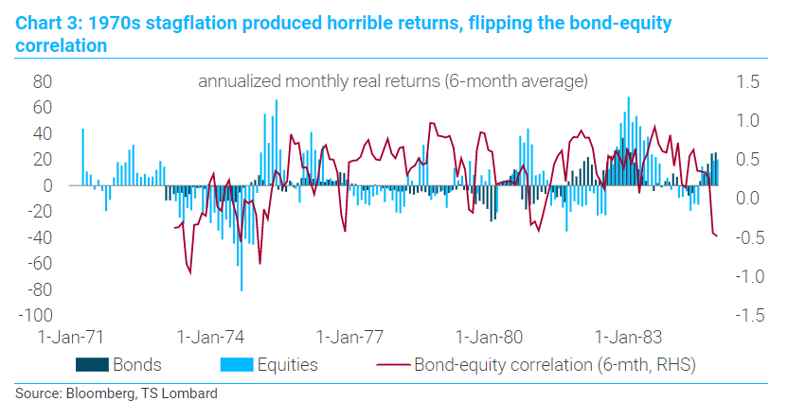

Inflation was always the Endgame

04 Nov 2022 - Dario PerkinsThere is beautiful irony in macroeconomics, a sort of inherent Minsky dynamic, or universal Goodhart law, that means that just when everyone thinks something is definitively true, it turns out to be spectacularly false..

#Federal Reserve #Monetary Policy #Interest Rates #Recession #UnemploymentHow High for Unemployment in the coming US Recession

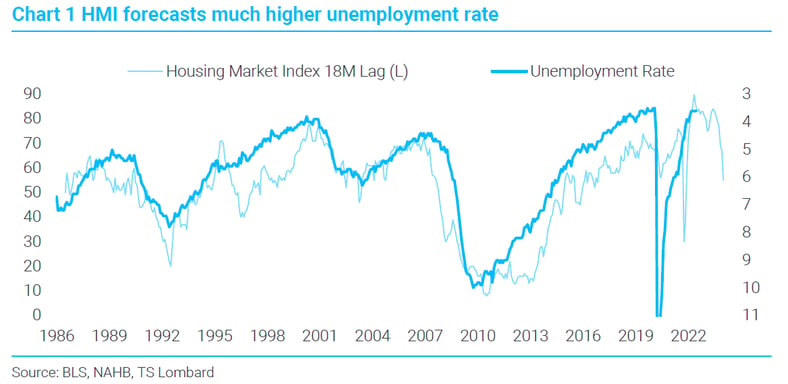

26 Jul 2022 - Steven BlitzThere are any number of ways to dissect the spread between the 7% job openings rate and 3.5% unemployment, but the needed drop in demand’s contribution to current inflation occurs when this spread turns negative..

#Federal Reserve #Monetary Policy #Interest Rates #Recession #UnemploymentFOMC commits to recession - are they late on this too?

16 Jun 2022 - Steven BlitzPowell told us policy is going to create a recession, but soft peddled it enough to leave markets to figure that out for themselves. After all, the FOMC is still very much in the clench of a dance between its objective.

#Federal Reserve #Monetary Policy #Recession #US EconomyA recession to tame inflation?

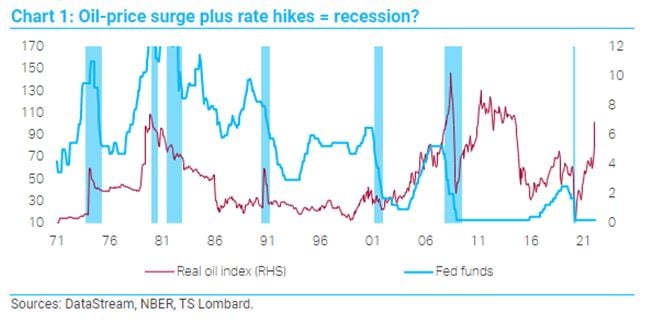

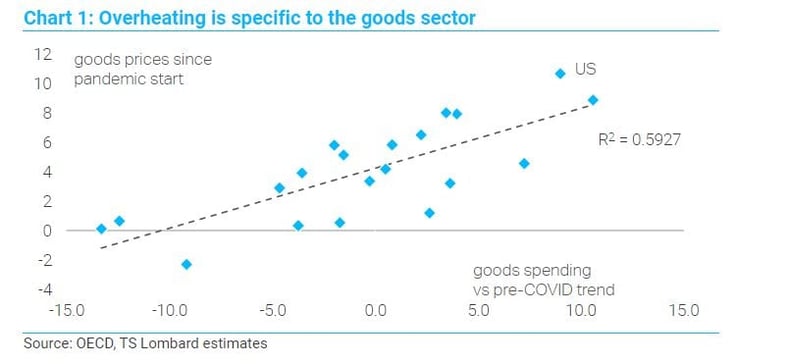

19 May 2022 - Dario PerkinsThere is currently a big debate about whether central banks will need to generate a recession in order to force inflation lower. For the doves, such action is not necessary – because the “cure for high prices is high.

#Central Banks #Inflation #Eurozone #RecessionUS CPI - Where to from here is what matters, not the "peak"

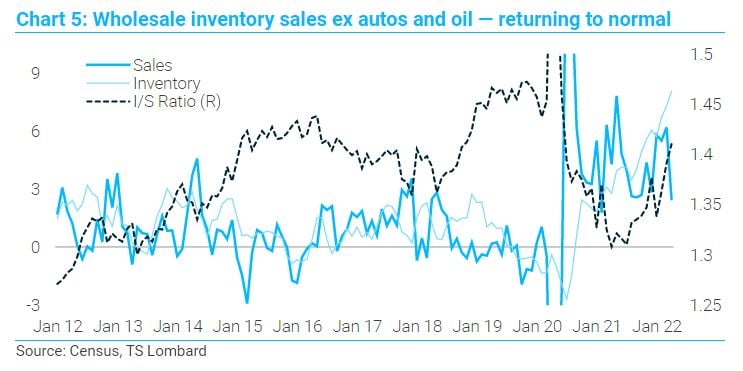

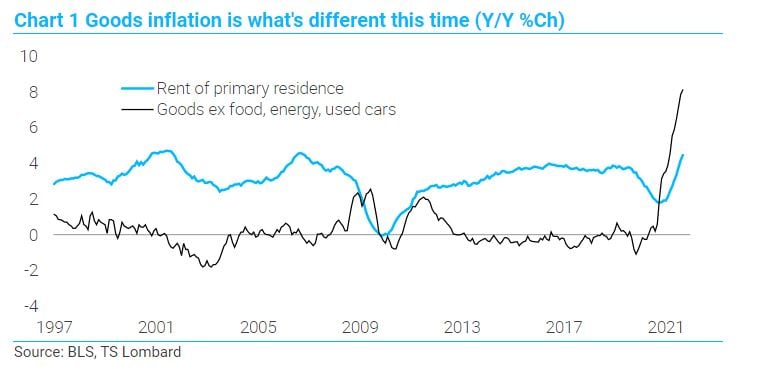

14 Apr 2022 - Steven BlitzMarch CPI data came in as expected, driven up by energy and a smattering of services – but goods prices ex food and energy fell 0.4% m/m, and this is key. The “secret sauce” of low core inflation for a generation has.

#Federal Reserve #Monetary Policy #Inflation #Recession #US EconomyIs the US recession inevitable? Always, but not when real rates are negative

06 Apr 2022 - Steven BlitzToday, in the middle of this cycle, the straight path is lost -- the Fed is hoping for relief from abroad because it fears the chase that inevitably leads to lost jobs and wealth. Seeing the Fed play for time, markets.

#Federal Reserve #Monetary Policy #Recession #US EconomyDon't bet on a soft landing

10 Mar 2022 - Dario PerkinsEvery economist wants to be famous for some great idea they had or to have their name forever linked to an original economic concept or unique thought. We have Keynesian demand-management, Friedman’s monetarism,.

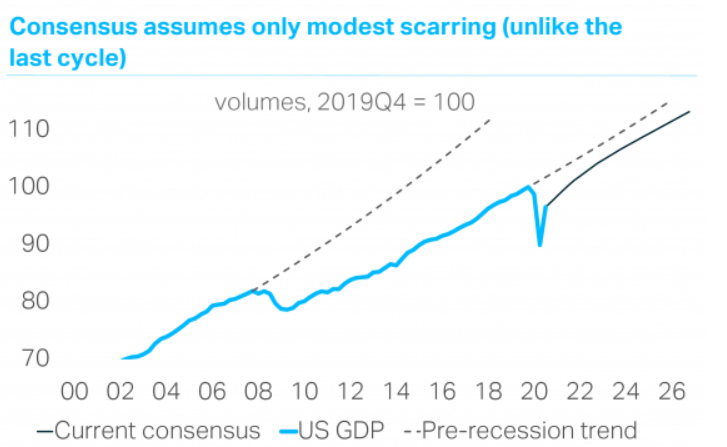

#Central Banks #Monetary Policy #Inflation #Eurozone #RecessionDon't extrapolate from this fake business cycle

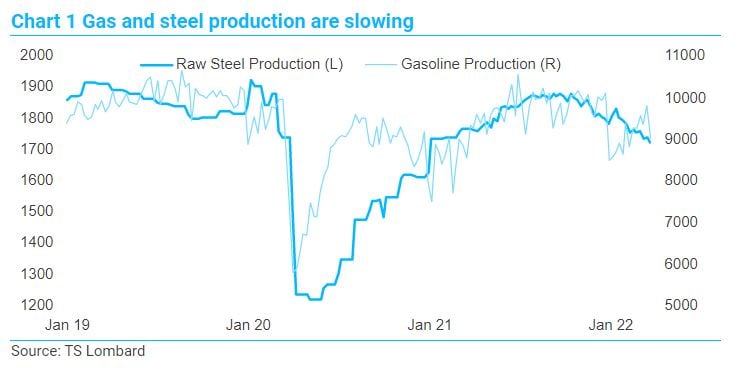

13 Jan 2022 - Dario PerkinsEdgar Fiedler, who served as Assistant Secretary of the Treasury in the Richard Nixon and Gerald Ford administrations, famously joked: “Ask five economists a question and you'll get five different answers – six, if one.

#Central Banks #Monetary Policy #Inflation #Recession #RecoveryUS recession is over - Backwards won't be the way forward

26 Mar 2021 - Steven BlitzThe “non-Covid” recession ended late summer, timed, in part, by the November peak for the number of unemployed not on temporary layoff. What we call the non-Covid recession is simply the downturn that created job losses.

#Federal Reserve #Recession #US Economy #Fiscal Policy #Employment #RecoveryDouble-Dip Recession on the way?

24 Nov 2020 - Davide OnegliaA virulent second wave of the Covid-19 pandemic is underway. We do a back-of-the-envelope calculation to estimate relative declines in domestic demand in what we think is a ‘credible’ worst case scenario. We compare the.

#Eurozone #GDP #Recession #Covid19 Client Login

Client Login Contact

Contact