The march to a March hike is on, assuming, of course, no great downward swerve in growth and/or inflation between now and then. The FOMC sees three hikes in 2022 and this pacing alone tells you March comes first. Powell said as much during his press conference when asked about the time between ending QE and hiking rates (“no reason for a gap”). He also said that by ending QE in two meetings, they have maximum flexibility to do what’s necessary based on what is in front of them at the time. He is pretty convinced the labour market will still be “hot” with labour participation rates lagging (he is right). As for the max employment barrier to hiking, he gave enough answers through his press conference to indicate employment is already full enough for them to act (definition is now a judgement call) – and that the demand for labour is already well above the prior cycle. More critically, all this has the FOMC concerned about the potential for persistent inflation (wage growth running ahead of productivity) to emerge, long after current price spikes are done and gone. He should be concerned.

Markets are slowly getting the message – the probability of no hike at the March meeting is down to 54% from 66% yesterday and 80% one month ago. By pulling forward the timing of the first hike, the curve steepens at the short end and works its magic through the asset markets, notably the dollar and, by extension, import prices. The market immediately pricing the Fed’s trajectory has, according to many (including the Fed), effectively eliminated the long and variable lags between policy and its impact. As for the impact of this steeper trajectory for raising policy rates on the rest of the world, especially emerging markets, Clarida told everyone a couple of weeks ago – they don’t care.

The Fed’s median forecast for 2022 is a fantasy -- real growth slows to 4.0% from 5.5%, unemployment drops to 3.5% from 4.3% yet core inflation somehow drops to 2.7% from 4.4. This all comes about with markets pricing a terminal funds rate of only 2.1% (2024 being the terminus) -- a zero real yield. In practice, the Fed’s terminal rate arrives after the economy has begun to turn down. Powell will always say, and he did again in this press conference, that the SEP is an agglomeration of individual forecasts, etc. Fair enough but having worked with the Fed model of the US economy, this is the model’s forecast bias as well. The model’s dynamics are built to quickly drive the economy back to 2% growth/2% inflation, regardless of the shock.

To reach this outcome from a practical perspective requires current inflation to quickly unwind as supply/demand imbalances resolve, with no other inflationary pressures lingering about. In other words, the pre-Covid economy re-emerges in terms of broad economic metrics. Even Powell does not believe this outcome (thankfully) and noted that policy must be based in reality, not wishful thinking. Further, the FOMC believes there is a real risk of persistent above-target inflation taking hold -- wages growing faster than productivity. He also let us know there are no signs yet, but this is a meaningless distinction. The 2022 round of wage hikes are about to begin against a backdrop of strong profits and higher price levels. This means next year is when an inflationary wage/price dynamic can move from cocktail conversation to reality. Powell knows this, and this means he also knows goods prices need to start dropping as soon as possible. Pulling forward the first rate is a start but given how the main lever is through the dollar, it questionable whether it will be enough on its own. He also told us that the FOMC began re-learning about balance sheet management (run-off) at this meeting (from the ones who totally misunderstood it back in 2018 – the Fed staff have long tenures). The Fed is building plans for a much more hawkish policy turn than what Powell is proffering, and what markets are pricing.

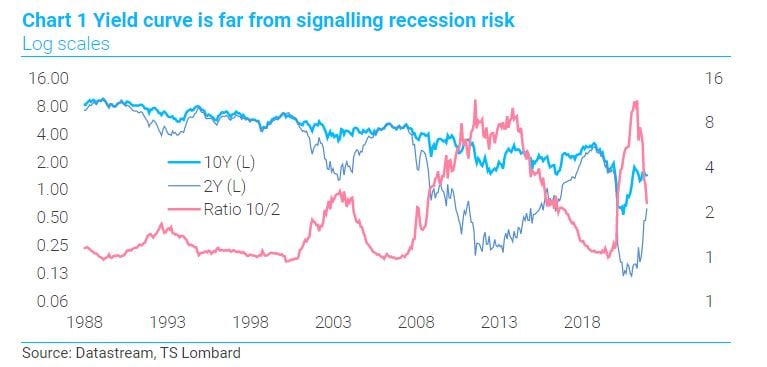

There is concern among some that the Fed is about to hike too aggressively, kill off the recovery and they see the yield curve as evidence of like-mindedness – they are wrong. They could always be right in the end about recession, especially if the Fed starts chasing inflation in earnest, but the curve today is not evidence of this risk. To me, the yield curve reflects a market betwixt and between whether the Fed is raising recession risk or will be chasing inflation throughout this cycle and seems to be leaning towards the chase. Looking at the ratio of 10-year to 2-year yields, as opposed to the spread (thereby adjusting for the sharply lower yields of today), the curve is far from being recessionary-causing flat (see Chart 1). It is, in fact, where it was in 2016, when the Fed began to tighten, and no recession was looming. To some, recession risk is rooted in the low rates needed to continue financing extraordinarily high levels of corporate debt, but this fails to account for the positive revenue impact from inflation that makes servicing easier. Inflation can bring a number of zombies back to life.

In sum, the Fed took a hawkish turn to help speed the process of quashing goods prices – mostly imported – and hope this keeps persistent inflation from taking hold. There is a good chance they get their wish fulfilment on goods prices, especially later next year when deflation from China begins to impact the US. Between now and then, unless the equity market cracks along the way, the risk of a persistent inflation process emerging can no longer be ignored -- and they know this. Productivity can bail them out over the cycle, not necessarily during the next six months. The Fed is consequently set to tilt to a more hawkish direction in 2022 than Powell let on -- if data do not begin to bend their way sooner than later. This is not, as Powell observed, the inflation their framework was designed to deal with – and they must act accordingly.

Client Login

Client Login Contact

Contact