Markets will not truly consider the Fed serious about inflation until policy stresses markets by pulling up real yields to some critical level. The Fed turns serious once they recognize that deteriorating global conditions are not going to deliver the soft landing their policies need to be effective. From a timing perspective this means summer, at the earliest. Further, returning reserves to banks at the same time reserves left on deposit are losing real value and loan/asset ratios are depressed, is a prescription for banks to rebuild loan books. A look at loan growth over the past year, on into today, indicates banks are doing just that-- outstandings have surpassed the spring 2020 surge. This can morph current inflation from being shortage-caused to credit-induced and leave the Fed even further behind. From a growth standpoint, the Fed either gets a soft landing delivered to it now, or its ensuing chase eventually creates a hard landing – as it always does. The key word is “eventually”. Until the Fed starts walking its talk, the equity markets take emerging pro-cyclical inflation and rallies with it, aided by expanding bank credit.

How high for real yields is high enough? If a near-term soft landing is hard enough in impact, probably not very high, but the critical point is that the Fed needs to be pulling real yields up, not growth. Real yields have been falling for decades and the breakpoint for the economy has been dropping too. In the 1980s, the Fed drove real yields close to 6% before the economy moved into recession. By 2000, just over 4% did the trick and in 2007, 2.7% was enough.

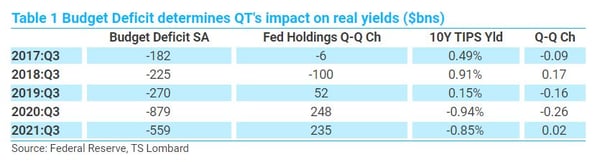

The economy started to bend in 2018 after the real 10Y yield moved over 1% -- more to the point, the Fed was pulling real yields higher (unbeknownst to them, for some reason, by accelerating balance sheet run-off when the deficit jumped from the tax cuts, see Table 1). To date, real yields have risen from -104bp in March 2021, to about 0 as of yesterday. The shift in Fed policy has had some impact, but less so than in 2018, considering that the deficit is shrinking, and real policy yields remain deeply negative. Rising private credit demands have been a factor in the current real yield rise, and so too is current coupon mortgage duration extending from 5 years to 5.8 since the year began (it was 4, one year ago) –the amount shorting10Y UST has consequently increased. Against a backdrop of sharply slowing growth in the near-term, 50bp is probably high enough. If, however, a credit cycle manages to take hold, chances are the Fed will need to exceed 1% to slow things down.

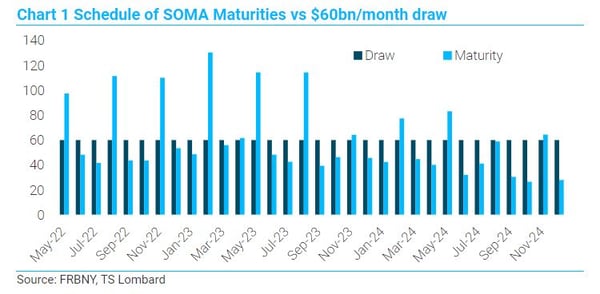

How will QT be managed this time? The most direct way the Fed can raise real term yields and cut short the equity market (Fed’s main avenue of impact) is by making public markets take down too much Treasury debt. Recent Fed minutes relayed $60bn/month in UST roll-off beginning in July – they are going to take a few months to get there because Treasury is issuing more than needed to cover the deficit to rebuild their deposits at the Fed to $800bn (currently $544bn). This does not qualify as forcing too many Treasurys onto the market. Because the maturity schedule is “lumpy”, owing to Treasury’s refunding schedule, not every month is going to deliver $60bn in maturities (see Chart 1). To manage, the Fed will buy and sell Treasury bills rather than notes, and presumes Treasury facilitates with increased bill issuance.

How will QT be managed this time? The most direct way the Fed can raise real term yields and cut short the equity market (Fed’s main avenue of impact) is by making public markets take down too much Treasury debt. Recent Fed minutes relayed $60bn/month in UST roll-off beginning in July – they are going to take a few months to get there because Treasury is issuing more than needed to cover the deficit to rebuild their deposits at the Fed to $800bn (currently $544bn). This does not qualify as forcing too many Treasurys onto the market. Because the maturity schedule is “lumpy”, owing to Treasury’s refunding schedule, not every month is going to deliver $60bn in maturities (see Chart 1). To manage, the Fed will buy and sell Treasury bills rather than notes, and presumes Treasury facilitates with increased bill issuance.

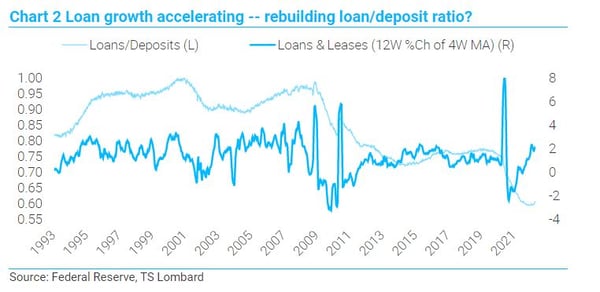

Banks are ready to lend the cash they get back. Strong loan growth was absent in the past decade – households and business deleveraged. and bank loan/asset ratios were crushed by regulation (Chart 2). But banks have no regulatory block keeping them from returning loan/deposit levels to pre-Covid levels, and recent loan growth indicates banks are doing just that. The outstanding level of loans has recently passed the spring 2020 surge.

Banks are ready to lend the cash they get back. Strong loan growth was absent in the past decade – households and business deleveraged. and bank loan/asset ratios were crushed by regulation (Chart 2). But banks have no regulatory block keeping them from returning loan/deposit levels to pre-Covid levels, and recent loan growth indicates banks are doing just that. The outstanding level of loans has recently passed the spring 2020 surge.

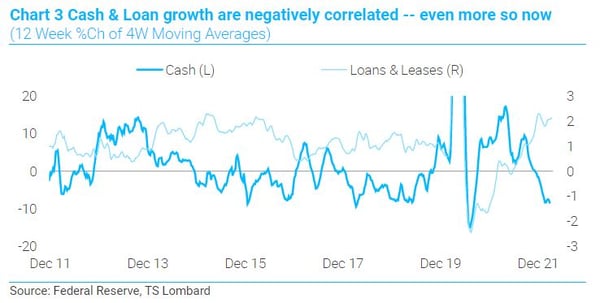

During this past decade of QE/QT, there was a strong negative correlation between growth in cash balances at the Fed and lending (Chart 3). Loan growth fuels inflation, but because banks were at their regulated ratios, there was no incentive to lend in the past 10 years (and little demand after the overleveraged pre-08-09 period). The current situation is different –there are good reasons to believe the supply and demand for loanable funds will be greater. At least until banks restore loan ratios to regulatory minimums. What the Fed will find is that IORB is the only policy tool they really need to get the inflation outcome they want. IORB needs to be set well above their target inflation rate to keep a credit cycle from taking hold.

During this past decade of QE/QT, there was a strong negative correlation between growth in cash balances at the Fed and lending (Chart 3). Loan growth fuels inflation, but because banks were at their regulated ratios, there was no incentive to lend in the past 10 years (and little demand after the overleveraged pre-08-09 period). The current situation is different –there are good reasons to believe the supply and demand for loanable funds will be greater. At least until banks restore loan ratios to regulatory minimums. What the Fed will find is that IORB is the only policy tool they really need to get the inflation outcome they want. IORB needs to be set well above their target inflation rate to keep a credit cycle from taking hold.

In sum, the economy is slowing but the question is whether it slows enough to get the Fed off the hook from having to ramp up rates well above current inflation. This should be known by summer, and if the economy has not slowed sufficiently, the chase is on – something the markets already suspect will occur. Until the Fed ramps up real term yields and using the balance sheet run-off to do that – and set IORB very high to curtail lending -- markets see a pro-cyclical inflation taking hold and will rally with it.

In sum, the economy is slowing but the question is whether it slows enough to get the Fed off the hook from having to ramp up rates well above current inflation. This should be known by summer, and if the economy has not slowed sufficiently, the chase is on – something the markets already suspect will occur. Until the Fed ramps up real term yields and using the balance sheet run-off to do that – and set IORB very high to curtail lending -- markets see a pro-cyclical inflation taking hold and will rally with it.

Client Login

Client Login Contact

Contact