The Fed may not be out of ammo, but the ammo they have may be futile in curtailing the financial instability that policy is creating. Bitcoin, call-option vigilantes, SPACs and market hype generally were topics the FOMC decided not to mention in their statement, or for Powell to discuss in his press conference. The FOMC statement was, instead, an exercise in trying to say something when there was nothing new to say about the usual things. They recognized the current slowdown in growth caused by the virus by shifting their assessment of the economy from “continued to recover” to “has moderated”. To underscore their point that the risk to the economy is now, they dropped “medium term” from “considerable risks to the economic outlook”. With the Fed’s policy mantra to do nothing until employment recovers fully to some still unknown metric, stewardship of the financial markets belongs to the financial markets. This has never been the market’s strong point – it is why government created the Fed and the SEC.

Everyone knows the Fed will step in to save the equity market if sell-off turns to a rout that becomes a risk “that could impede the attainment of the Committee's goals.” The Fed has said as much in recent declarations of its principle. What their declarations do not square with is the distortionary impact from keeping markets aloft while waiting for the economy to catch up. In the current cycle, timing of the catch-up is particularly difficult to assess because Covid rather than economics is the determinant. Fiscal policy is the more appropriate tool to help the economy while waiting for vaccines and herd immunity, by propping up incomes among the unemployed and adding income to the employed, who have fewer places to spend the extra cash.

To make sure fiscal efforts have no effect on bond yields, the Fed is buying $80bn/month of UST and has quashed the front end by pledging no rate hikes for years. The Fed plans to do this until everyone who has lost a job because of Covid is rehired, or close to this, (the metric is still unknown). Tapering is not something they are willing to entertain, although we believe they will try by year’s end, if the second half upturn takes shape as expected – the repo rate is the critical barometer for Fed action. The impact from taking out so many UST from the market is a negative real yield, because the foreign sector does not have to finance the deficit, thereby the Fed effectively rebalances S=I all by itself This, by definition, lowers real yields and weakens dollar – all else being equal around the world. If the deficit ramps up again, as Biden promises, the Fed will buy more to keep real yields from rising and stifling the potential upturn. As for the foreign sector, they are still receiving dollars to the tune of about 3% of nominal GDP (current account deficit) that, in turn, need to be invested, and these dollars will find their way into the corporate market -- direct investment, bonds, or equities.

"Inflation would be “welcome” – a concern that isn’t the story"

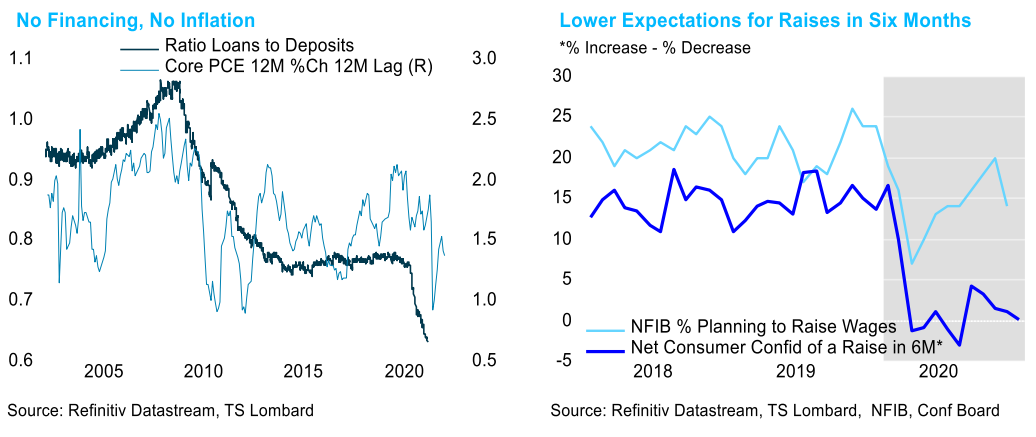

Suppressed yield levels and a mountain of liquidity on private sector balance sheets has made inflation a concern, but it should not be. Powell correctly stated how prices for some goods and services might temporarily jump as the economy reopens and cash is spent, but these are transient episodes. Secular disinflationary forces remain very much in place. More to our point, the banking system is not making loans and inflation in the US requires financing (chart above left). In addition, downward wage growth from weak 2020 earnings alone is yet to come and consumers align with business in planning for lower or no wage hikes in 2021 – the most relevant inflation expectation (chart above right).

The story to be concerned about is financial market instability – capital market inflation from too low yields, bubbles popping up in one market or another - which the Fed refuses to acknowledge, at least publicly. The Fed has come a long way from its original charge of making sure the banking system is sound, made during a time when banking and the capital markets were effectively one. Depression, regulation, and inflation separated banks from capital markets over the years, re-regulation then narrowed the divide, and today tech is disrupting the role of banking and upending capital markets – notably when regulation is back constraining bank activity. Putting all this back together again after the bubble inevitably pops is a task the Fed takes on, but as we heard from the Powell today, he sees market issues as a matter of regulation not interest rates and they are not in charge of markets. They can change allowed leverage to short equities, Reg T, but Powell wisely rebuffed the question – the notion that Reg T alone governs the volume of shorts in the market is rooted in another time.

"Financial instability is the story as the market surrounds Fed’s cavalry"

Market bubbles and the expectation of rapid recovery are in a balancing act and the Fed, having obligated itself to re-employment foremost, has hit a wall in what it can do. The FOMC, like everyone else, waits for vaccines and the herd immunity it promises to remove the lid from economic activity. Our base forecast is still that this lid is lifted, the Fed starts to taper by yearend, and the first rate hike occurs at the end of 2022. This, however, does not diminish the distortionary impact on markets from the now and “forever” too low rates for too long. The Fed cavalry of a still bigger balance sheet may prove less effective with interest rates sitting at zero – or even negative repo, if need be. The Fed would rather not find out whether the ammo they have left can still be effective, but they cannot do anything otherwise because the positive impact of equities on household spending is a big part of why low rates help. Quashing markets by citing “irrational exuberance” is a non-starter. And so, we all wait for the vaccine revival.

Client Login

Client Login Contact

Contact