The looming threat to the global growth outlook posed by the Delta variant should not be conflated with what is a natural cyclical downshift in output growth – something that was always on the cards following the powerful surge from the mid-2020 lows.

As we approach the final quarter of this year, the transition from the “Covid reopening” to a “normal” recovery cycle looks more or less complete. The data have started to reflect a slowdown in world economic growth as the “V-shaped” rebound in China and the US tapers off and inflationary pressures have kicked in with a lag following the upturn in real activity. The pandemic has not changed the inflation dynamic but has turbocharged it as strong pent-up demand combines with acute supply-chain disruptions.

The 2021 Q2 peak in global GDP growth has left behind a macro landscape marked by high expectations and low visibility. The combination of 1) bullish earnings estimates, 2) noisy inflation and employment data and 3) uncertainty around the deployment of surplus private-sector cash balances while 4) the fiscal and monetary policy stimulus launched last year is pared back has set up a “fork-in-the-road” macro environment going into 2022. The answer to what comes next hinges on how and over what timeframe the disruptions brought about by the pandemic will resolve themselves.

The price action suggests that financial markets have taken a middle-of-the-road “wait-and-see” view until the macro fog begins to clear, consistent with discounting a “soft landing” scenario – not reflation failure. Meanwhile, the dialling back of bullish consensus forecasts for world GDP growth in 2021 H2 is already under way, while downward pressure on economic surprise indices – the corollary of high expectations and slowing growth – looks long in the tooth.

High-frequency data point to healthy, albeit slowing momentum in global output growth. World trade volumes growth stalled in 2021 Q2, according to the latest CPB data, dragged by cooling Chinese shipments. The IFO export expectations index, which is a reliable gauge of global trade momentum, has rolled over from levels that, historically, have marked cyclical turning points. The flash global composite output PMI dropped further to a seven-month low in August as growth in new orders reverts lower. The slowdown is driven predominantly by supply limitations, not by a relapse in demand. Forward expectations remain buoyant but persistent shortages of raw materials and staff are holding output back and keeping cost pressures high.

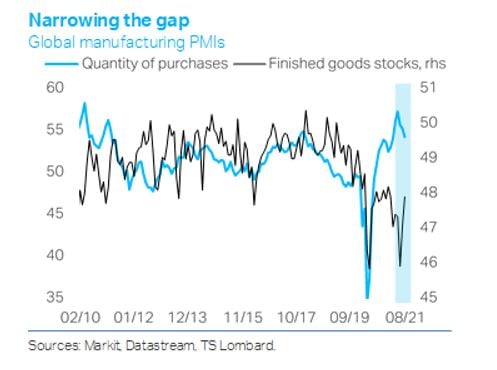

That said, the message from both survey and financial market indicators of inflation is that cost-push pressures are topping out. The PMIs show that inflation of both input costs and selling prices eased to four-month lows in August. The backlogs of work manufacturing PMI has held steady below its May 2021 high, while the delivery times PMI has stopped deteriorating. The “quantity of purchases” manufacturing PMI has eased over the summer, while the index for inventories has increased – a combination that raises the bar for further intensification in production cost inflation.

What is more, the inventories PMI remains well below its long-term average, pointing to more catch-up ahead. In the US, the net share of businesses that plan selling price hikes according to the NFIB survey continues to hover at record highs but has held fairly steady in 2021 Q3, consistent with the recent correction in the “prices paid” series of the ISM surveys. TIPS inflation breakeven rates have come off their highs and the latest US inflation data show tentative signs of core inflation backing off, confirming our view that the bulk of the upward price pressures is likely behind us – especially if a firm dollar continues to keep a lid on import price inflation.

All this seems to suggest that inflation is unlikely to intensify further but will prove more persistent than most anticipated even as private demand faces headwinds from the Delta variant and tapered policy support.

It also suggests that concerns about stagflation – fuelled by the combination of sticky inflation and the recent downshift in global growth expectations – are misguided. Supply-chain disruptions alone are unlikely to catalyse a “hard landing” economic scenario against the backdrop of strong private-sector balance sheets, elevated household saving rates and loose monetary conditions for as far as the eye can see, although historical precedent suggests excess savings do not necessarily imply a spending boom.

It also suggests that concerns about stagflation – fuelled by the combination of sticky inflation and the recent downshift in global growth expectations – are misguided. Supply-chain disruptions alone are unlikely to catalyse a “hard landing” economic scenario against the backdrop of strong private-sector balance sheets, elevated household saving rates and loose monetary conditions for as far as the eye can see, although historical precedent suggests excess savings do not necessarily imply a spending boom.

The marginal reduction in global liquidity implied by the Fed and other major central banks scaling back monetary accommodation is unlikely to be the sole cause of a major setback in risk sentiment. But it is set to coincide with intensifying fundamental headwinds for global equities and thus could act as an amplifier to a souring macro narrative.

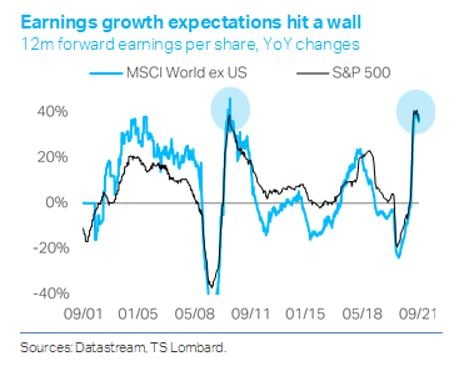

There are two reasons why this is likely to be the case. First, barring a significant relapse in global demand, the balance of risks for (real) bond yields looks skewed to the upside, capping the potential for multiple expansion to drive valuations higher. Second, the strong GDP rebound of 2021 H1 has fuelled outsized expectations for forward business earnings growth, which have only just started to correct. As the tailwinds to corporate profitability from higher operating leverage during the early days of the recovery kick into reverse, margins are likely to come under increasing pressure, triggering a drop in earnings revision ratios.

The above analysis underlies our overall constructive stance on the post-Covid economy. But it also goes hand in hand with moderating equity returns as earnings growth becomes the dominant performance driver while the uncertainty that comes with monetary policy normalization is bound to transmit more volatility to financial markets.

Client Login

Client Login Contact

Contact