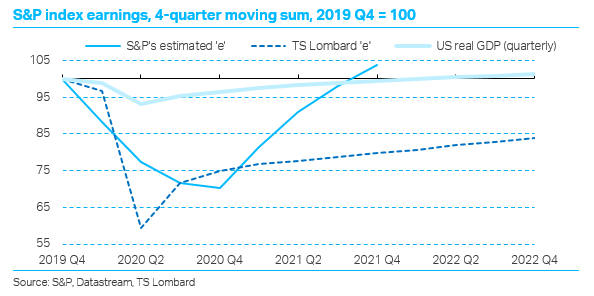

This blog summarises our View on our bearish views about US stock prices. Steve Blitz’s analysis of the US economy in 2020-21 shows the policy context for the November elections. But our pessimism about stock-market prospects has more to do with the likely major disappointment of investors’ hopes for a rebound of earnings next year, back to their 2019 level, or even higher. Our earnings forecasts (chart below) result from the economic recovery from the dire Q1-Q2 recession being only gradual – a view widely shared by economic forecasters, including the Fed, but ignored by investors. The timing of our bearish call in late-March may prove wrong, but we remain even more strongly bearish after the rally.

We put the sharp stock rally in the context of previous such rebounds, which have then foundered for lack of earnings follow-up. Then we look at Chinese policy after its violent recession in Q1: China being, of course, ‘1st in, 1st out’ in the Covid-19 crisis. The main thrust of its monetary policy, is instructing banks to use ‘forbearance’ with debtors stressed by cash flow and revenue shortages. Taking care of this issue with monetary policy leaves China fiscal-policy ‘space’ for major spending programmes on infrastructure as of now (and probably soon, property and construction). By contrast, in the US and Europe major fiscal-policy capacity, as well as monetary action, is being used to relieve stressed business cash flow: while necessary to prevent depression, this leaves the recovery largely dependent on consumers released from lock-downs. Only next year are we likely to see governments engage in their own spending, to make up for the lack of private spending.

In addition to likely capex cuts in Q3-Q4 owing to slumping capacity utilisation and stressed cash flow, there is another reason why the private sector could recover slowly. Even if the inevitable new outbreaks of COVID-19 infections remain reasonably well contained, people will be cautious about mixing with strangers (sports events, theatres, restaurants & bars); and labour income is held back by high unemployment. Profit incomes are also hammered, and alarm about economic prospects and asset values is raising savings rates. Our forecast is that the full year 2020 will see US GDP down nearly 4% (still -3% YoY by 2020 Q4) and the EA’s down by 8½%.

Applying these economic forecasts to our model of S&P earnings, we find that 2020’s dip is close to the consensus – down 25% versus the consensus of minus 30%. But the slow recovery we are forecasting still leaves 2021 earnings 20% below 2019’s, versus the market consensus that sees a complete earnings recovery. Even with such a complete recovery the year-ahead p/e ratio with the S&P index at 3098 is nearly 19x, versus the long-run average of 18x same-year prospective earnings, which comes down to about 16-16½x for year-ahead earnings – all of this accepting the view that we should ‘look through’ 2020 to the rosy uplands of 2021. Applying a multiple of 16 to our forecast of 2021 earnings yields an S&P index value close to 2000 – bearish indeed!

Such is the self-confidence driving stock prices higher that current forward p/e ratios have only one precedent, the 1999-2000 tech bubble – and we know how that ended. This suggests comparison with the 2½-3-year bear market, started by the slump in 2000, that finally ended in early 2003. The erosion of the tech bubble’s super-confidence occurred in several waves of bearishness, before eventual capitulation. And in other respects outlined here, current markets are less well placed than in early 2000, though also less overvalued vs. fundamental measures.

A major feature of the early 2020s is acceptance of a major role for fiscal stimulus. From 2011on tighter fiscal policy in the US and Europe conflicted with monetary stimulus: the result was ultra-low interest rates and QE. Monetary stimulus works by boosting assets values, and ultra-easy money certainly did that, though without helping economic growth enough. Now, with major fiscal stimulus – and (probably next year) actual government spending, not just income support – both large budget deficits and less dependence on monetary stimulus argue for a much less benign environment for stock prices. As we assume demand eventually recovers to match the economy’s full potential, weakness of stock-market earnings will yield to higher interest rates.

The TSL View also registers the downside for stocks arising from the tariff war, whether or not we are seeing the US and China in a new ‘Cold War’. At a more general level, it is hard to believe the socialisation of risk on a massive scale in the US and Europe will not damage the creation of value within the free-market system, depending as it does on the culling of weak economic performance by letting the failures fail, releasing resources to successful enterprises. The Fed’s market dominance means ‘they may ring their bells now, but they will wring their hands soon’.

Client Login

Client Login Contact

Contact