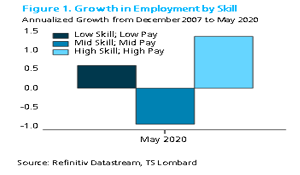

Politics of unemployment to reign

26 Jun 2020 - Steven BlitzAs the economy reopens, the revealed recessionary environment will reflect the imbalance of the expansion just ended – a surplus of service-related workers with no obvious direction in which to go to find re-employment..

#Federal Reserve #Interest Rates #Fiscal Policy #Bear Market #Unemployment #US ElectionInvestors can’t rely on central banks

24 Jun 2020 - Dario PerkinsThe bounce in global stock markets since March has been both spectacular and a bit puzzling. Despite widespread gloom among institutional investors about ‘fundamentals’ – concerning both the macro outlook and the.

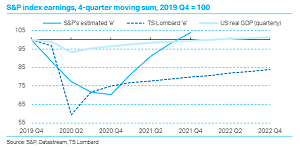

#Central Banks #Federal Reserve #Liquidity #Equities #Fiscal Policy #Covid19 #Bear MarketWhy we remain bears

23 Jun 2020 - Charles DumasThis blog summarises our View on our bearish views about US stock prices. Steve Blitz’s analysis of the US economy in 2020-21 shows the policy context for the November elections. But our pessimism about stock-market.

#US Economy #Covid19 #Stock Market #Bear MarketThe equity rebound - just another bulltrap?

01 May 2020 - Dario PerkinsWatching financial markets, it is tempting to think the worst of the COVID-19 crisis is over. Equity values have bounced and credit spreads have narrowed, even as the oil market continues to suffer alarming strains..

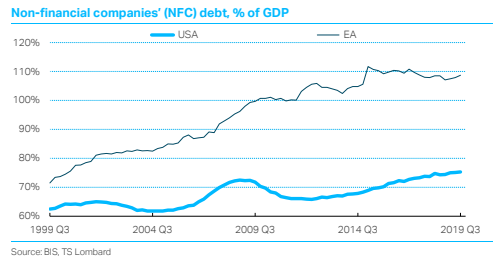

#Monetary Policy #Recession #Fiscal Policy #Covid19 #Bear Market #Bull MarketWorld slump - weak rebound

26 Mar 2020 - Charles DumasWidespread hopes for a V-shaped recovery from the impending recession will probably be dashed. And stock markets are only likely to rebound sharply if they fall a lot further from here – at Tuesday's Close the S&P index.

#Equities #Recession #Covid19 #Bear MarketThe bear and fear stalk the world

10 Mar 2020 - Charles DumasGlobal spread of the Covid-19 virus looks likely to cause a worldwide recession and bear market in stocks. Nobody knows how serious the disease is likely to be. But The Brookings Institution’s estimates suggest a.

#Equities #Recession #Covid19 #Stock Market #Bear Market Client Login

Client Login Contact

Contact