Charles Dumas

Recent Posts

If the Fed buys stocks? Then sell

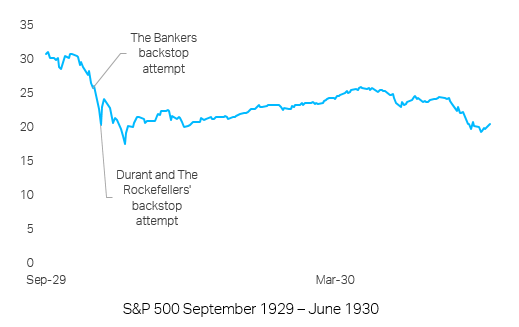

05 Aug 2020 - Charles DumasOctober 1929 – the Wall Street Crash is gathering frightening momentum. Several leading Wall Street bankers get together and decide to backstop the stock market, they come out swinging, placing a bid to purchase a large.

#Federal Reserve #Recession #Stock MarketWhy we remain bears

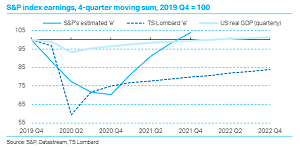

23 Jun 2020 - Charles DumasThis blog summarises our View on our bearish views about US stock prices. Steve Blitz’s analysis of the US economy in 2020-21 shows the policy context for the November elections. But our pessimism about stock-market.

#US Economy #Covid19 #Stock Market #Bear MarketWorld slump - weak rebound

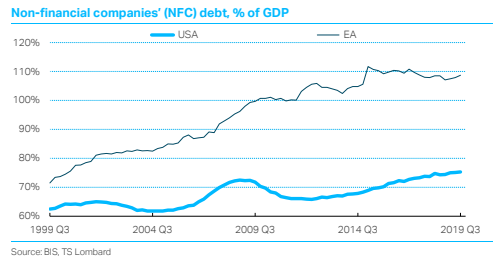

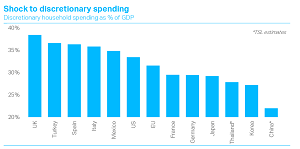

26 Mar 2020 - Charles DumasWidespread hopes for a V-shaped recovery from the impending recession will probably be dashed. And stock markets are only likely to rebound sharply if they fall a lot further from here – at Tuesday's Close the S&P index.

#Equities #Recession #Covid19 #Bear MarketThe bear and fear stalk the world

10 Mar 2020 - Charles DumasGlobal spread of the Covid-19 virus looks likely to cause a worldwide recession and bear market in stocks. Nobody knows how serious the disease is likely to be. But The Brookings Institution’s estimates suggest a.

#Equities #Recession #Covid19 #Stock Market #Bear Market Client Login

Client Login Contact

Contact