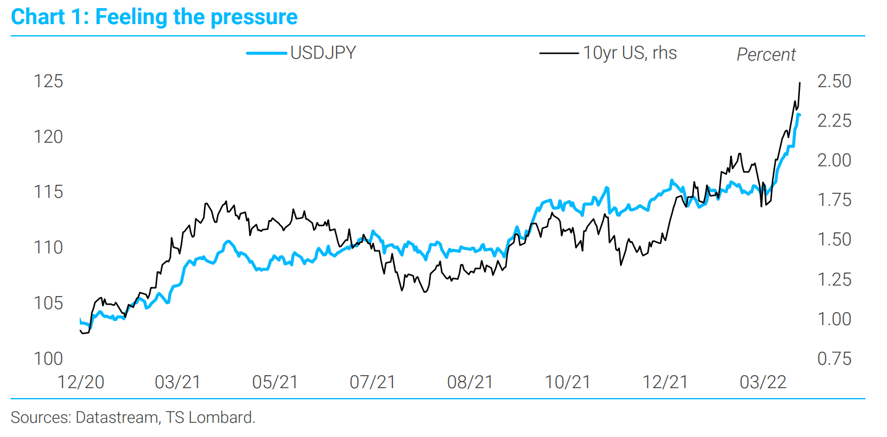

Pronounced widening in JGB interest rate differentials, particularly versus US Treasuries, catalysed accelerated yen depreciation in March. Chances are that we are getting closer to a “taper” of Japanese monetary divergence even as on the surface the latest BoJ action and recent comments by Governor Kuroda seem to suggest otherwise.

The limits of divergence.The BoJ will remain a laggard as the Fed and other major DM central banks normalize policy, but there are limits to how big a lag Japanese officials can afford to accept. The exchange rate plays a key role in defining these limits, i.e., the degree and pace of moves in the yen is a useful yardstick of the Bank’s tolerance for monetary divergence.`

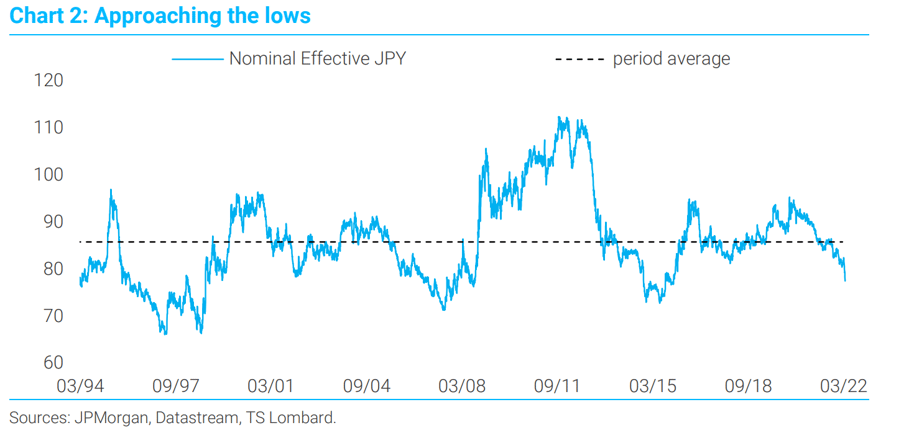

Yawning interest rate differentials drove dollar-yen close to 125 this week, a level last seen in 2015. With CNY strength exerting additional downward pressure, the yen has fallen 5% in trade-weighted terms YtD; another 5% decline would push the index to the summer 2015 lows.

Meanwhile, the message from BoJ Governor Kuroda remains that a weak exchange rate is, on balance, a positive for the Japanese economy – in contrast with the more cautious tone struck by government officials. What is more, unlike Fed chair Powell, Kuroda has clung to the “transitory” narrative on inflation. Is the BoJ in effect “doubling down” on monetary divergence? (Short answer: no); or is it sowing the seeds for a policy surprise in April? (Increasingly likely).

As the rally in DM interest rates gathers pace, the BoJ is hard-pressed to adopt a more flexible policy stance – and chances are it soon will: it would be wrong to think of 0.25% – the upper bound of the band under Yield Curve Control (YCC) – as an “unconditional” line in the sand. The 10yr JGB yield is now flirting with that level for the second time this year. When this first happened in February, the BoJ sent a strong message, offering to buy unlimited amounts of 10yr paper at a 0.25% fixed rate, without any take-up from investors. It did the same this week – but this time round there were also some telling differences. First, the BoJ made a (rare) second offer after the first one failed to push down yields. Second, while the first offer drew no bids, in the second offer the BoJ ended up accepting some (ca. 65bn yen). Third, whereas in February the BoJ offered to buy only 10yr JGBs, today it was JGBs with maturities of more than five years and up to 10 years.

Taken together, these are tentative signs that as market pressure intensifies the BoJ is setting the stage for recalibrating the parameters of YCC (band range, targeted maturities) at next month’s meeting.

Headline CPI inflation is set to climb close to the Bank’s 2% target in 2022 Q2, giving policymakers leeway to adjust the policy stance, although Kuroda has so far downplayed the pickup in prices as “driven mostly by cost-push inflation…basically temporary and unlikely to be sustained…so there’s no reason to tighten monetary policy. Doing so would be inappropriate. We need to tweak monetary policy if inflation expectations or wages see second-round effects. But Japan isn’t in such a situation.” To be sure, in contrast with other major DMs the Japanese economy is currently nowhere near overheating. The bigger point, however, is that any tweaks to YCC would leave financial conditions highly accommodative and make virtually no difference to real economic activity.

This is not about a shift in the policy stance but about risk management, i.e., leaning against the negative side-effects of increasingly divergent, super-loose monetary policy. The spotlight is squarely on the currency. BoJ officials surely understand that while the recent rise in import costs has not been driven by a weak yen, sustained exchange rate depreciation nevertheless amplifies the squeeze on household real incomes and corporate profit margins from higher commodity prices.

Why, then, is the Bank maintaining the ‘weak yen is good’ rhetoric? The reason can be traced back to the importance of the exports-profits nexus for Japan’s economy. The missing ingredient for inflation to stabilize sustainably at higher levels is faster wage growth that can drive a lasting “step increase” in domestically generated price pressures. Wages, capex and employment follow business earnings, so nurturing conditions that are favourable to corporate profitability lies at the heart of the BoJ’s policy objectives. In short, the positive effect on profits seems to outweigh the extra ‘bad inflation’ that comes with a depreciating yen. The onus is increasingly on the government to prop up the household sector in the face of supply-side headwinds to demand: directly via fiscal stimulus (a new package is on the way) and indirectly via continuing to push businesses for bigger pay increases.

Make no mistake: it is still moves in US Treasury yields that will shape the fate of the yen and it is fiscal policy that will define the overall policy stance in Japan. But with JPY volatility rising, the trade-weighted exchange rate fast approaching the lower end of its long-term historical range, the current account deficit swelling on the back of a bloated import bill and deflationary pressures ebbing, conditions are ripe for the BoJ to tweak Yield Curve Control. If not now, when?

Client Login

Client Login Contact

Contact