The COVID-19 economic collapse was unlike anything we have seen before. This was not your classic recession. Yet it was actually easy to forecast. Given the nature of the shock – especially lockdowns and social distancing – the largest decline in history was always likely to be followed by a powerful rebound. The more difficult question, which has dominated our conversations with clients, was about where we would end up after this initial revival. Would activity bounce back to where it was before the pandemic (the “V-shaped” recovery), or would we be left with a serious shortfall in demand? Our forecast, which is where the consensus ended up, was for a Nike-style ‘swoosh’ – a partial rebound that would leave a persistent shortfall. Now the lockdowns are over, we have the data to confirm this forecast – the global recovery remains patchy and incomplete.

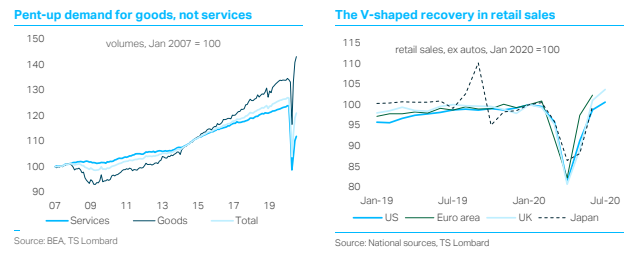

Consumer spending has been the main driving force for activity in 2020. Households cut their spending because they were worried about the virus and because governments restricted their ability engage in regular commerce (closing retail outlets etc.). When we look at the composition of spending, we can see why the subsequent recovery has been incomplete. Consumers continue to shy away from certain activities, especially those that require social interaction. This means consumption is patchier and more uneven than it was in 2019. For most economies, the strongest rebound has occurred in retail sales. For the US, the UK and parts of the euro area (including Germany), retail spending is already back to pre-pandemic levels (the classic “V”).

While consumers are now making up for the spending they postponed on garden equipment, TVs etc, they will not make up for lost spending on services – haircuts, restaurant meals etc. In fact, continued fear of COVID-19 seems to be causing substitution from social to non-social expenditure, which is compounding the patchiness we see in consumption. Online retail has done particularly well, which has supported the demand for consumer goods (and tech stocks). But this is part of a broader theme, where people are more comfortable engaging in some activities than others. Visiting large retail outlets, for example, is safer than sitting in restaurants or visiting a gymnasium, which is driving patterns of spending. This means there are some parts of the economy, such as tourism, leisure and hospitality, which remain in a deep hole.

While consumers are now making up for the spending they postponed on garden equipment, TVs etc, they will not make up for lost spending on services – haircuts, restaurant meals etc. In fact, continued fear of COVID-19 seems to be causing substitution from social to non-social expenditure, which is compounding the patchiness we see in consumption. Online retail has done particularly well, which has supported the demand for consumer goods (and tech stocks). But this is part of a broader theme, where people are more comfortable engaging in some activities than others. Visiting large retail outlets, for example, is safer than sitting in restaurants or visiting a gymnasium, which is driving patterns of spending. This means there are some parts of the economy, such as tourism, leisure and hospitality, which remain in a deep hole.

The ‘consumer response’ to COVID-19 is a misnomer because there has been no unitary experience of the pandemic. Job losses and furloughs have been concentrated among low skill/low income households, while, the high-income are home-working and have preserved their wealth, as asset prices rebounded (the “K-shaped” recovery). This is creating fascinating macro cross-currents, which are pulling the economy in different directions. Retail vs consumer services is one of these, while we have another in residential housing vs commercial property. While the wealthy look to upgrade their homes, in the expectation they will be spending more time in them, commercial property seems to be on the brink of a dangerous collapse (with acute pressure on rents etc.). Residential activity has bounced nicely in the US and UK, but this will not survive a sustained tightening in lending standards, high unemployment and a city-centre crash.

We always thought there would be two parts to the post lockdown economic recovery – a strong initial rebound, followed by a more difficult period where activity became patchier and progress would lose momentum. The world is now entering this trickier phase, where:

- Virus prevents full rebound in some sectors: Unfortunately the underlying cause of the recession – the COVID-19 virus – hasn’t gone away. Back in March, Imperial College produced some epidemiological simulations, with a baseline showing stop-go lockdowns and social distancing measures would be necessary for at least 18 months, or until a vaccine was discovered. Given ‘second-waves’ in the US and now parts of Europe (especially Spain and France), those simulations look increasingly prescient.

- Precautionary savings stays high: Consumers have cut their spending in 2020, even as government policy supported disposable incomes. This has raised personal saving rates. Part of this increase was involuntary - people were unable to engage in certain activities. We also see widening inequalities, with the wealthiest households responsible for most of this extra saving. The prospects for consumption depend on how these patterns evolve. Perhaps the wealthy will cut their saving (especially if the stock market holds up) but lower-income households are in a trickier position. Many of these people are not saving enough, especially if fiscal support fades and they face a lengthy period out of work.

- Spillover effects take over: Persistent weak activity in some sectors will create an aggregative shortfall in demand, leading to stubbornly high unemployment. The H1 decline in employment, recorded as "temporary" job losses (esp. in the US) and official furloughs (esp. in Europe) will start to look more permanent. This could increase precautionary saving and cause wider damage, especially via credit markets. As we showed in previous research, we would usually expect such high unemployment rates to be associated with rising corporate bankruptcies, stress in consumer credit and pressure on bank balance sheets. Policy can delay this damage but it cannot control the credit cycle. Continued uncertainty and a prolonged downturn will also have implications for business investment, another component of GDP that is set to remain weak in 2021.

Client Login

Client Login Contact

Contact