Surging demand for semiconductors is putting pressure on vehicle production and US-China relations. Taiwan and Korea are the prime beneficiaries, insatiable demand for their exports and rising prices adds conviction to our overweight North East Asian equity position. The chip famine is transitory and will not derail the global recovery. Although supply shortages are temporary they have renewed developed markets leaders’ focus on reshoring of critical production: the politicization of technology supply chains is here to stay.

Positive Covid-19 shock drives semiconductor shortage. National lockdowns and the shift to work from home created an unprecedented “Zoom Boom”, raising demand for semiconductor-intensive consumer electronics, office equipment, and cloud computing power. The pandemic is also helping vehicle sales, as people seek to avoid public transport. This strong auto sector recovery caught manufacturers, who had been cutting parts orders as recently as November, off guard. Semiconductor supply is tight across all sectors, but the problem is particularly acute for automakers as they are low volume low value customers for chip producers, and they carry lower inventories than the electronics sector.

Production capacity frozen for now. In my previous blog post on the importance of semiconductors to the global economy (“Semiconductors are the new oil”), I described the structural shift in demand for chips and the near-monopoly power of Taiwan and Korea at the fabrications stage of the production process. While there are quasi monopolies at most levels of the semiconductor value chain, it is at the ‘fab’ level that supply shortages most frequently manifest. It typically takes three years to build a new fab, so there is no quick-fix for current shortages. Moreover, the capital intensive nature of construction, and the need for high capacity utilization to generate an acceptable ROI, means supply tends to lag demand. The result is high cyclicality (around a secular trend) and periods of greater/lesser monopoly power. The current episode is firmly one of greater monopoly power.

Demand is likely to subside to a post covid-19 normal in late Q3/21. As vaccines roll out consumers will switch from goods consumption back to services, allowing order backlogs to clear. Until that time prices of chips will rise: TSMC is set to lead with a 10-15% increase. Insatiable demand and higher prices is another boost to North East Asian economies, equities, and FX, adding conviction to our overweight Taiwan and Korea in asset allocation.

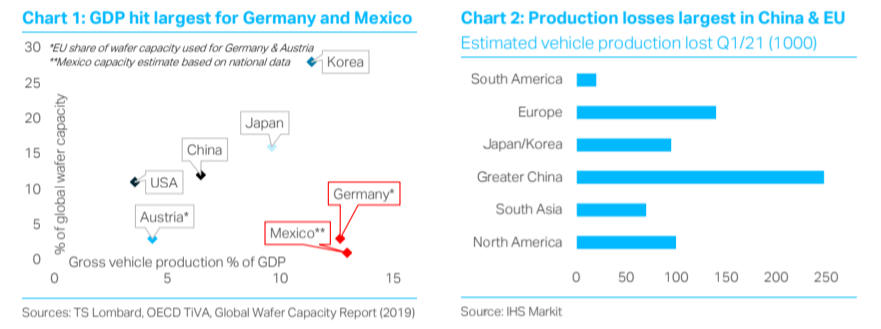

The greatest impact on the real economy is in the auto sector, which will face shortages until Q3/21. All the vehicle majors have shuttered some production and most have re-furloughed workers. Industry estimates put lost vehicle production at 672,000 in Q1/21. The impact will be uneven, vehicle output in chip-producing nations is likely to fare better than that of semiconductor importers. Toyota for instance is confident enough in local/regional supplies to raise its 2021 profit outlook. We plot the auto sector and foreign chip dependence in Chart 1 above. Germany and Mexico are most exposed.

In a bid to tackle the shortage, world leaders, particularly those of major vehicle producing nations, have made prominent overtures to the Taiwanese government. Biden, Merkel, Macron and Suga have all committed to resolving supply difficulties. But as noted above there is little the supply side can do to ameliorate the scarcity in the short-term. Nevertheless, top-level political involvement gives Taiwan an opportunity to leverage its near-monopoly position to gain concessions from DM governments. Taiwan’s Economic Ministry asked firms to help “like-minded economies” alleviate the shortage. The timing is particularly opportune with regard to the Taipei-Washington relationship. Biden is in the process of defining his China and Taiwan policy (look out for upcoming China Watch and US Watch notes on this subject). There is scope for Taipei to gain ground on long standing political and economic objectives including a US-Taiwan FTA, greater sovereign recognition, and leeway for FX intervention.

For Beijing, the further politicization of trade in technology is deeply concerning. Biden appears to be slowly building a Washington-Taipei relationship that is closer than that of the Obama era and more substantial than Trump’s high profile but erratic diplomacy. China is likely to view this as further evidence of America undermining the One China Policy which would trigger a strong response. We still think the risk of war over Taiwan is low, not least because invasion and the ensuing sanctions would cripple Taiwanese and Chinese chip production. Nevertheless, the potential for China-Taiwan-US political and economic friction rises as Taiwan’s power grows. A secondary worry for China is that PRC firms may lose out to rivals from “likeminded” countries in the competition for Taiwanese output. Korea – the only real alternative, and soon to be a lower-cost producer thanks to RCEP tariff reductions – stands to gain market share in the medium term. TS Lombard is bullish KRW in our Asset Allocation and Macro Strategy publications.

The chip shortage is cyclical, but DM leaders now aware of domestic vulnerability are looking to re-shore production. This is an extremely difficult goal that will require years of significant political and financial investment before making a dent in the Taiwan-Korea manufacturing duopoly. Semiconductor nationalism is here to stay.

Client Login

Client Login Contact

Contact