Whether one views the last couple of years as a break in the business cycle or the beginning of a new cycle, the bigger point is this has been a cycle on steroids: in terms of its amplitude, the speed of maturity and the policy response.

The reopening unleashed a surge in aggregate demand that exposed the usual lags in producers’ response, but these were exacerbated by acute and persistent supply-chain bottlenecks. Commodity prices soared while wage growth gathered pace on the back of pronounced labour market shortages and mismatches.

The result was a surge in inflation that eventually spooked policymakers out of their “transitory” narrative and spurred a hawkish turn from the Fed and other major DM central banks over the course of 2021 H2. With CPI prints surprising to the upside, Covid fears receding and political pressure to “do something” building up in the background, central bankers have changed tack and are now rushing to catch up with the macro cycle.

All this translates into ‘late cycle’ dynamics playing out earlier and on a larger scale than usual.

It would be wrong to blame central banks for the high inflation, just as it would be wrong to blame them for undershooting their inflation targets in the 2010s. Policymakers’ misstep this time round was to stay too far behind the curve for too long, i.e., leave monetary settings in emergency mode through 2021 even as economies were already far out of the depths of the pandemic. The recently espoused “Average Inflation Targeting” (AIT) framework is part of the reason behind this inertia; but AIT was meant to be a promise to not raise rates too soon, not keep real rates falling as a recovery takes hold.

The good news is that, at this stage, embarking on monetary tightening is still “easy” for policymakers owing to how loose the initial conditions are: in other words, there is currently room to adjust policy without fearing a “policy mistake” that upends the economic cycle.

The risk is that inflationary pressures do not let up going into 2022 H2. This would force central banks to hit the brakes too hard, i.e., tighten further and faster, in the hope of taming inflation. Given that this inflationary burst is dictated by supply-side deficiencies, the efficacy of policymakers’ attempts to slow inflation is questionable – just like erring on the side of easing post-GFC in the hope of raising inflation was like pushing on a string. The difference this time round is that the direction of policy would have deleterious, not benign, implications for the cycle – in other words, “things could start to break” – both in the real economy and financial markets.

All this boils down to two big (and related) macro questions: 1) whether we have reached “peak-inflation scare”; and 2) whether the current hawkish market pricing for the pace and size of monetary tightening in the major DMs has gone too far.

To us, the short answer to both these questions is ‘yes, it looks like it’.

Inflation is a lagging indicator. Cost-push pressures can be expected to linger owing to the staying power of demand and the severity of the disruptions in supply. But with forward indicators of growth softening and supply constraints set to ease, albeit at a relatively slow pace, chances are that goods price inflation will come down in 2022 H2 – perhaps sharply if energy prices reverse some of their recent gains – while services are unlikely to provide enough of an offset.

The industrial cycle is cooling as Covid consumption patterns in the major DMs reverse while Beijing’s aim to ensure stable rates of economic expansion still leaves risks for Chinese growth skewed to the downside. The silver lining is that some EM economies are gradually moving to ease Covid restrictions, boding well for a rebound in consumer confidence.

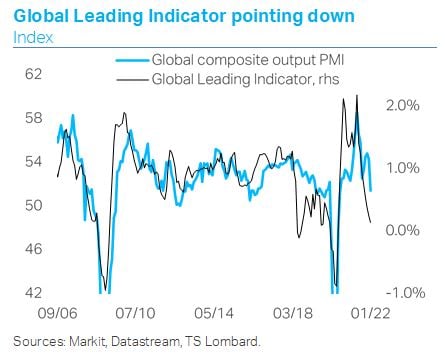

Our Global Leading Indicator keeps losing altitude, consistent with further deceleration ahead. In the same vein, the new orders sub-index of the global manufacturing PMI has dropped to levels last seen in July 2020; and with inventory pressures having eased significantly since mid-2021, output is set to cool further. US durable spending is returning to trend and January’s NFIB January survey showed that while inventory plans remain positive, plans to add have dropped below sentiment about current inventory levels.

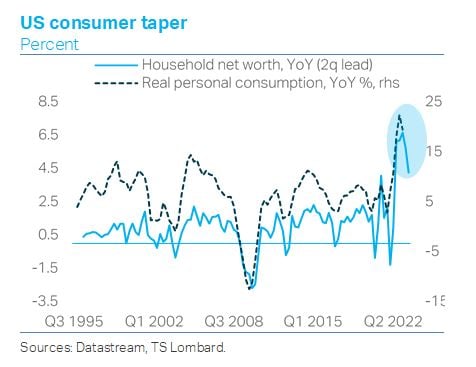

Further, it is real spending that ultimately drives inflation, and the combination of elevated energy prices with the broadening of inflation to services is already eating into DM household real incomes just as policy stimulus is tailing off.

If all this is right, then current market expectations for interest rates are too “linear”, i.e., they do not give enough weight to what is likely to be a softer world economy later in the year.

Client Login

Client Login Contact

Contact