The pandemic demand shift and supply mismatch catalysed a surge in global goods inflation. The supply side is improving to meet the new Covid-19 demand reality just as DM consumers transition to services spending. Omicron in China and the long lead time of semiconductor production complicate the picture, but overall demand/supply is moving into balance and, as a result, we are seeing moderation in goods inflation and elements of hawkish pressure on central banks. For China, falling exports sets up RMB depreciation going in to H2.

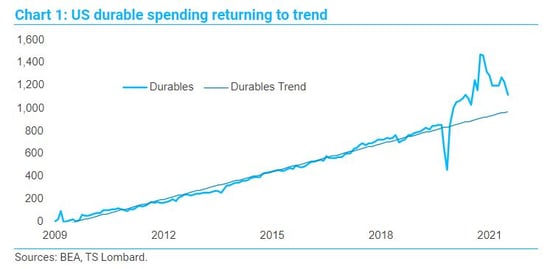

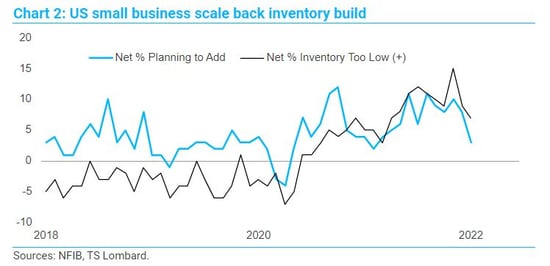

The great demand surge in the US has passed and, in time, inflation will follow. The demand surge was tied to fiscal transfers giving a large swath of consumers the wherewithal to let loose pent-up demand for durables – at the same time that supply chains were constrained by Covid. With the payments now past tense, spending is slowly returning to trend (Chart 1). Meanwhile, small businesses are beginning to downward adjust their accumulation of inventory. The NFIB January survey revealed that while inventory plans remain positive (Chart 2), plans to add have dropped below sentiment about current inventory levels – such a drop is normally concurrent with a recession. While a recession is unlikely, the drop in consumer demand together with the downshift in inventory plans points to a period of slow economic growth.

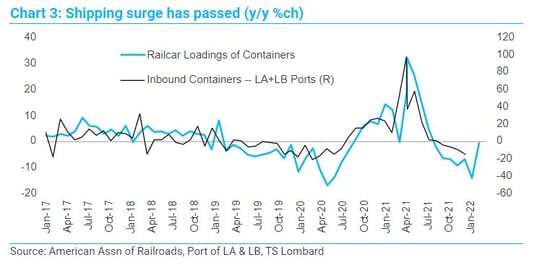

That the surge in demand has passed is also evident in the negative Y/Y growth rates for railcar loadings of containers and the inbound volume of containers entering the nation’s main port for goods from Asia – Los Angeles and Long Beach (Chart 3). With volumes diminishing, prices will follow – as evidenced by the fall in container rate for shipping from China to the US West Coast and the PPI for transport and warehousing of consumer goods.

That the surge in demand has passed is also evident in the negative Y/Y growth rates for railcar loadings of containers and the inbound volume of containers entering the nation’s main port for goods from Asia – Los Angeles and Long Beach (Chart 3). With volumes diminishing, prices will follow – as evidenced by the fall in container rate for shipping from China to the US West Coast and the PPI for transport and warehousing of consumer goods.

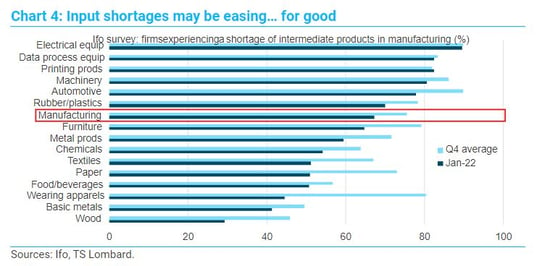

Across the Atlantic, Euro Area input shortages and demand appear to have eased. A major survey conducted by Ifo in Germany shows that the share of firms in the whole sample experiencing a shortage of intermediate goods declined to 67% in January, down from more than 75% on average in 2021Q4 (Chart 4). Looking at this from the supply side: Euro Area (EA) manufacturing PMIs point to a gradual reduction in suppliers’ delivery times. From the demand side, upside surprises in Germany’s industrial orders in December (2.8% MoM vs 0.5% expected), both for foreign and domestic markets, highlight that pressure on firms’ work backlogs is here for longer.

Across the Atlantic, Euro Area input shortages and demand appear to have eased. A major survey conducted by Ifo in Germany shows that the share of firms in the whole sample experiencing a shortage of intermediate goods declined to 67% in January, down from more than 75% on average in 2021Q4 (Chart 4). Looking at this from the supply side: Euro Area (EA) manufacturing PMIs point to a gradual reduction in suppliers’ delivery times. From the demand side, upside surprises in Germany’s industrial orders in December (2.8% MoM vs 0.5% expected), both for foreign and domestic markets, highlight that pressure on firms’ work backlogs is here for longer.

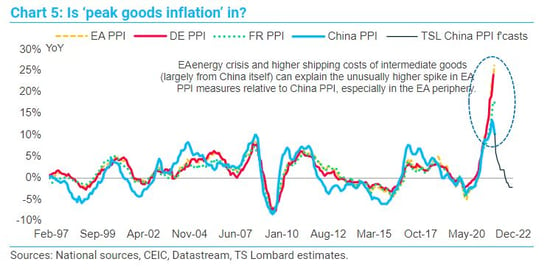

Nonetheless, there are three major indicators that reinforce our relatively optimistic view that the inflationary impulse from input shortages in the EA will start to ease as of 2022 Q2 and will abate throughout H2. On the supply side: (i) China PPI is rolling over, as we expected – historically, China PPI has led EA PPIs by a couple of months (Chart5); and (ii) firms are rebuilding inventories, which will help manage supply-chain issues, giving production some respite from current stop-and-go dynamics – leading indicators such as Taiwan’s stock-of-purchases PMI appear to confirm this trend over the next six months. On the demand side, easier restrictions in the EA (but also in EMs) will finally trigger the consumption rotation from goods to services, taking the foot off the consumer-goods demand accelerator.

Nonetheless, there are three major indicators that reinforce our relatively optimistic view that the inflationary impulse from input shortages in the EA will start to ease as of 2022 Q2 and will abate throughout H2. On the supply side: (i) China PPI is rolling over, as we expected – historically, China PPI has led EA PPIs by a couple of months (Chart5); and (ii) firms are rebuilding inventories, which will help manage supply-chain issues, giving production some respite from current stop-and-go dynamics – leading indicators such as Taiwan’s stock-of-purchases PMI appear to confirm this trend over the next six months. On the demand side, easier restrictions in the EA (but also in EMs) will finally trigger the consumption rotation from goods to services, taking the foot off the consumer-goods demand accelerator.

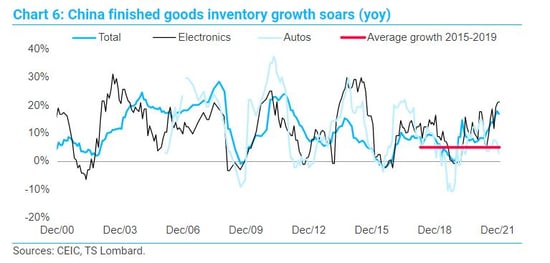

China and chips are key to the global supply side. Chinese factories have operated at record high utilization levels throughout the pandemic, as the PRC benefited from surging DM demand and trade competitors in lockdown. Capex for Covid-related goods production soared and China gained market share. Over the past quarter, as DM consumers have slowly shifted back to services consumption, trade competitors largely reopened and domestic consumption remained sluggish (Omicron and wage growth), higher output has fuelled rapid inventory growth at 17% yoy (Chart 6) 12 ppts above pre-Covid trend. Surging finished goods stocks will weigh on Chinese goods prices and contribute to disinflation of export prices. For industrial prices, we continue to forecast a large slump in residential property investment, government price controls and base effects, which will send PPI negative in H2/22 (Chart 5).

China and chips are key to the global supply side. Chinese factories have operated at record high utilization levels throughout the pandemic, as the PRC benefited from surging DM demand and trade competitors in lockdown. Capex for Covid-related goods production soared and China gained market share. Over the past quarter, as DM consumers have slowly shifted back to services consumption, trade competitors largely reopened and domestic consumption remained sluggish (Omicron and wage growth), higher output has fuelled rapid inventory growth at 17% yoy (Chart 6) 12 ppts above pre-Covid trend. Surging finished goods stocks will weigh on Chinese goods prices and contribute to disinflation of export prices. For industrial prices, we continue to forecast a large slump in residential property investment, government price controls and base effects, which will send PPI negative in H2/22 (Chart 5).

Omicron and Beijing’s “Omicron and Beijing’s ‘dynamic-clearing’ policy pose a risk to global supply chains. We think China will maintain strict Covid control policies through 2022, which means that disruption at ports and manufacturing hubs is highly likely this year. However, the hit to domestic demand, the return of non-China production and improved management of domestic supply chains should reduce the impact on global supply chains compared with previous outbreaks.

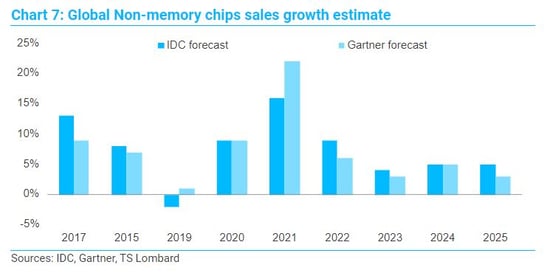

Chip demand is still outstripping supply. Building a new fab takes two years (and billions of dollars), and the long lead time means that resolving semiconductor shortages in this cycle has always been about demand normalizing rather than production catching up. The latest industry forecasts put supply/demand normalization at mid-year 2022 (Chart 7). Sourcing difficulties remain most acute for automakers – Chart 6 above shows that owing to the lack of chips, the inventory of finished vehicles in China is growing well below that of broader manufacturing. However, even the auto industry is expected to see improvements in Q3/22 and return to normal by 2023.

Goods demand is tapering off and supply is improving. This – not current inflation – is the relevant backdrop for the Fed’s decision-making come mid-March. It is not so much a case of a weak economy as that of an economy scaling back from an illusory pace of growth built on reopening and income transfers. While we remain positive enough about where the economy ends up after this transition from Covid cycle to the “long cycle”, the transition itself creates enough doubt to rein in the aggressiveness of the Fed’s plans for removing accommodation. As regards the ECB, market expectations of ECB hawkishness may have peaked, even though the ECB itself has not officially reached its “peak hawkishness” yet. We expect the March meeting to revise inflation projections upwards and put a December hike firmly on the table. Finally, for China, limited consumer price pressure and outright PPI deflation mean that the PBoC can and will stay dovish in the face of a property-sector slump and a sluggish consumer recovery. We see another 50bps RRR reduction and another10bps in policy rate cuts. Falling global goods demand and narrowing yield differentials will lead to RMB depreciation in H2/22.

Client Login

Client Login Contact

Contact