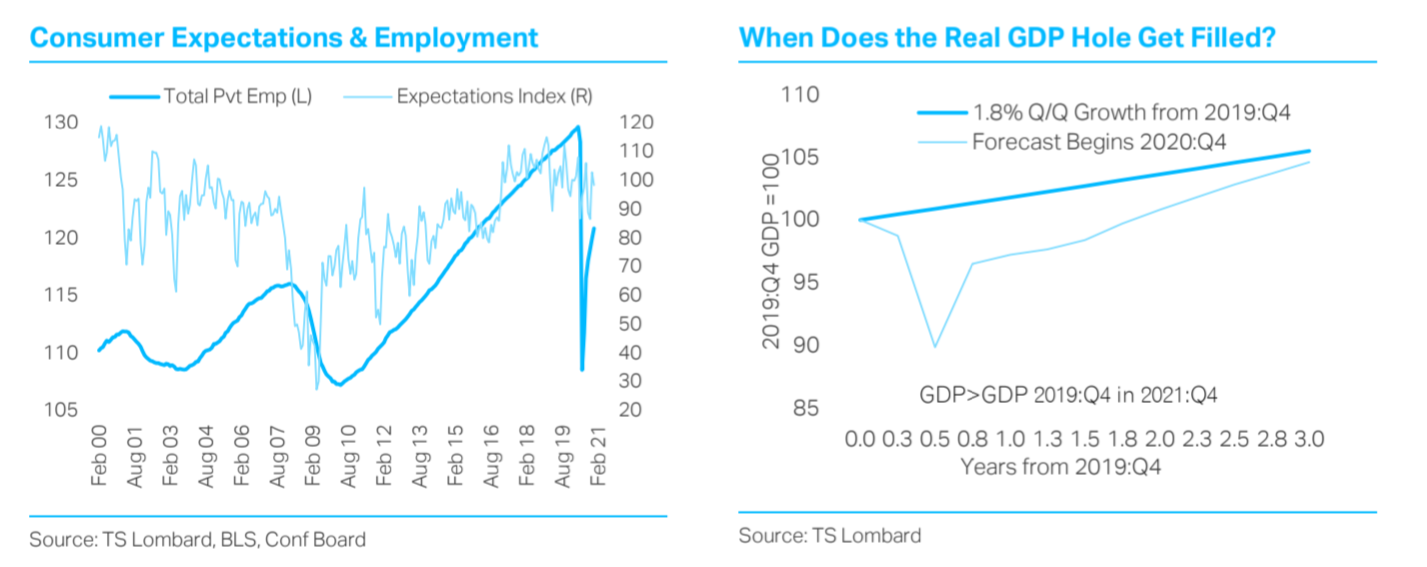

The vaccine arrives early 2021, so our growth forecast accelerates as a result, beginning in 2021 Q3, and the timeline for when the Fed first “tightens” shortens. It may seem odd to relay this view just when the resurgent virus and failure to pass a Covid-relief package weakens real GDP growth in this and the next quarter -- 3% Q/Q annualised in Q4, 1.8% in Q1 (inclusive of a package enacted before years end that is topped up, if needed, in February). But consumers and market participants have proven remarkably consistent in seeing Covid-related disruptions as transient in their impact on income and wealth. It is, in fact, a salient feature of this whole episode that despite the sharp drop in employment, only halfway recovered, forward expectations never dropped as they did in 2008, or even in 2016 (see chart below left). With a vaccine arriving this spring, and the election results in place, it is easier to look through this coming disruption and see how Fed policy unfolds relative to their new lower-for-longer mantra. From our perspective, the rebound looks rapid enough (chart below right) that by the time 2022 comes to an end, a 0.125% funds rate will be too low even for the FOMC.

The election outcome plays a part in our Fed outlook because current outsized fiscal deficits now have an end date and therefore so too does the Fed’s Treasury purchases. Covid-relief transfers wind down once the vaccine arrives, and Biden’s plans for tax hikes and large-scale infrastructure spending are going nowhere with a Republican Senate. Nothing turns Senate Republicans into deficit hawks faster than a Democrat in the White House – only two years ago Republicans doubled the deficit with their own tax and spend plan. Quick ends to large deficits are contractionary, but this will be heavily outweighed in 2021 and 2022 as the vaccine unleashes an economy impaired by social distancing. This has already played out on a limited scale these past several months -- spending and employment rebounding sharply even after CARES Act transfers ended, notably the $600 boost to unemployment insurance. There is a debate as to how long consumers can keep spending, but as we have written many times, so long as equity markets remain high so does consumer confidence, meaning growth momentum is only stopped by the virus shutting activity, as it did in Europe. This is the point Powell was making in his press conference.

People never warmed to the notion of an economy in crisis. The Democrats ran on economic crisis, and for far too many it is one, but Republicans held the Senate and reduced their deficit in the House, because that view is not shared by most – even though Trump lost. Biden’s candidacy gave moderate Republicans the option to vote against Trump as a person while still voting for Republican management of the economy. (We assume Republicans hold the two seats in Georgia. Even with maximum turnout, each Democrat was behind the combined Republican and Libertarian votes, and we expect the same outcome in January, especially with Libertarians not running and Biden being President because, in part, he carried the state.)

What all this sums to is that once the social distancing shackles are off, the economy is poised to race ahead. The rebound we expect once enough people are vaccinated (30 June is our arbitrary date) pulls real GDP above its 2019:Q4 level by the end of 2021 and, on a dynamic basis, it will be close to growth potential by 2022 Q4 (see chart above right). With this growth plus constrained Federal spending, the budget deficit shrinks quickly. A deficit snap-back is already evident this year, on a monthly basis, although it will rewiden once the new relief package is passed. Therefore, even with a $1trn Covid-relief package before year’s end or in the first quarter, net new issuance by Treasury drops off sharply after that and, with growth strong, so too will the Fed’s need to buy $120bn/month of issuance to support market intermediation. This program could stop by the end of 2021. The Fed’s communication problem with extricating itself from perennial balance sheet expansion is that markets will see this as precursor to the first rate-hike. This is where yield curve caps may come into play.

The Fed’s rate commitment cannot justify a 0.125% funds rate if unemployment is 4%,real GDP is back close to potential, and inflation. though just below 2%, is rising again. Wage growth could also be high in 2022 because of strong profits in 2021, rising employment in mid-wage jobs such as construction, and probable increases in the minimum wage. It is difficult to see any benefit to keeping the funds rate effectively at zero in this forecast economic environment. The Fed has veered from promised trajectories before, this will just be another time – so the Fed could hike in 2022 Q4.

The Fed raising the funds rate at the end of 2022, two to three years sooner than expected, does not mean everything in the economy will be fine. Issues bedevilling the economy pre-Covid are still here, expressed to us in the gap to the 1966-93 trend line, and there will be a lingering impact from Covid on the organization of economic activity. The solutions do not, however, rest with monetary policy. They rest with governmental policies, beyond just building bridges, roads, tunnels, windmills, and solar panels. What the vaccine does do, and what our forecast is meant to convey, is it lops off deflationary risk from a virus shutdown and unleashes activity, reducing the large number of unemployed. The slingshot should last at least until the end of 2022. Unless, of course, something else comes along.

Client Login

Client Login Contact

Contact