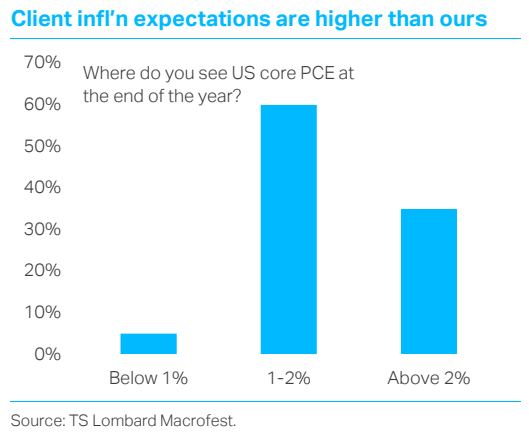

What is normal anyway? Our clients respond

22 Jan 2021 - Oliver BrennanAt our MacroFest virtual event on 12th and 13th January, we discussed the outlook for global growth, global markets, energy, deglobalization and, of course, COVID-19, among many other topics. As a follow-up to the.

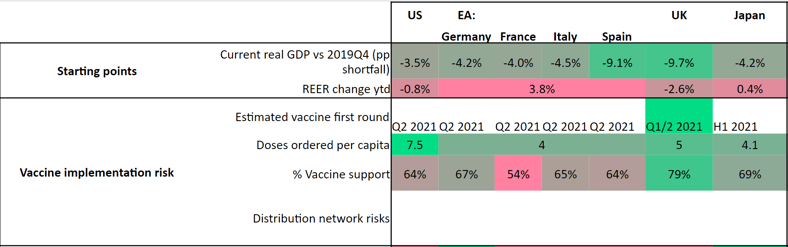

#Inflation #Eurozone #Emerging Markets #Covid19 #Currencies #USD #VaccineThe Vaccine Matrix: Winners and Losers

30 Nov 2020 - Oliver BrennanFill in the form below to download the full report - The Vaccine Matrix: Winners and Losers, by Oliver Brennan, Managing Director, Macro Strategy. What does the great rotation mean for countries’ economies? Is it simply.

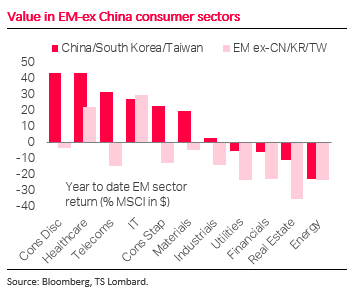

#Eurozone #China #Vaccine #RecoveryEM: Vaccine rotation impact

17 Nov 2020 - Jon HarrisonThe prospect of a vaccine will drive a rotation to underperforming EM assets at the expense of outperformers. EM exporters will benefit from rising global growth, while growing inflationary pressures will shift the.

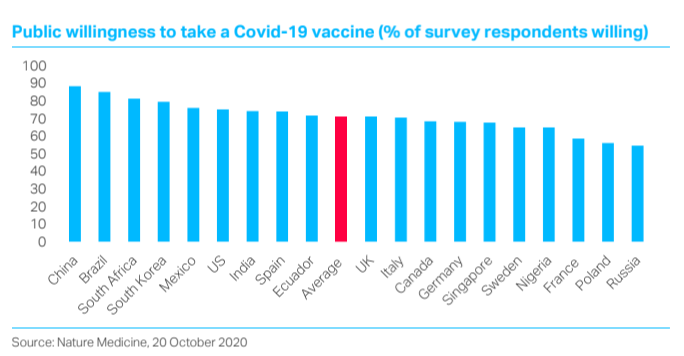

#Emerging Markets #VaccineBioNTech/Pfizer vaccine announcement in a financial market perspective

13 Nov 2020 - Christopher Granville“Where might be the catch?” This question about the prospects for the vaccine route to suppressing the pandemic arises naturally from financial markets’ acclamation of last Monday’s Pfizer/BioNTech announcement. Before.

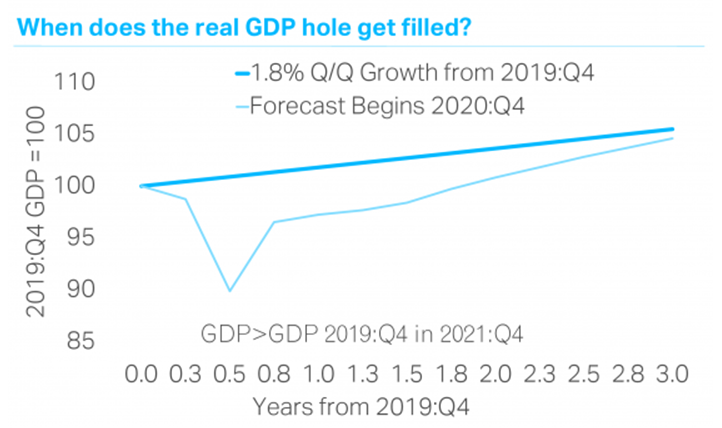

#Fiscal Policy #Stimulus #VaccineThe Fed's Shortened Timeline

12 Nov 2020 - Steven BlitzThe vaccine arrives early 2021, so our growth forecast accelerates as a result, beginning in 2021 Q3, and the timeline for when the Fed first “tightens” shortens. It may seem odd to relay this view just when the.

#Federal Reserve #Monetary Policy #US Economy #Vaccine #Quantitative Easing Client Login

Client Login Contact

Contact