The markets remain caught in the pincer movement between a hawkish Fed and slowing world growth: 2022 is “payback year” following the outsized gains of 2021. Inflation looks like it is about to peak but at the same time prove protracted, keeping policymakers on their toes and raising the risk of a Fed-induced global economic “hard landing” next year. Rising oil prices are the best cure for rising oil prices, but the level from which demand slows matters and the world economy’s pain threshold may be higher than in previous cycles.

Between a rock and a hard place. The pincer movement between slowing global growth and a hawkish Fed continues to squeeze asset prices, reinforced by the combination of USD strength and CNY weakness.

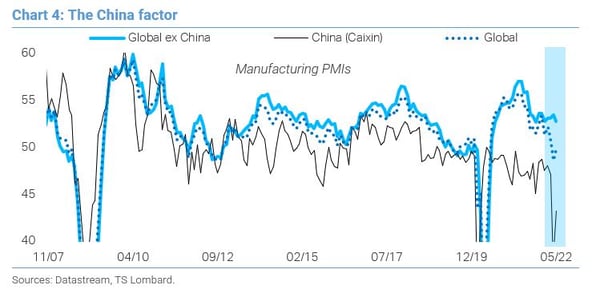

Temporary relief. Expectations for Fed tightening cooled following May’s FOMC meeting, capping the advance in US yields, pulling the dollar lower and giving equities some breathing space. News that Shanghai was lifting lockdown restrictions, coupled with the latest China manufacturing PMIs showing signs of improvement and fresh stimulus efforts from Beijing, allowed CNY to stabilize around the 6.70 mark and industrial metal prices to temporarily find a firmer footing.

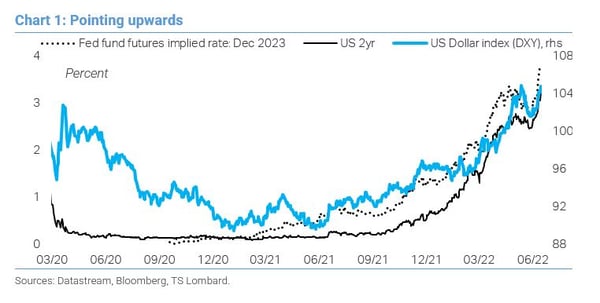

The Fed is not done. Still, US CPI inflation increasing further to an 8.6% annual rate in May was a reminder that the Fed is not done, pulling asset prices lower again. We see the Fed funds rate on a path towards 4% sometime at the beginning of 2023.

From “transitory” to “protracted”. Inflation looks like it is about to peak but at the same time remain elevated against the backdrop of tight labour markets and persistent supply dislocations, limiting the scope for a dovish turn from the major DM central banks and keeping equities on the back foot. Earnings breadth is deteriorating, valuations have corrected lower, a lot of market froth has come off, and expectations for profit margins have started adjusting to rising cost pressures. However, headline earnings estimates for 2022 H2 and 2023 have barely moved. The looming risk is that investors have yet to adequately price in the risk of negative payback in private spending as last year's fiscal stimulus dries up, food and energy prices spike, inventories catch up with demand and consumer confidence rolls over.

From “transitory” to “protracted”. Inflation looks like it is about to peak but at the same time remain elevated against the backdrop of tight labour markets and persistent supply dislocations, limiting the scope for a dovish turn from the major DM central banks and keeping equities on the back foot. Earnings breadth is deteriorating, valuations have corrected lower, a lot of market froth has come off, and expectations for profit margins have started adjusting to rising cost pressures. However, headline earnings estimates for 2022 H2 and 2023 have barely moved. The looming risk is that investors have yet to adequately price in the risk of negative payback in private spending as last year's fiscal stimulus dries up, food and energy prices spike, inventories catch up with demand and consumer confidence rolls over.

King dollar. Perhaps the more important macro development over the last year or so has been broad-based USD strength. The dollar bottomed out in 2021 Q2; it has trended higher since and the rally looks like it has further to run, underpinned by continued deceleration in Eurasian growth and sticky US inflation that is set to keep the Fed hawkish, pushing US Treasury yields higher.

King dollar. Perhaps the more important macro development over the last year or so has been broad-based USD strength. The dollar bottomed out in 2021 Q2; it has trended higher since and the rally looks like it has further to run, underpinned by continued deceleration in Eurasian growth and sticky US inflation that is set to keep the Fed hawkish, pushing US Treasury yields higher.

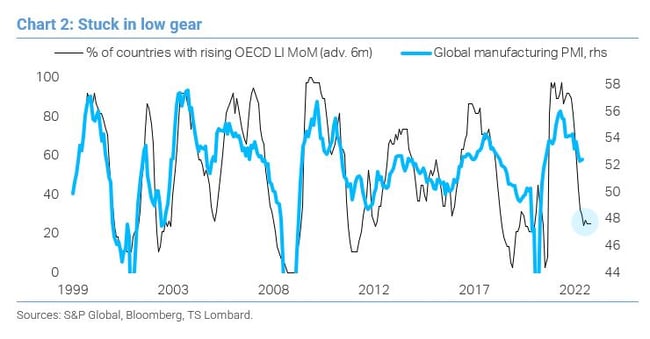

China drag. What is more, the Chinese economy remains stuck between “zero Covid” and the authorities’ desire to support real activity. We think that ultimately growth is what gives, raising the likelihood that CNY heads back to pre-Covid levels of 7-7.2 by yearend. History suggests that the Chinese PMIs tend to lead the rest of the world by six to nine months; so even if the bottom in Chinese industrial activity is in, chances are that the global industrial cycle deteriorates further rather than stages a sustainable recovery over the course of this year – not least as China’s credit impulse remains negative. In addition, while one of our favourite indicators for the global cycle – the share of countries whose OECD Leading Indicator is rising MoM – has steadied this year, it has yet to show signs of a positive turnaround.

Commodity skew. All this points to a “soft landing” as the least likely path for the world economy, clouding the demand outlook for commodities and leaving the combination of deficient supply, low inventories and elevated risk premia on the prospect of Ukraine becoming another “forever war” to keep propping up prices. Overall, commodities continue to trend higher but the breadth of the advance has narrowed. With industrial metals resetting lower in 2022 Q2 and agricultural prices holding steady over the past three months, it is continued strength in energy prices that has single-handedly kept feeding the rally.

At this juncture, it looks like only a severe shock to demand can cool this oil market. It is striking that we are at US$120 oil despite decelerating Chinese activity and intensifying worries about a global economic “hard landing”. This reflects a fundamental backdrop of low inventories and sluggish supply, from both OPEC and non-OPEC producers, which has been exposed by a surge in demand as the world economy reopened. Elevated geopolitical uncertainty has made an already tight oil market only tighter still.

The million-dollar question is what the world economy’s pain threshold is. We do not pretend to know the answer, but we note that the level from which demand slows matters. Our sense is that the outsized post-Covid snapback in global economic activity means that oil prices may need to stay higher for longer than in previous cycles for material demand destruction to set in – just as the Fed feels it needs to stay aggressive on monetary tightening in order to bring demand down closer in line with supply.

Client Login

Client Login Contact

Contact