Time to play catch-up. Policymakers have finally dropped the “transitory” narrative and are playing catch-up, rushing to normalize monetary settings closer in line with last year’s sharp positive macro turnaround. While the major DM central banks started dialling back their ultra-dovish stance in late spring 2021 on growing evidence that the world economy had turned the corner, the latest change in posture mirrors a lack of appetite for remaining behind the curve.

Hot then cold. The services side of the world economy is holding up, with December’s PMIs showing only a limited impact from the Omicron variant – a sign that consumers and businesses are adapting to life with an endemic virus like Covid-19. Overall global demand is cooling, however, against the backdrop of a maturing industrial cycle, and coupled with some easing in supply-chain pressures this should allow inflation to stabilize (in 2022 H1) and subsequently head lower (in 2022 H2).

There are tentative signs that 2021 Q4 marked the peak in cost-push price pressures. A closer look at the global manufacturing PMI subcomponents shows both input and output prices coming off October’s top during November-December. The “backlogs of work” PMI remains elevated but has stayed below its May 2021 high, while the “delivery times” PMI has risen in the last couple of months to levels last seen before 2021 Q2. China’s official manufacturing PMIs (NBS) show a sharp drop in the “main raw material purchase price” index while the “stock of major inputs” PMI has risen to its highest since mid-2018. In the US, the manufacturing ISM “prices paid” index declined markedly during the last two months of 2021; and if history is any guide, its non-manufacturing counterpart is set to follow suit over the coming months.

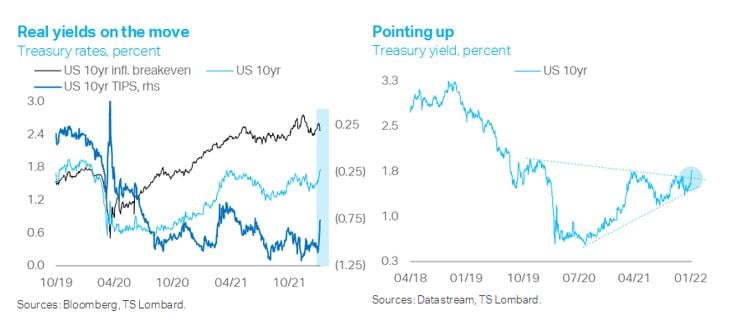

The combination of hawkish Fed rhetoric and easing fears about Omicron’s impact on economic activity has allowed an “undecided” bond market to make up its mind, at least for the time being. Long US real yields have jumped to levels last seen in early summer 2021, pushing the nominal 10yr Treasury rate a little over the highs set in March. Meanwhile, the 10yr TIPS inflation breakeven remains in a tight range consistent with signs of cost pressure exhaustion.

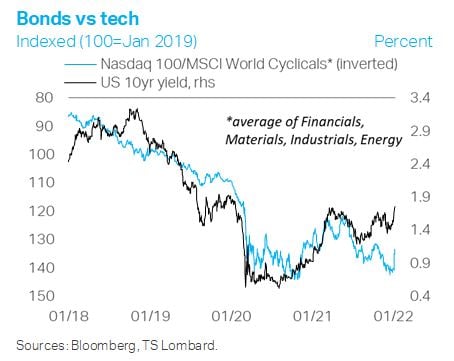

Equity investors have responded by rebalancing further away from the “weak links” among growth stocks towards the more cyclical parts of the market. While the uptrend in the Nasdaq 100 remains intact, the dispersion in performance between those companies with strong and stable earnings versus the more speculative names – with demanding valuations and little or no profits – has widened significantly. The Nasdaq has lagged Cyclicals since the ‘Powell pivot’ at the end of November 2021. Just like during the period from 2020 Q4 to 2021 Q1, the positive impulse in long Treasury yields is now associated with tech sector underperformance.

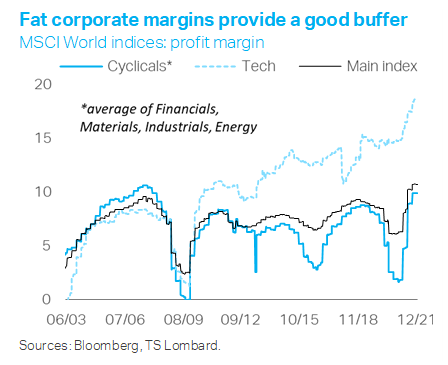

What remains to be seen is whether this will prove a short-lived move or the tracing of a double-top in the Nasdaq’s relative strength that paves the way for a longer-lasting turnaround. Besides the degree and pace of any further upside in long bond yields, the main factor is the outlook for corporate earnings against the backdrop of intensifying margin pressures and cooling sales growth. Our take is that while the conditions are falling into place for tech outperformance to moderate, this does not necessarily imply a sustained/major reversal of fortunes.

Contrasting today’s macro environment with that of 2018 is instructive in this context. Back then, the Fed was in balance-sheet run-off mode and the global manufacturing cycle was slowing down while headwinds for corporate profit margins were rising, amplified by Trump’s trade war. 2018 was essentially a lost year for global equities – one that culminated in a sharp winter sell-off. Tech stocks outperformed Cyclicals throughout 2018 H2 in the face of rising long bond yields – a sign that the Fed’s policy stance was getting too restrictive for global growth, adding to the headwinds from an appreciating dollar.

This time round, notwithstanding lingering Covid-related uncertainty, the initial conditions are somewhat different and suggest that while we are entering a more volatile period for risk assets, cyclical stocks can still post positive returns despite slower economic growth and ongoing monetary policy normalization in the major DMs.

First, the FOMC is about to embark on a rate hiking cycle with real Treasury yields at unprecedentedly low/negative levels. The next round of the Fed’s balance-sheet reduction is also set to kick off with total Fed assets at roughly double their level of 2017 Q4, when the Fed started implementing QT following 100bps of rate increases from December 2015.

Second, while the world’s major economies are set to decelerate this year, the slowdown will be from above-trend GDP levels/rates.

Third, corporate earnings power is hovering around record levels, including for Cyclicals. Profit margins can be expected to shrink in 2022, yet the decline will be towards only trend/average levels.

Finally, with supply-chain disruptions more likely to ease than not (the question is how much and at what pace) and with the world learning to live with the virus, the global economic expansion is bound to become more stable and less geographically uneven in 2022. This will ultimately put a lid on US monetary policy divergence, which should act as a brake on further material upside for the dollar relative to the major DM currencies (not the CNY, however) – on balance, a tailwind for the global cycle.

Client Login

Client Login Contact

Contact