At our MacroFest virtual event on 12th and 13th January, we discussed the outlook for global growth, global markets, energy, deglobalization and, of course, COVID-19, among many other topics. As a follow-up to the event, we use our poll results to identify where there was no clear consensus among attendees, and where our views differ markedly: one big picture, one on the dollar and one on the perennial attention-grabber – inflation.

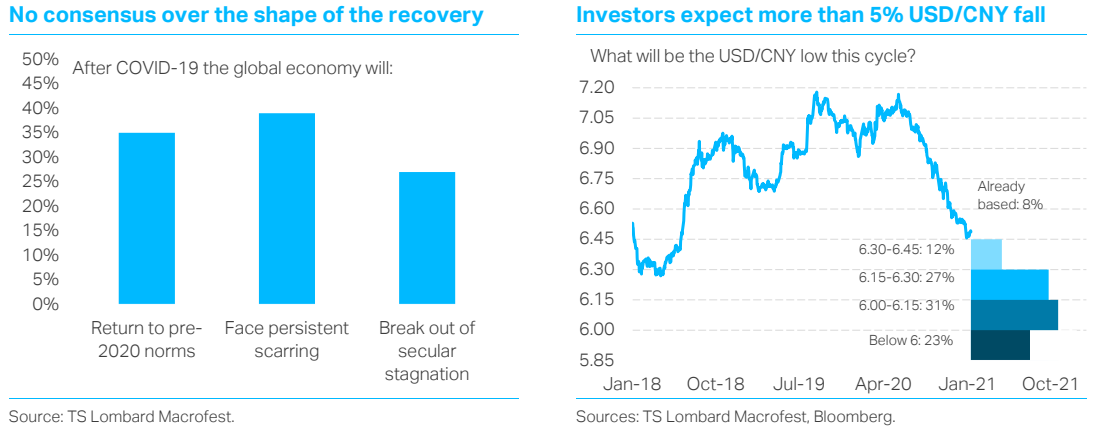

Big picture: the post-COVID economy. What will the global economy look like once this pandemic is over? There was a three-way split (see below-left chart) and a near-equal split in expecting a return to pre-2020 norms and persistent scarring. We are worried about scarring and are watching employment data carefully for signs of permanent detachment from the labour market. For now, as the vast majority of job losses were in the hospitality sector, the scale of scarring can only be gauged as this sector re-opens. Most interesting is that a significant minority reckon the post-pandemic global economy will break out of secular stagnation – a bold call given the historical behaviour of economies following past pandemics. Pandemics have historically triggered decades-long declines in the equilibrium real interest rate – an outcome that suggests escaping secular stagnation will be a challenge after this crisis. As one of the most dynamic economies in the world the US has a better chance of breaking out of stagnation than (e.g.) the EU, but it’s a bold bet for today. Recovery, yes; reflation, yes; but we’re not betting on a return to high interest rates: look, for example, at the mini-tantrum when 10y rates rose to a mere 1.2%.

The dollar and the renminbi. During our Emerging Markets currencies panel we asked two questions: one on broad dollar appreciation and the other on the USD/CNY rate specifically. The majority of our attendees (70%) reckoned on less than 5% appreciation in the broad dollar this year. Our view is more in line with the minority here: we expect between 5% and 10% dollar depreciation this year (in line with 23% of attendees), helped by cheap EMFX revaluations.

"The dollar-decline sell-side consensus is joined by clients’ USD/CNY view – but not by the broad USD view"

In fact, the majority were more bearish USD/CNY than USD/TWI. The right-hand chart above shows that most expect USD/CNY to break the 2018 low this cycle and for this low to be below 6.15 – equivalent to a drop exceeding 5%. This is more bullish than us: we reckon 6.30 by mid-year, when we will reassess based on China’s external dynamics. But the view that the broad dollar falls by less than the decline in USD/CNY implies USD strength vs EUR at least: we reckon this is very unlikely. Incoming Treasury Secretary Yellen is committed to a “market-determined” dollar rate, and the Fed is pursuing an inflation target which implies a weak-dollar policy. If USD/CNY falls by 5-10%, we expect USD to fall by a similar magnitude against most other majors.

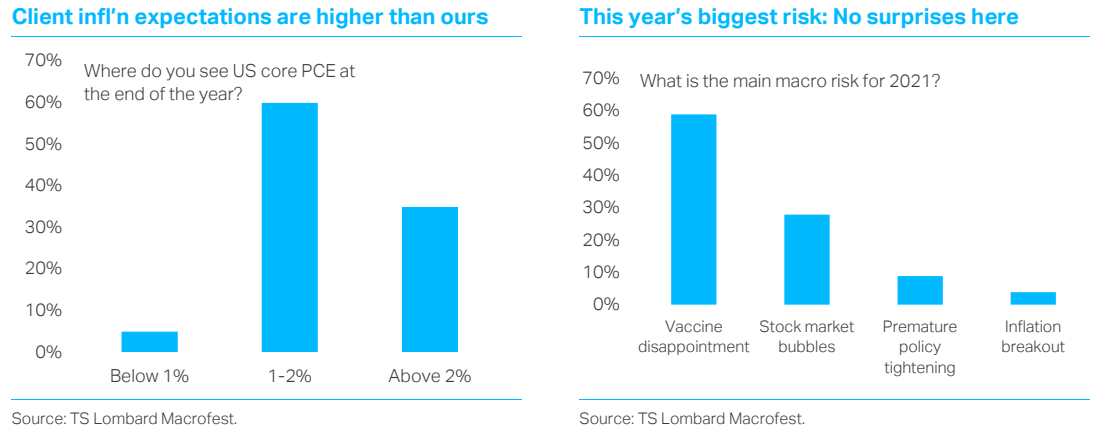

Inflation: Core PCE is currently around 1.4%. We expect it to drop to 1% this year: we neither buy the monetarist argument of high supply nor expect inflation to break its 18-months-after-GDP-bottoms relationship with growth after recessions. This puts us at the low end of market expectations; attendees at MacroFest think inflation is more likely to end the year well above 1% (see above-left chart). We reckon any inflation scare is an opportunity to fade, not chase.

"On inflation, we remain below clients’ views, and consensus, this year"

As for the biggest risk? Quite rightly, attendees were most worried about COVID-19 vaccines (see top-right chart), while recent mutations were seen as causing only some additional tail risk. For us, mutation risk is one that keeps us awake at night as we reckon it could delay the recovery by four to five months, especially given the resurgence in infections in certain countries. The other risk that keeps us awake is the stock market bubble; no matter that there may be no alternative, or markets are driven by stay-at-home tech: when stocks are so rich – and long-run returns are likely to disappoint – any risk can be a trigger.

These MacroFest poll results are a great guide to consensus and to still-uncertain views and they tell us to keep a close eye on the live debate around the shape of the recovery (including scarring), the dollar, and inflation.

Client Login

Client Login Contact

Contact