US growth and the Fed - after the Russian invasion

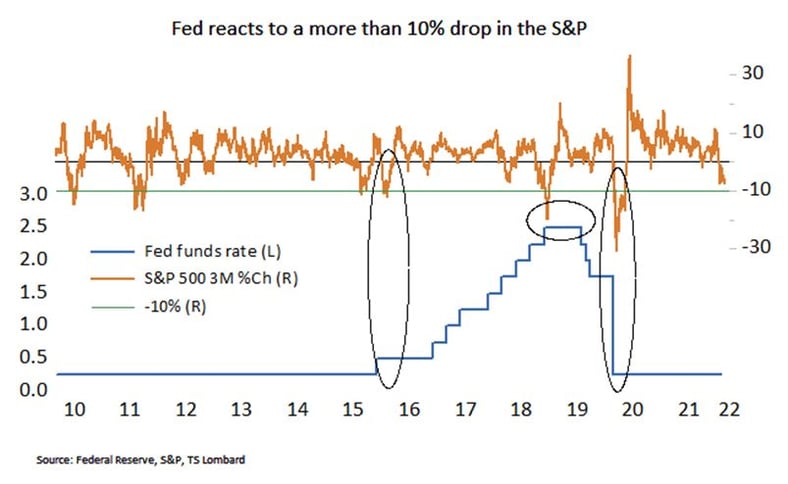

28 Feb 2022 - Steven BlitzThe short-term implications of the Russian invasion of Ukraine pales next to the longer-run consequences, but the world focuses on the short-term and so too does this note (with a coda on the long-run). First off, Biden.

#Federal Reserve #Russia #Geopolitics #UkraineRussia-Ukraine war: Initial market take

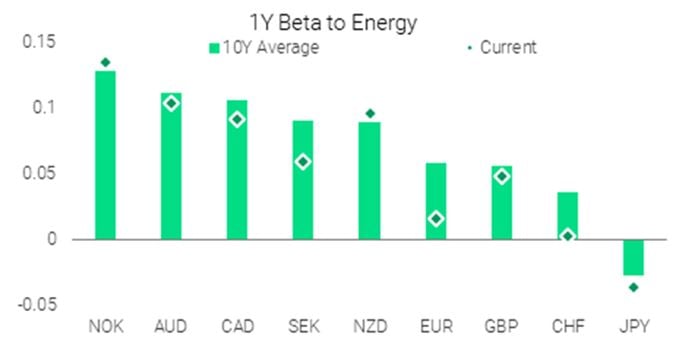

25 Feb 2022 - Andrea CicioneMarkets normally react negatively to geopolitical risks but soon lose interest. The North Korea crisis of 2017-18 is a prime example of this: since it’s impossible to put a price on a nuclear war, markets simply decided.

#Federal Reserve #Oil & Gas #Oil Price #Russia #Commodities #Ukraine #War Client Login

Client Login Contact

Contact