Dario Perkins

Recent Posts

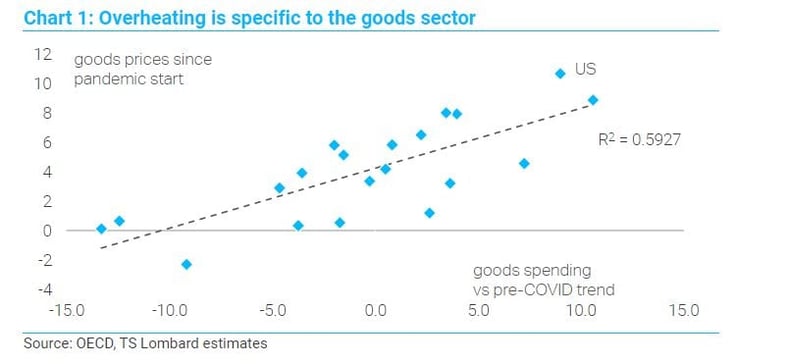

Don't extrapolate from this fake business cycle

13 Jan 2022 - Dario PerkinsEdgar Fiedler, who served as Assistant Secretary of the Treasury in the Richard Nixon and Gerald Ford administrations, famously joked: “Ask five economists a question and you'll get five different answers – six, if one.

#Central Banks #Monetary Policy #Inflation #Recession #RecoveryThe Sellside Guide to Christmas

24 Dec 2021 - Dario PerkinsThe Christmas blockbuster: For economists, Christmas is all about the big “Year Ahead” publication. Even though it’s obvious nobody actually reads these tomes (except, maybe, other sellsiders), they have to be really.

#Central Banks #Bank Of England #FX Market #Cryptocurrency #ChristmasHawkish markets to force global policy response?

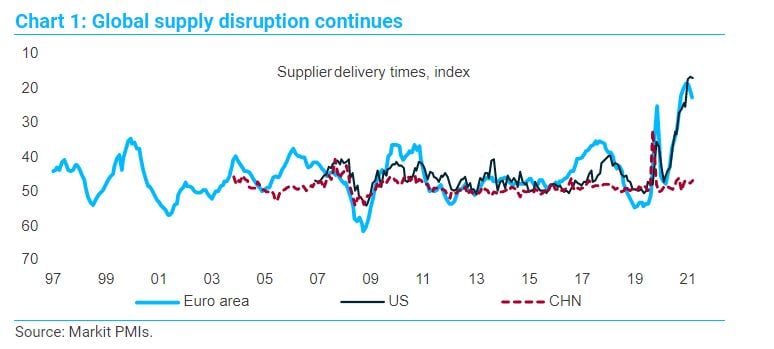

04 Nov 2021 - Dario PerkinsA simple narrative is taking over financial markets, especially the short end of the yield curve, where the idea that central banks are “behind the curve” is rapidly gaining traction. Initially, it was just the emerging.

#Central Banks #Monetary Policy #InflationWhy central banks are suddenly sounding hawkish

29 Sep 2021 - Dario PerkinsCentral banks across the world have pivoted to a more hawkish mode in recent weeks. While this is in part acknowledgement that the recovery from COVID is continuing – albeit more hesitantly than officials expected at.

#Central Banks #Monetary Policy #InflationSecular turning point in inflation?

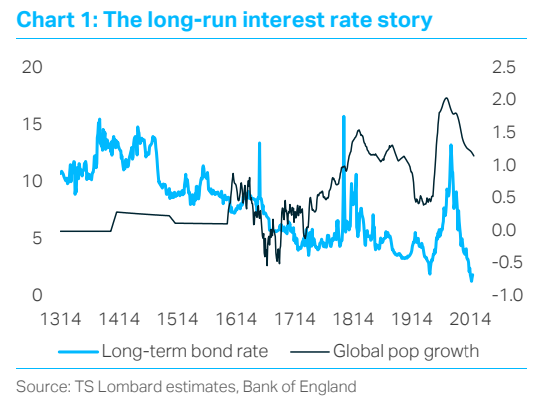

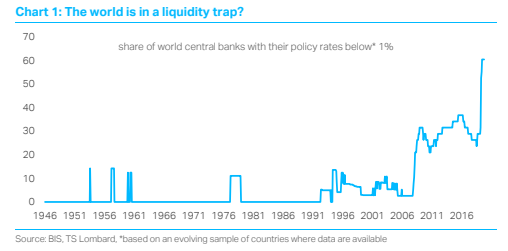

12 Mar 2021 - Dario PerkinsThese days, economists tend to assess monetary policy relative to some deep underlying interest rate (the “equilibrium rate”, or r*) which depends on structural forces and is largely beyond the control of central banks..

#Central Banks #Monetary Policy #InflationEconomists’ guide to Christmas (redux)

23 Dec 2020 - Dario PerkinsThis was something we published back in 2013 – the Economists’ guide to Christmas. But we made a serious omission, by leaving out Modern Monetary Theory. So here’s an update, incl. MMT: ‘If you put two economists in a.

#Central Banks #Federal Reserve #European Central Bank #Bank Of England #Bank of Japan #Modern Monetary TheoryQE Nuclear Options

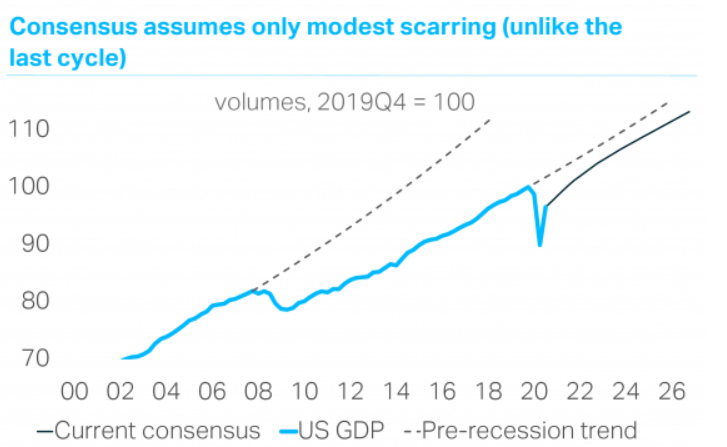

19 Nov 2020 - Dario PerkinsAn effective COVID-19 vaccine is great news because it will save lives and means we might still escape from the current economic crisis with minimal long-term scarring. Yet, the global economy faces a difficult winter,.

#Central Banks #Liquidity #International Monetary Fund #Macro PictureCovid Scarring. Impact in 12 charts

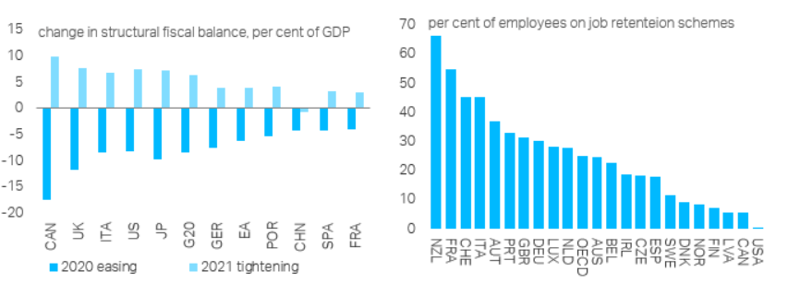

09 Nov 2020 - Dario PerkinsCovid economic scarring is not inevitable, but it is becoming likelier with a second wave of the virus and “fiscal fatigue” setting in. Central banks are determined to ensure scarring does not materialise, but fiscal.

#Fiscal Policy #Covid19Long covid

06 Nov 2020 - Dario PerkinsThe authorities’ attempt to reopen their economies has caused a sharp acceleration in COVID cases across Europe and the US, the (entirely predictable) “second wave” of the pandemic. While the health authorities are.

#Recession #Fiscal Policy #Covid19Perma-frosts and fiery endgames

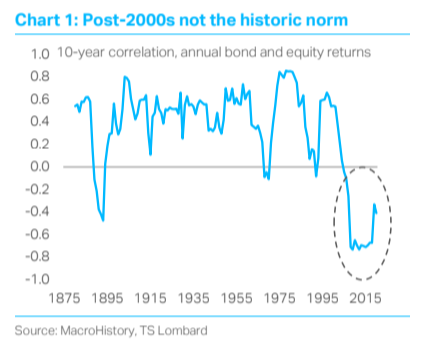

06 Nov 2020 - Dario PerkinsThe bond-equity correlation has gone mainstream in 2020, thanks in part to what happened in March when yields spiked even as equities crumbled (i.e. there was a POSITIVE correlation in returns). While this was.

#Central Banks #Equities #Bond markets Client Login

Client Login Contact

Contact