Steven Blitz

Recent Posts

FOMC Minutes + Retail Sales + Industrial Prod. = 50BP in March

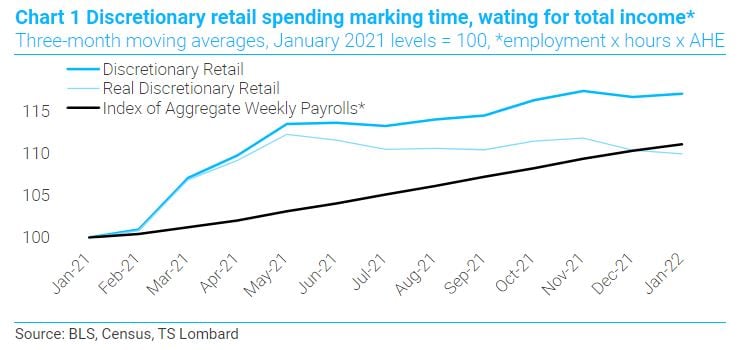

21 Feb 2022 - Steven BlitzMarkets are 60/40 favouring a 25bp rate hike in March vs 50bp. I was similarly positioned until January retail sales, industrial production, and the FOMC minutes were released. January retail sales more than reversed.

#Federal Reserve #Employment #RecoveryPowell lowers the strike price on the Fed's put

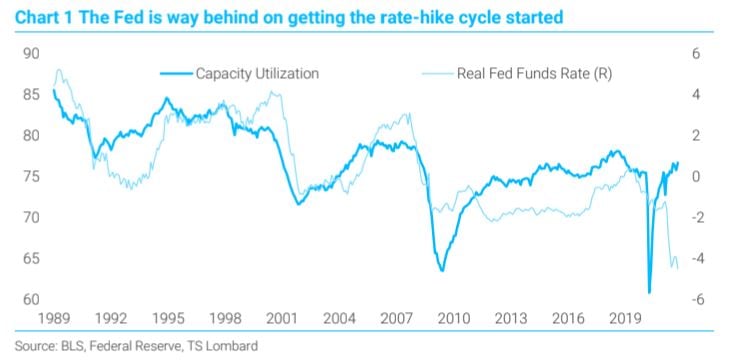

27 Jan 2022 - Steven BlitzAIT was the promise that the Fed would chase inflation rather than be pre-emptive and here we are, promise kept. Powell now promises the chase to be executed, using a combination of rate hikes and balance sheet.

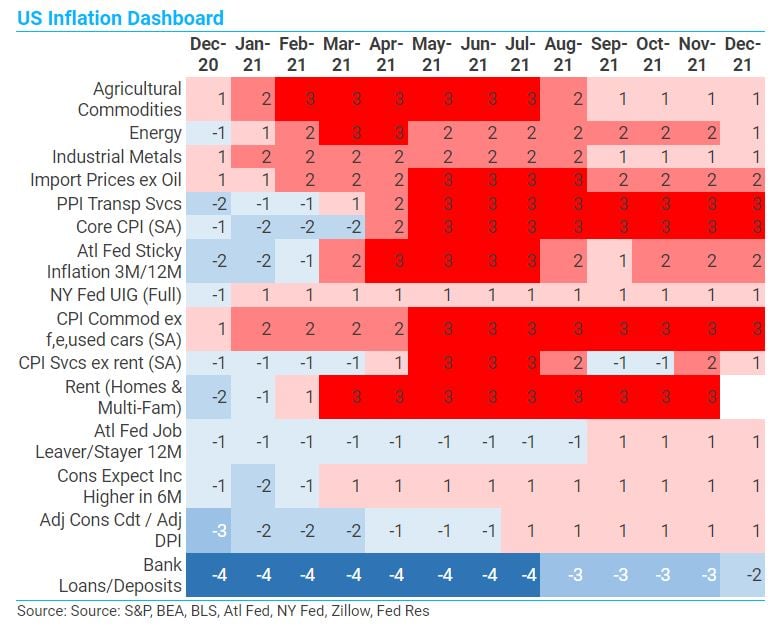

#Federal Reserve #Monetary Policy #Inflation #RecoveryUS inflation - It's not about the rent

18 Jan 2022 - Steven BlitzThe inflation problem for the US is not rent, but the loss of zero inflation in goods prices as an offset, and this offset is unlikely to return in the coming cycle. One can say current goods price inflation is the.

#Federal Reserve #Inflation #RecoveryPowell underplays hawkish turn

17 Dec 2021 - Steven BlitzThe march to a March hike is on, assuming, of course, no great downward swerve in growth and/or inflation between now and then. The FOMC sees three hikes in 2022 and this pacing alone tells you March comes first. Powell.

#Central Banks #Federal Reserve #Monetary Policy #InflationFirst Fed hike in March - it's not about current inflation

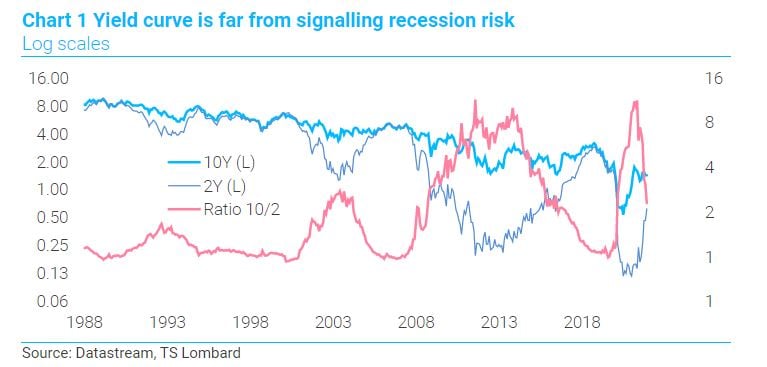

09 Dec 2021 - Steven BlitzMarch will mark the first Fed rate hike, sooner than the June timing I recently shifted to, and much sooner than the original Q4 call made in November 2020. The timing is being pulled forward because the circumstances.

#Central Banks #Federal Reserve #Monetary Policy #InflationFed's inflation problem is wages in 2022, and no workable answer for it

02 Dec 2021 - Steven BlitzThe Fed’s problem is that current price hikes from shortages of goods and labour will pass, but the coming increase in wages will not. Because the conduit of monetary policy runs through the dollar and the equity.

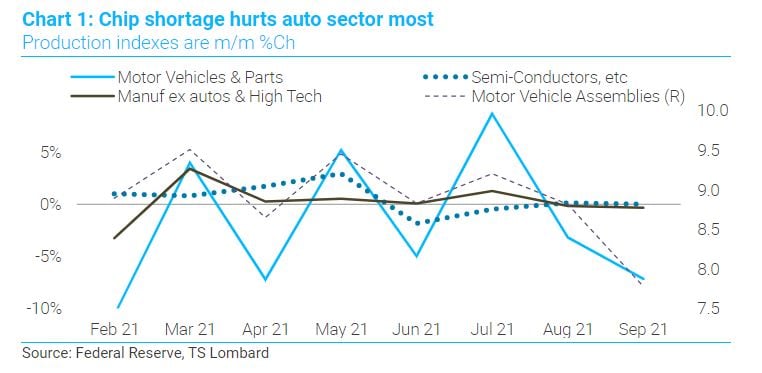

#Central Banks #Federal Reserve #Monetary Policy #InflationSupply stops US production, but that's not the stagnation story

25 Oct 2021 - Steven BlitzGlobal supply constraints reversed US production growth in September; excess global supply has stagnated US production. Current constraints will ease, and so too related price hikes, as transportation and production.

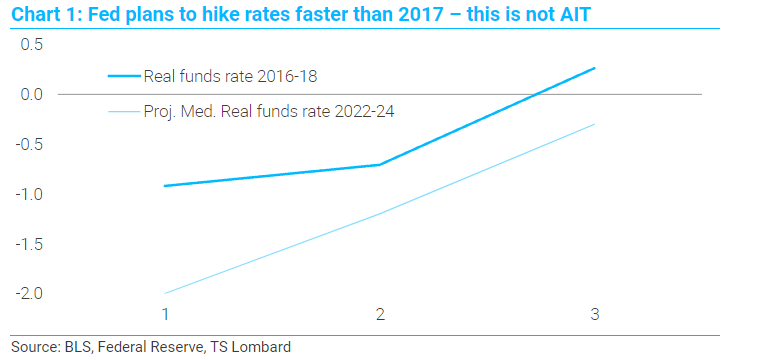

#Federal Reserve #US Economy #Retail SalesFOMC: AIT over before it starts?

27 Sep 2021 - Steven BlitzThe equity market rallied on a hawkish communication because the FOMC’s rate projections mirrored 2017-18, indicating the return to a strong dollar policy (intentional or not). The FOMC has now shown its hand (broadly.

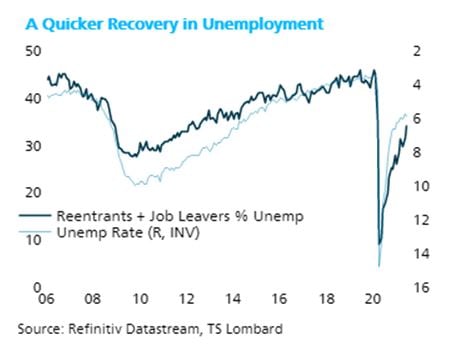

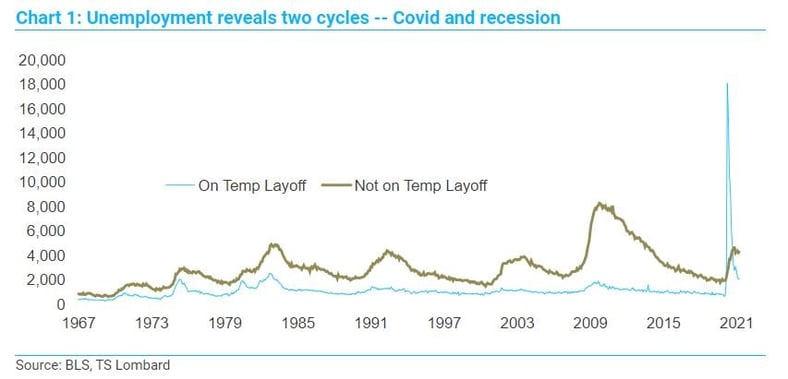

#Federal Reserve #Equities #US EconomyReading through US unemployment

05 Jul 2021 - Steven BlitzThis was a healthy jobs report by most measures, and a read through of the unemployment data indicates the same. All of the increase in unemployment (household survey) came from a rise in people quitting their jobs and.

#Federal Reserve #Unemployment #RecoveryFed resets the betting table

21 Jun 2021 - Steven BlitzAt Wednesday 16th June’s meeting, the FOMC moved closer to my long-held view that the rate hike first comes at the end of 2022, with two hikes completed by the end of 2023. It was not a unanimous decision, but the.

#Federal Reserve #Unemployment #Recovery Client Login

Client Login Contact

Contact