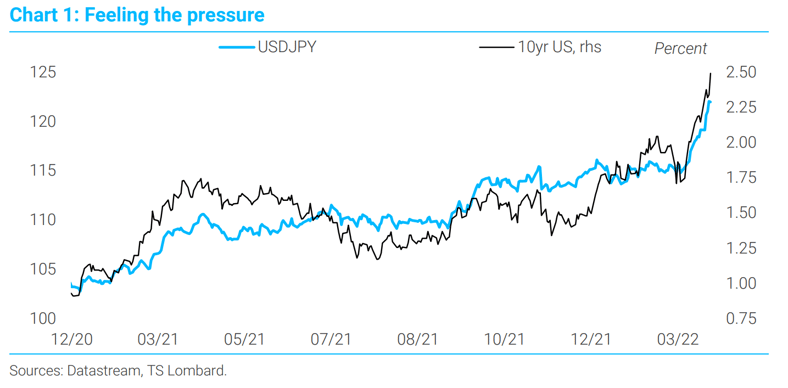

YEN MOVES AND THE BOJ ‘TAPER’

29 Mar 2022 - Konstantinos VenetisPronounced widening in JGB interest rate differentials, particularly versus US Treasuries, catalysed accelerated yen depreciation in March. Chances are that we are getting closer to a “taper” of Japanese monetary.

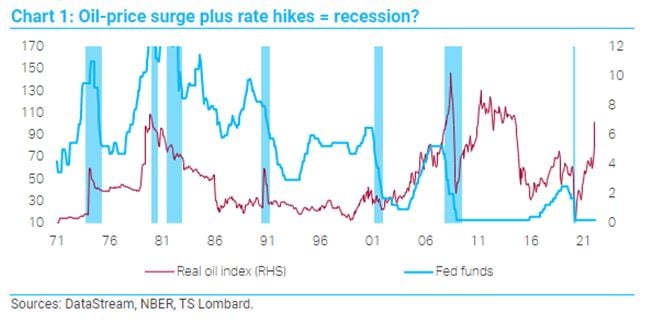

#Monetary Policy #Bond markets #Bank of Japan #FX MarketDon't bet on a soft landing

10 Mar 2022 - Dario PerkinsEvery economist wants to be famous for some great idea they had or to have their name forever linked to an original economic concept or unique thought. We have Keynesian demand-management, Friedman’s monetarism,.

#Central Banks #Monetary Policy #Inflation #Eurozone #Recession"Late cycle" comes early

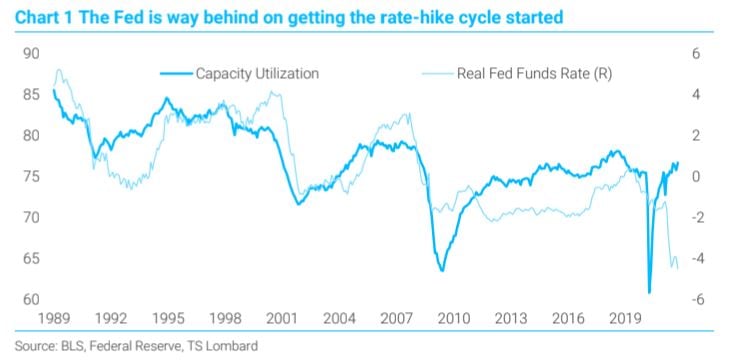

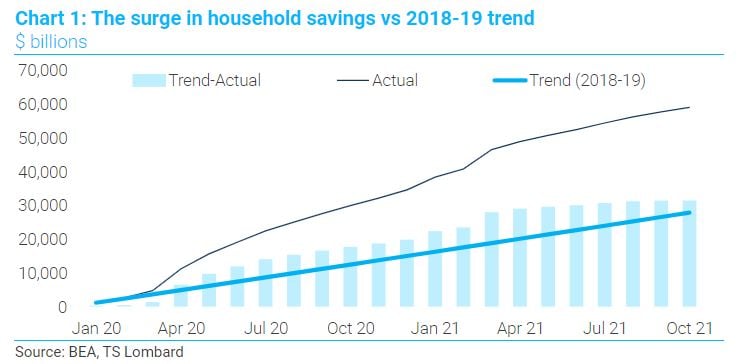

18 Feb 2022 - Konstantinos VenetisWhether one views the last couple of years as a break in the business cycle or the beginning of a new cycle, the bigger point is this has been a cycle on steroids: in terms of its amplitude, the speed of maturity and.

#Federal Reserve #Monetary Policy #Inflation #CommoditiesHawkish Bank of England plays ‘catch-up’ with the cycle

04 Feb 2022 - Konstantinos VenetisA 25bp hike was already in the price ahead of February’s meeting and the MPC did not disappoint, paving the way for ‘passive QT’ as the policy rate has now reached the 0.50% threshold for allowing maturing gilts to roll.

#Monetary Policy #Inflation #Bank Of EnglandPowell lowers the strike price on the Fed's put

27 Jan 2022 - Steven BlitzAIT was the promise that the Fed would chase inflation rather than be pre-emptive and here we are, promise kept. Powell now promises the chase to be executed, using a combination of rate hikes and balance sheet.

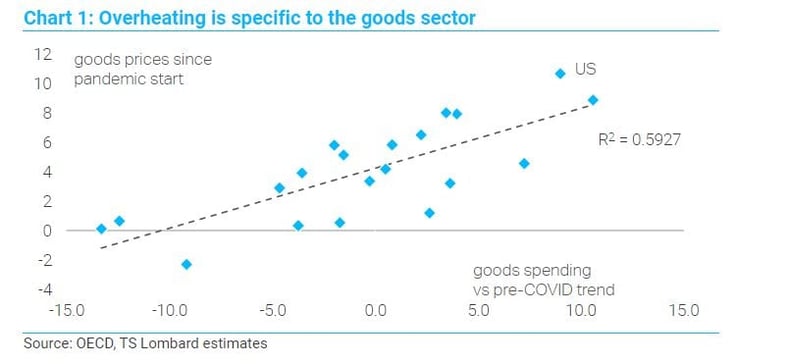

#Federal Reserve #Monetary Policy #Inflation #RecoveryDon't extrapolate from this fake business cycle

13 Jan 2022 - Dario PerkinsEdgar Fiedler, who served as Assistant Secretary of the Treasury in the Richard Nixon and Gerald Ford administrations, famously joked: “Ask five economists a question and you'll get five different answers – six, if one.

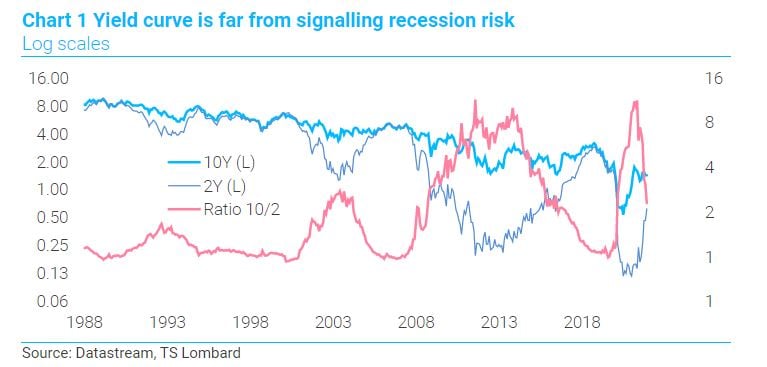

#Central Banks #Monetary Policy #Inflation #Recession #Recovery‘Undecided’ bond market has made up its mind – at least for now

13 Jan 2022 - Konstantinos VenetisTime to play catch-up. Policymakers have finally dropped the “transitory” narrative and are playing catch-up, rushing to normalize monetary settings closer in line with last year’s sharp positive macro turnaround. While.

#Central Banks #Federal Reserve #Monetary Policy #Inflation #Bond marketsPowell underplays hawkish turn

17 Dec 2021 - Steven BlitzThe march to a March hike is on, assuming, of course, no great downward swerve in growth and/or inflation between now and then. The FOMC sees three hikes in 2022 and this pacing alone tells you March comes first. Powell.

#Central Banks #Federal Reserve #Monetary Policy #InflationFirst Fed hike in March - it's not about current inflation

09 Dec 2021 - Steven BlitzMarch will mark the first Fed rate hike, sooner than the June timing I recently shifted to, and much sooner than the original Q4 call made in November 2020. The timing is being pulled forward because the circumstances.

#Central Banks #Federal Reserve #Monetary Policy #InflationFed's inflation problem is wages in 2022, and no workable answer for it

02 Dec 2021 - Steven BlitzThe Fed’s problem is that current price hikes from shortages of goods and labour will pass, but the coming increase in wages will not. Because the conduit of monetary policy runs through the dollar and the equity.

#Central Banks #Federal Reserve #Monetary Policy #Inflation Client Login

Client Login Contact

Contact