Hawkish markets to force global policy response?

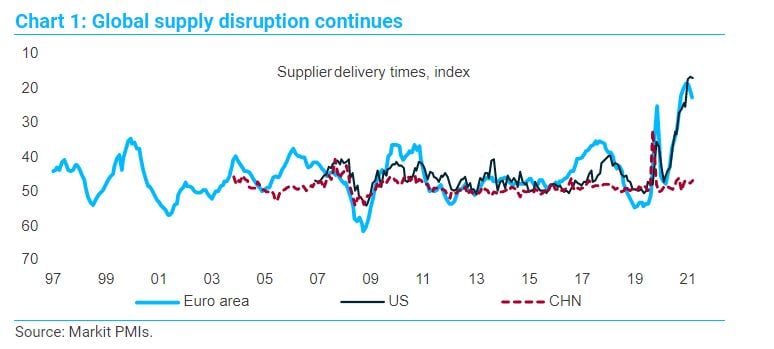

04 Nov 2021 - Dario PerkinsA simple narrative is taking over financial markets, especially the short end of the yield curve, where the idea that central banks are “behind the curve” is rapidly gaining traction. Initially, it was just the emerging.

#Central Banks #Monetary Policy #InflationWhy central banks are suddenly sounding hawkish

29 Sep 2021 - Dario PerkinsCentral banks across the world have pivoted to a more hawkish mode in recent weeks. While this is in part acknowledgement that the recovery from COVID is continuing – albeit more hesitantly than officials expected at.

#Central Banks #Monetary Policy #InflationWhen the V starts to fade

17 Sep 2021 - Konstantinos VenetisThe looming threat to the global growth outlook posed by the Delta variant should not be conflated with what is a natural cyclical downshift in output growth – something that was always on the cards following the.

#Monetary Policy #Inflation #Equities #Stock Market #VolatilitySecular turning point in inflation?

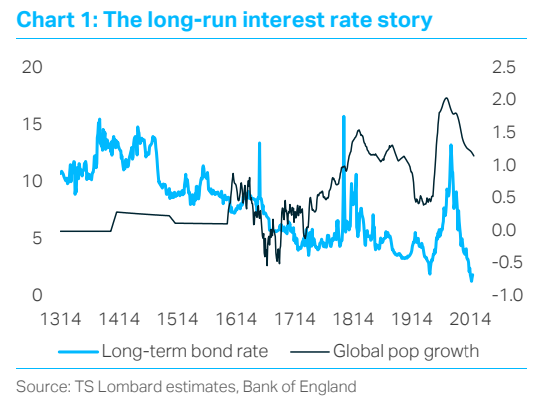

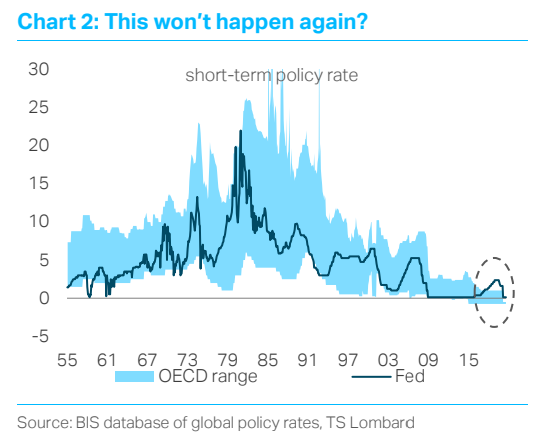

12 Mar 2021 - Dario PerkinsThese days, economists tend to assess monetary policy relative to some deep underlying interest rate (the “equilibrium rate”, or r*) which depends on structural forces and is largely beyond the control of central banks..

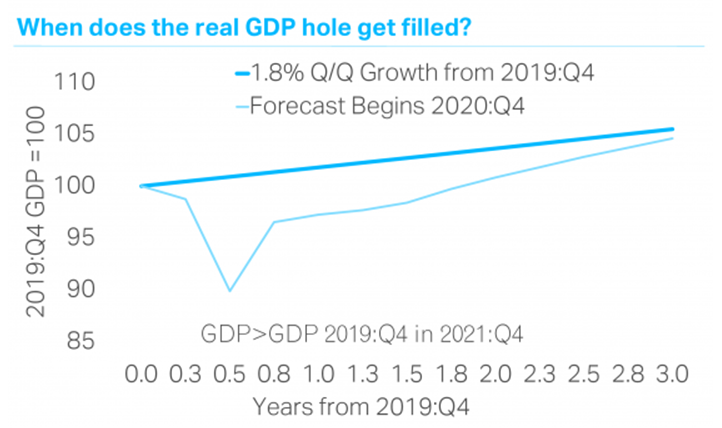

#Central Banks #Monetary Policy #InflationThe Fed's Shortened Timeline

12 Nov 2020 - Steven BlitzThe vaccine arrives early 2021, so our growth forecast accelerates as a result, beginning in 2021 Q3, and the timeline for when the Fed first “tightens” shortens. It may seem odd to relay this view just when the.

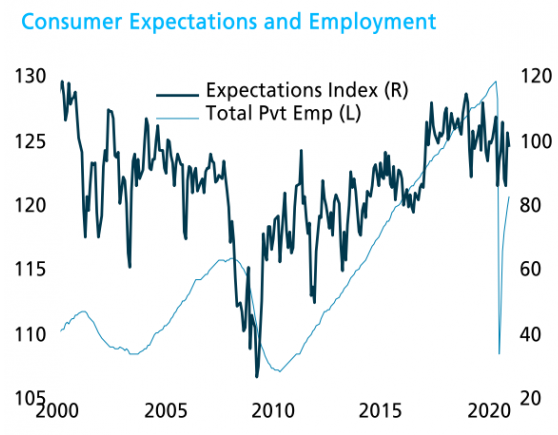

#Federal Reserve #Monetary Policy #US Economy #Vaccine #Quantitative EasingThe Equity Market is now in charge

09 Nov 2020 - Steven BlitzBiden won, Trump lost, but lots of Republicans also won, and the October employment data help explain why – the population does not see the economy in crisis. The ongoing recovery in the labour market (906,000 private.

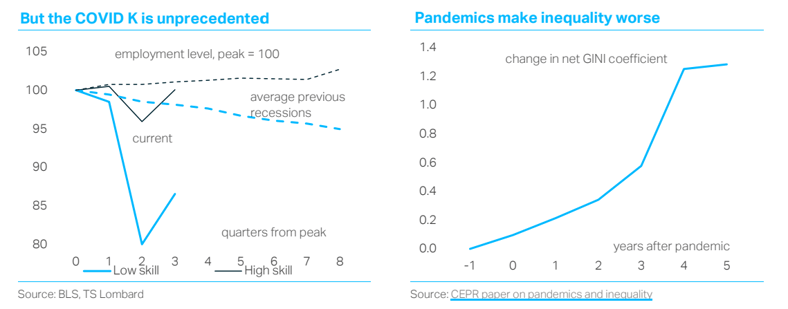

#Federal Reserve #Monetary Policy #Equities #Bond markets #US Economy #US ElectionK-runch Time

12 Oct 2020 - Dario PerkinsData for other countries confirms the tendency for inequality to widen during recessions, though the picture is more mixed than the US experience – because it depends, in part, on the policy response. UK disparities,.

#Monetary Policy #Fiscal Policy #Inequality #K RecoveryCentral Banks are changing

30 Sep 2020 - Dario PerkinsOnce upon a time, it was my job to advise the UK government on the Bank of England’s policy remit, which the Chancellor has the option of adjusting every year. I’m sure whoever is in that role today is spending much of.

#Central Banks #Federal Reserve #Monetary Policy #European Central Bank #InflationThe message from gold and industrial commodities

01 Sep 2020 - Konstantinos VenetisThe nature of the Covid-19 shock makes this macro cycle unique – but this is still a macro cycle. The pattern remains the same. A contraction in GDP is met with counter-cyclical policy measures that aim to get the.

#Monetary Policy #Reflation #Gold #CommoditiesCOVID-19 and secular stagnation - the next business cycle

16 Jun 2020 - Dario PerkinsCOVID-19 has resolved our most popular client question of the last five years – “when will this cycle end?’ Even as the number of infections slows and the lockdowns end, most economies will reopen to a serious global.

#Federal Reserve #Monetary Policy #Equities #Bond markets #Covid19 Client Login

Client Login Contact

Contact