Dario Perkins

Recent Posts

Central Banks are changing

30 Sep 2020 - Dario PerkinsOnce upon a time, it was my job to advise the UK government on the Bank of England’s policy remit, which the Chancellor has the option of adjusting every year. I’m sure whoever is in that role today is spending much of.

#Central Banks #Federal Reserve #Monetary Policy #European Central Bank #InflationThe Covid-19 recession: L comes after K?

17 Sep 2020 - Dario PerkinsIt is a cliché to say everyone’s experience of the COVID-19 recession has been different, but no sell-side economist ever shies away from using cliché to construct a narrative. For some people – especially those on the.

#Recession #Fiscal Policy #Covid19 #Unemployment #Macro PictureCan the world rebound from the Covid-19 recession?

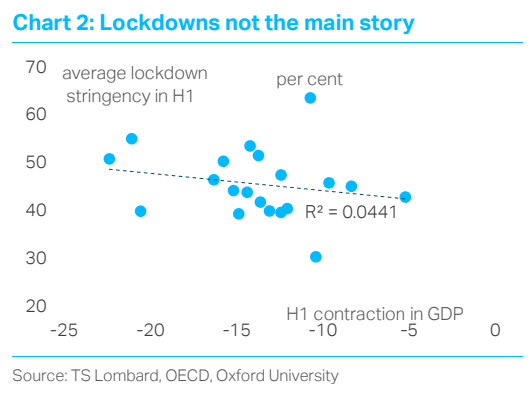

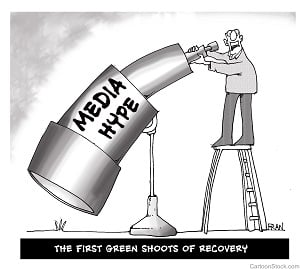

01 Sep 2020 - Dario PerkinsThe COVID-19 economic collapse was unlike anything we have seen before. This was not your classic recession. Yet it was actually easy to forecast. Given the nature of the shock – especially lockdowns and social.

#Recession #Covid19 #Unemployment #Retail SalesBubbles, Covid-19 and digital disruption

07 Aug 2020 - Dario PerkinsArguments about a bubble in equities continue, with US tech at the center of the dispute. Some are drawing comparisons with Dotcom in the 1990s. Yet the economic risks are greater this time. Big tech companies provide.

#Equities #Technology #BubbleRoad to inflation

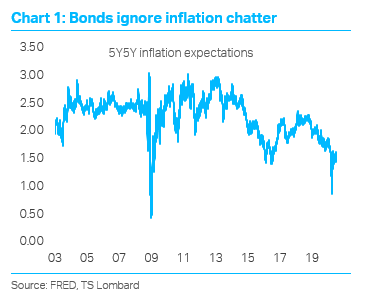

27 Jul 2020 - Dario PerkinsInflation remains an important theme for our clients. Perhaps this reflects supreme confidence in the policies governments and central banks have introduced to support their economies during the COVID-19 pandemic. With.

#Central Banks #Inflation #Equities #Covid19 #UnemploymentLessons from the lockdown

16 Jul 2020 - Dario PerkinsFor months, investors have been “looking through” macro data and focusing on the prospects for a global recovery, with aggressive policy support – both monetary and fiscal – bolstering their confidence. With the global.

#Covid19Can Europe outperform during America’s COVID-19 second wave?

09 Jul 2020 - Dario PerkinsWith every macro data point we are learning more about the economic consequences of the COVID-19 pandemic. What have we discovered so far? First, the contraction in activity – the largest in modern history – is.

#Eurozone #Recession #Covid19Investors can’t rely on central banks

24 Jun 2020 - Dario PerkinsThe bounce in global stock markets since March has been both spectacular and a bit puzzling. Despite widespread gloom among institutional investors about ‘fundamentals’ – concerning both the macro outlook and the.

#Central Banks #Federal Reserve #Liquidity #Equities #Fiscal Policy #Covid19 #Bear MarketCOVID-19 and secular stagnation - the next business cycle

16 Jun 2020 - Dario PerkinsCOVID-19 has resolved our most popular client question of the last five years – “when will this cycle end?’ Even as the number of infections slows and the lockdowns end, most economies will reopen to a serious global.

#Federal Reserve #Monetary Policy #Equities #Bond markets #Covid19Further stimulus needed

10 Jun 2020 - Dario PerkinsAs the global economy exits “lockdown”, improving macro data will provide a further boost to investors determined to look-through the deepest economic contraction they will see in their lifetimes. Yet the economic.

#Covid19 Client Login

Client Login Contact

Contact