Dario Perkins

Recent Posts

Macro policy vs Covid-19 - Has policy done enough?

26 May 2020 - Dario PerkinsThe recovery in investor sentiment since March has been impressive (even puzzling...). Back then, as the global economy entered lockdown, a “flight-to-safety” rapidly became disorderly, leading to an outright.

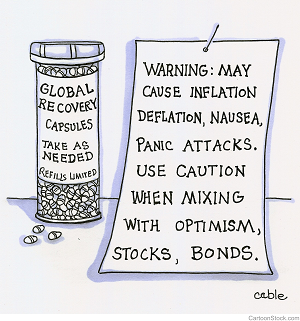

#Central Banks #Balance Sheet #Fiscal Policy #Covid19The war on deflation

15 May 2020 - Dario PerkinsThe COVID-19 pandemic has forced governments and central banks to work together to support the economy. While most investors welcome these efforts – it is the reason global asset prices have recovered from their March.

#Central Banks #Monetary Policy #Inflation #Recession #Covid19The equity rebound - just another bulltrap?

01 May 2020 - Dario PerkinsWatching financial markets, it is tempting to think the worst of the COVID-19 crisis is over. Equity values have bounced and credit spreads have narrowed, even as the oil market continues to suffer alarming strains..

#Monetary Policy #Recession #Fiscal Policy #Covid19 #Bear Market #Bull MarketFire starter?

21 Apr 2020 - Dario PerkinsPolicymakers all over the world have responded forcefully to COVID-19, using war-time analogies to justify massive expansions in their budget deficits. With governments adding up to 20% pts of GDP to their national.

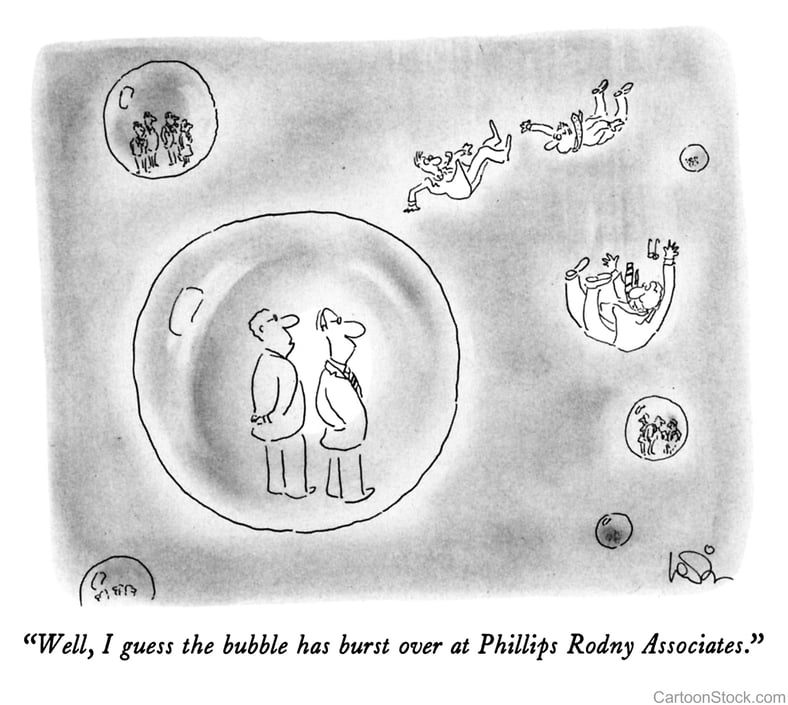

#Monetary Policy #Inflation #Debt #Covid19Buyside bust & the dollar crunch

14 Apr 2020 - Dario PerkinsDespite my best efforts, the phrase Buyside Bubble has never really caught on as a description of post-2008 financial markets. Perhaps this is because, what it gained in clever alliteration (or so I like to think…), it.

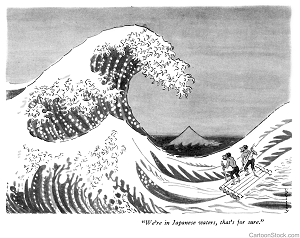

#Interest Rates #Yield curve #BubbleSudden stop

13 Mar 2020 - Dario PerkinsIt has been clear for a while that the coronavirus posed a serious risk to the global economy. Yet the nature of this threat has changed dramatically. What looked like a temporary supply shock has morphed into a major.

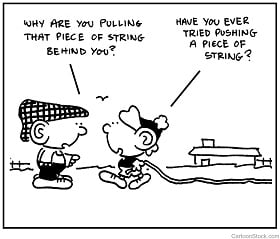

#Covid19What can policymakers do?

03 Mar 2020 - Dario PerkinsTwo weeks ago everyone was working with the same assumption about the coronavirus. China would contain the virus reasonably quickly and gradually reopen its factories. There would be some disruption to global supply.

#Central Banks #Fiscal Policy #Covid19Three reasons markets were ignoring the coronavirus

14 Feb 2020 - Dario PerkinsThe contrast between the awful humanitarian crisis in China and the euphoria in global stock markets had been bordering on the surreal. Every night (London time) the Chinese authorities updated their count of the number.

#China #Covid19 #Stock MarketThe rules to being a sellside economist

21 Jan 2020 - Dario Perkins1) Economic forecasts: Forecasting GDP is basically a waste of time - no investor actually cares what this backward-looking gauge of the economy is doing. But getting it "right" is one of the few (though dubious) ways.

#Central Banks #Liquidity #GDP #RecessionIs the consensus wrong?

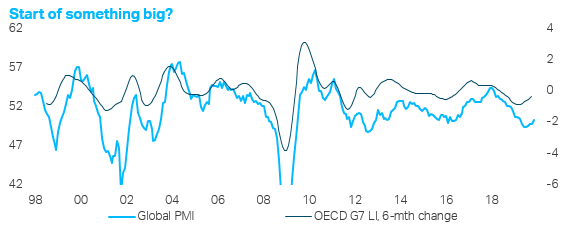

09 Jan 2020 - Dario PerkinsThis is the time of year when economists across the financial sector are busily marketing their chunky ‘year ahead’ volumes. There is an old joke that the savvy investor should take note of whatever consensus emerged.

#Central Banks #Inflation #2020 outlook Client Login

Client Login Contact

Contact