US CPI - Where to from here is what matters, not the "peak"

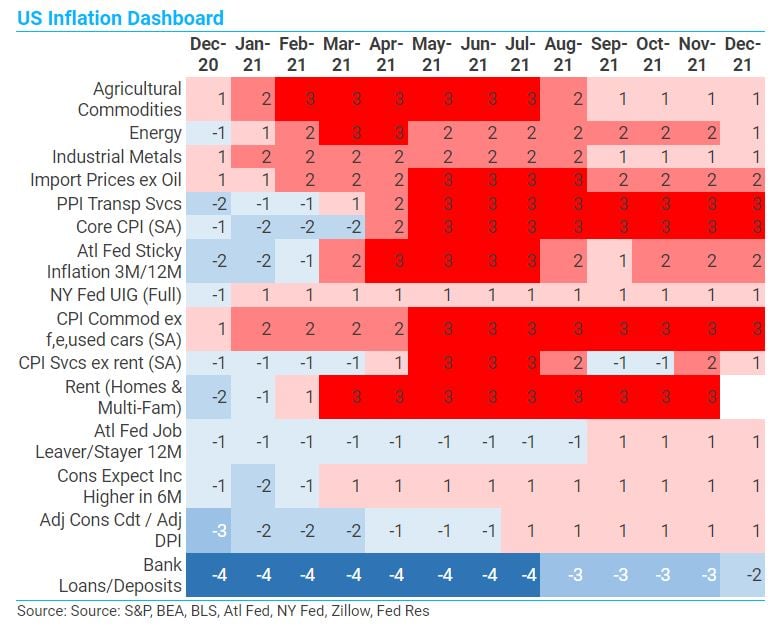

14 Apr 2022 - Steven BlitzMarch CPI data came in as expected, driven up by energy and a smattering of services – but goods prices ex food and energy fell 0.4% m/m, and this is key. The “secret sauce” of low core inflation for a generation has.

#Federal Reserve #Monetary Policy #Inflation #Recession #US EconomyIs the US recession inevitable? Always, but not when real rates are negative

06 Apr 2022 - Steven BlitzToday, in the middle of this cycle, the straight path is lost -- the Fed is hoping for relief from abroad because it fears the chase that inevitably leads to lost jobs and wealth. Seeing the Fed play for time, markets.

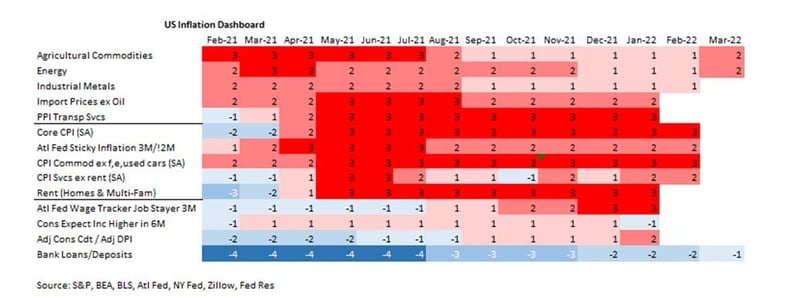

#Federal Reserve #Monetary Policy #Recession #US EconomyFebruary CPI and bank lending starts to rise

16 Mar 2022 - Steven BlitzThere was little in the Feb CPI report to give the Fed comfort, and the rise in bank lending should be a cause for concern. The “good news” in the Feb CPI report was some deceleration in inflation excluding food,.

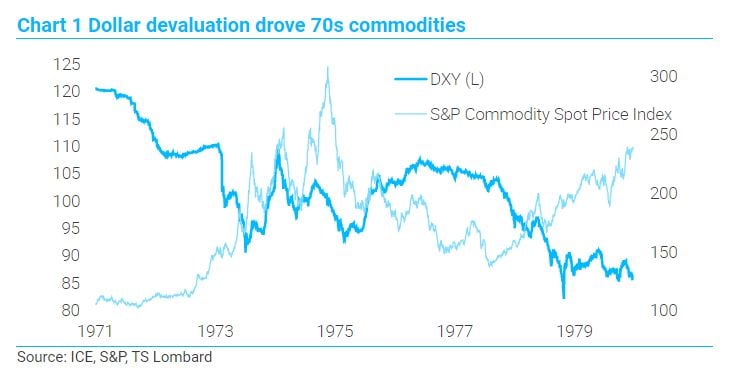

#Federal Reserve #Inflation #US EconomyUS inflation to set a new course

14 Mar 2022 - Steven BlitzThe historic analogue for current inflation does not lie in the 1970s, and the Fed’s on-again off-again response. Inflation in the 1960s eventually strained the Bretton Woods fixed-currency system to the point where it.

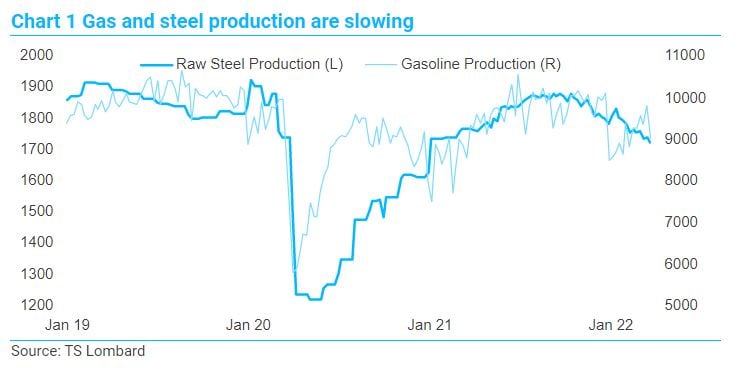

#Federal Reserve #Inflation #Commodities #StagflationUS growth and the Fed - after the Russian invasion

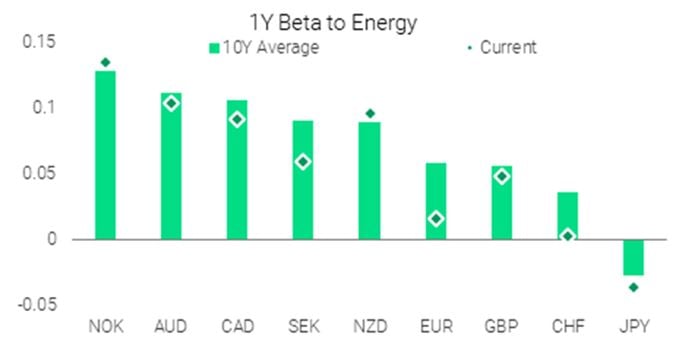

28 Feb 2022 - Steven BlitzThe short-term implications of the Russian invasion of Ukraine pales next to the longer-run consequences, but the world focuses on the short-term and so too does this note (with a coda on the long-run). First off, Biden.

#Federal Reserve #Russia #Geopolitics #UkraineRussia-Ukraine war: Initial market take

25 Feb 2022 - Andrea CicioneMarkets normally react negatively to geopolitical risks but soon lose interest. The North Korea crisis of 2017-18 is a prime example of this: since it’s impossible to put a price on a nuclear war, markets simply decided.

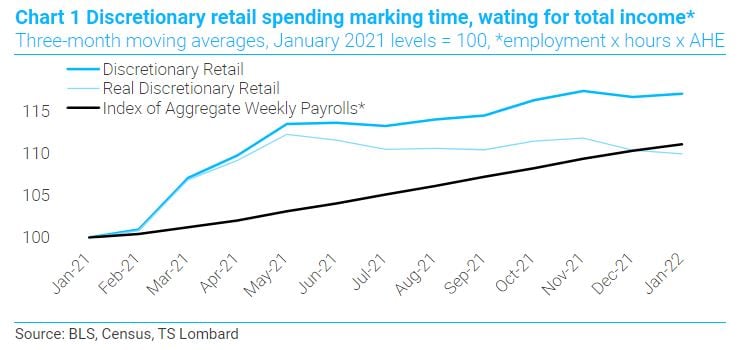

#Federal Reserve #Oil & Gas #Oil Price #Russia #Commodities #Ukraine #WarFOMC Minutes + Retail Sales + Industrial Prod. = 50BP in March

21 Feb 2022 - Steven BlitzMarkets are 60/40 favouring a 25bp rate hike in March vs 50bp. I was similarly positioned until January retail sales, industrial production, and the FOMC minutes were released. January retail sales more than reversed.

#Federal Reserve #Employment #Recovery"Late cycle" comes early

18 Feb 2022 - Konstantinos VenetisWhether one views the last couple of years as a break in the business cycle or the beginning of a new cycle, the bigger point is this has been a cycle on steroids: in terms of its amplitude, the speed of maturity and.

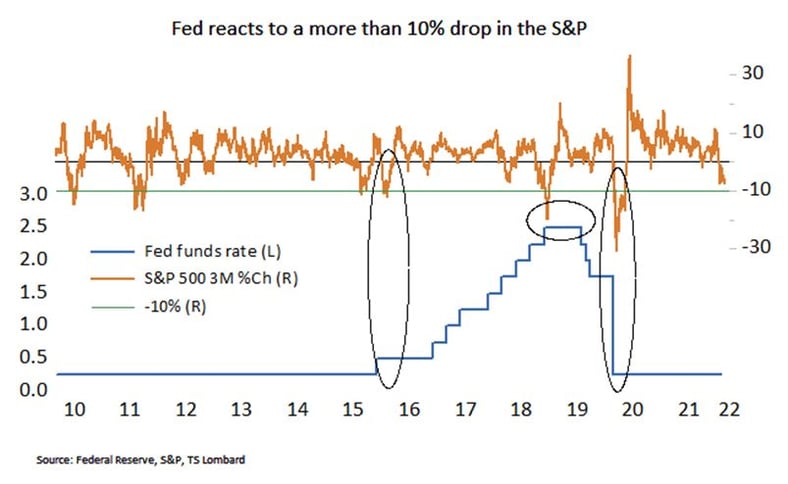

#Federal Reserve #Monetary Policy #Inflation #CommoditiesPowell lowers the strike price on the Fed's put

27 Jan 2022 - Steven BlitzAIT was the promise that the Fed would chase inflation rather than be pre-emptive and here we are, promise kept. Powell now promises the chase to be executed, using a combination of rate hikes and balance sheet.

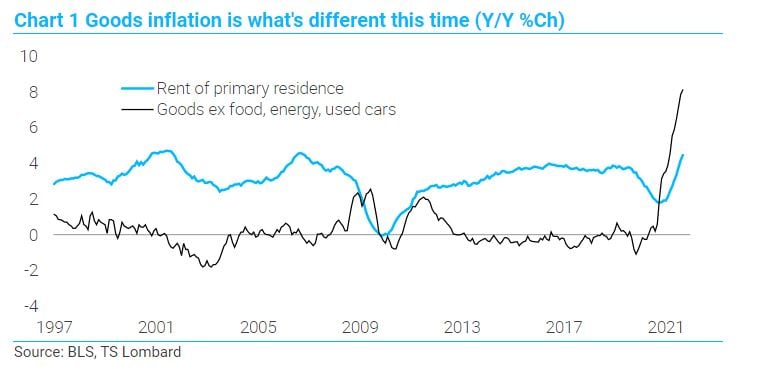

#Federal Reserve #Monetary Policy #Inflation #RecoveryUS inflation - It's not about the rent

18 Jan 2022 - Steven BlitzThe inflation problem for the US is not rent, but the loss of zero inflation in goods prices as an offset, and this offset is unlikely to return in the coming cycle. One can say current goods price inflation is the.

#Federal Reserve #Inflation #Recovery Client Login

Client Login Contact

Contact