Konstantinos Venetis

Recent Posts

Bonds are saying the market needs a new catalyst

15 Jun 2021 - Konstantinos VenetisThe second quarter of 2021 is set to mark the peak in quarterly GDP growth for most of the major economies, which will give way to a still solid but slower pace of expansion as the transition from an early to a.

#Federal Reserve #Inflation #Bond markets #RecoveryMid-cycle transition means no more low-hanging fruit

11 May 2021 - Konstantinos VenetisThis economic cycle has matured very quickly, courtesy of a strong policy response and the speedy arrival of effective vaccines against Covid-19. Indeed, this has felt more like a bounce-back from a natural disaster.

#Federal Reserve #Inflation #Bond marketsCommodity bull moving into mid-cycle

30 Apr 2021 - Konstantinos VenetisIt has been a little over a year since commodity prices bottomed out, marking the start of a powerful rally that is reminiscent of those in 1993-95, 2005-07 and 2009-10. With the global economic recovery set to gather.

#Federal Reserve #Commodities #OilBond market takes a breather

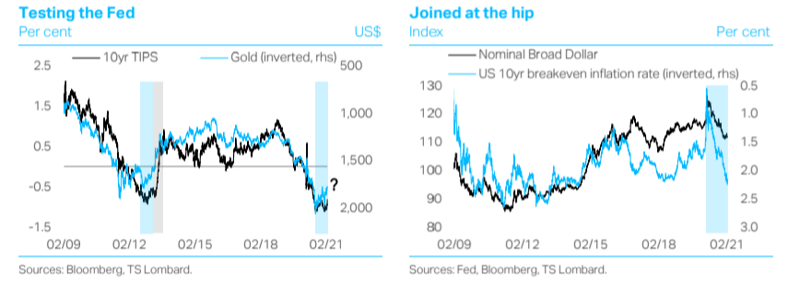

14 Apr 2021 - Konstantinos VenetisIf there is one theme that marked the first quarter of 2021, it is the upturn in bond yields. February saw real interest rates take up the baton from inflation expectations as the primary force behind rising long US.

#Liquidity #Stimulus #Stock MarketOil: new playbook, same old cycle

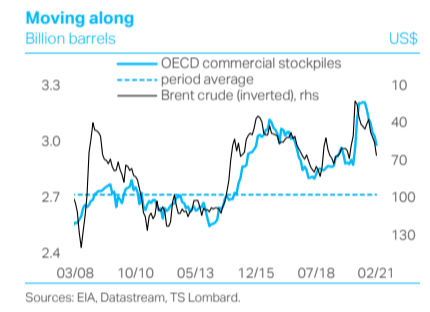

05 Mar 2021 - Konstantinos VenetisWe have often made the argument that although the nature of the Covid shock makes this macro cycle unique, it is important not to lose sight of the fact that this remains a cycle. The same is true of the oil market..

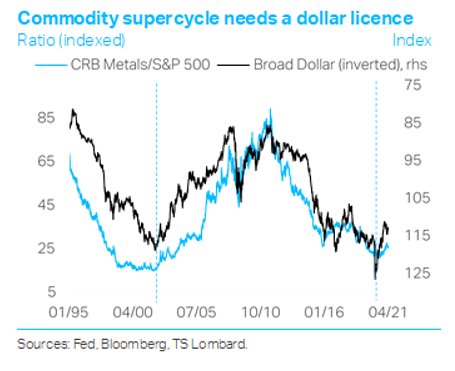

#Inflation #OPEC #Commodities #OilCommodity Supercycle now on? Potential is there

01 Mar 2021 - Konstantinos VenetisThere are two questions that the current debate on the commodity cycle tends to conflate. Does the rally that kicked off in spring 2020 have further to go? And are we in the early stages of a so-called “supercycle”,.

#Federal Reserve #Stimulus #Commodities #OilUK economy at inflection point

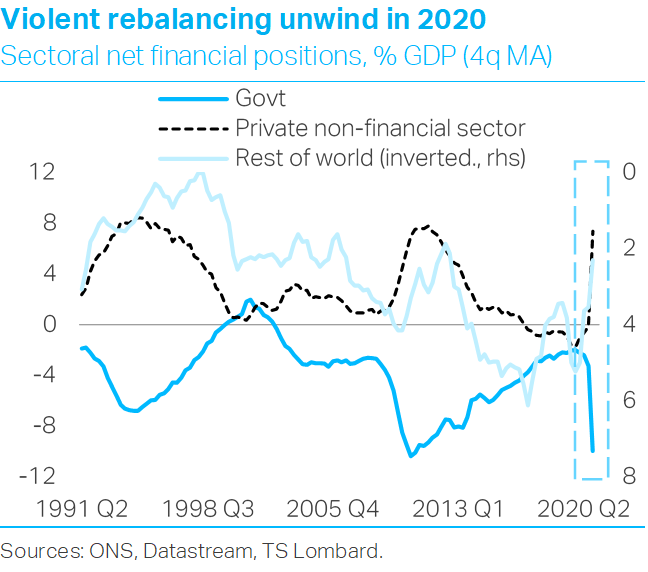

07 Oct 2020 - Konstantinos VenetisChancellor Rishi Sunak has vowed to “balance the books”, yet pressure to keep the fiscal taps loose is unlikely to let up anytime soon. The government’s backstops have put a floor under the economy, but as the mid-year.

#Bank Of England #United Kingdom #Labour MarketJapan: nothing more permanent than a temporary solution

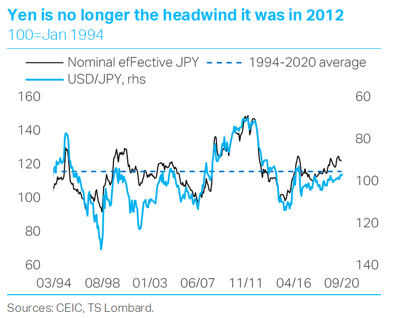

06 Oct 2020 - Konstantinos VenetisThe appointment of Yoshihide Suga marks the end of Abenomics in name, but not in substance. And while this may look like an opportune time to press on somewhat harder with 'third arrow' structural reforms, we would not.

#Abenomics #Bank of Japan #YenWorld Trade momentum

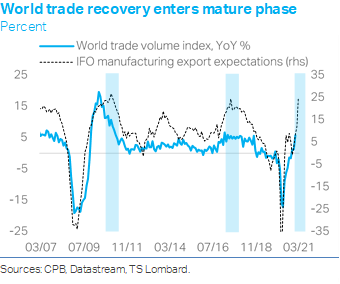

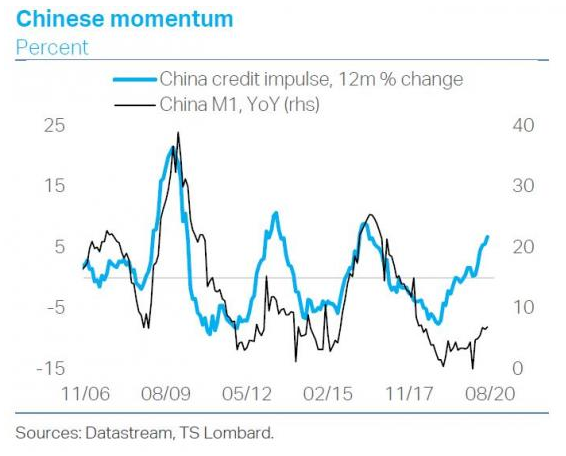

06 Oct 2020 - Konstantinos VenetisMacro momentum is easing but remains positive. Our Global Leading Indicator remains consistent with improving macro momentum, in line with the message from other widely followed high-frequency series like the OECD.

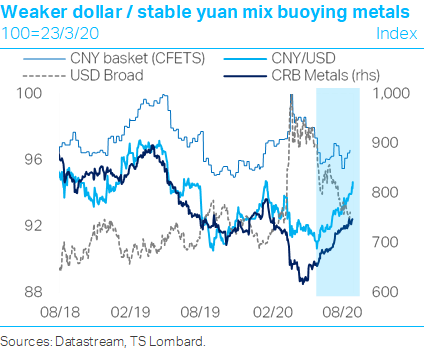

#Equities #China #Bond markets #Commodities #USDThe message from gold and industrial commodities

01 Sep 2020 - Konstantinos VenetisThe nature of the Covid-19 shock makes this macro cycle unique – but this is still a macro cycle. The pattern remains the same. A contraction in GDP is met with counter-cyclical policy measures that aim to get the.

#Monetary Policy #Reflation #Gold #Commodities Client Login

Client Login Contact

Contact