The equity rebound - just another bulltrap?

01 May 2020 - Dario PerkinsWatching financial markets, it is tempting to think the worst of the COVID-19 crisis is over. Equity values have bounced and credit spreads have narrowed, even as the oil market continues to suffer alarming strains..

#Monetary Policy #Recession #Fiscal Policy #Covid19 #Bear Market #Bull MarketCrisis roadmap: After the false dawn

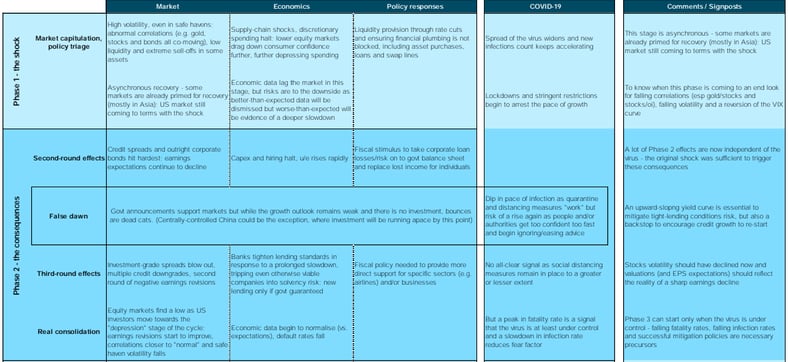

29 Apr 2020 - Oliver BrennanOne month ago we introduced our crisis roadmap as our framework to think about the evolution of the global economy, financial markets and the path of the virus over the next several months. At the time, we reckoned we.

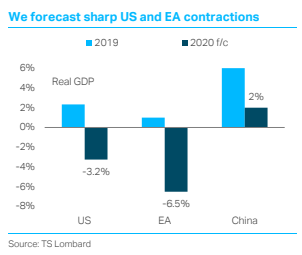

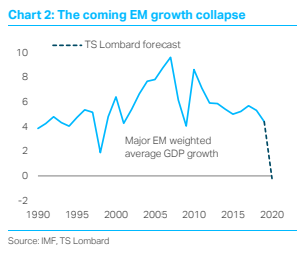

#Eurozone #US Economy #Covid19Emerging Markets: The coming growth collapse

28 Apr 2020 - Jon HarrisonSome EM lockdowns are starting to ease. Many EM economies are now 3-4 weeks into restrictive measures and progress is seemingly being made on flattening the curve. Thoughts are turning to the exit strategy. India and.

#Emerging Markets #Covid19Fire starter?

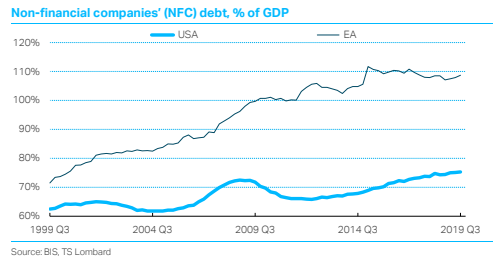

21 Apr 2020 - Dario PerkinsPolicymakers all over the world have responded forcefully to COVID-19, using war-time analogies to justify massive expansions in their budget deficits. With governments adding up to 20% pts of GDP to their national.

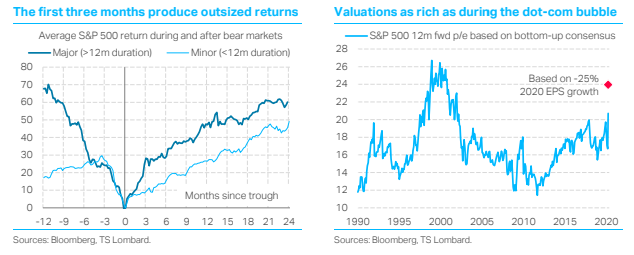

#Monetary Policy #Inflation #Debt #Covid197 reasons the rally won't last

21 Apr 2020 - Andrea CicioneAndrea Cicione, our Head of Strategy, and Steven Blitz, our Chief US Economist, answer the following 7 questions: Equity markets have rallied on the back of unprecedented fiscal and monetary support. Why do we think.

#Federal Reserve #Covid19Where are we in the COVID-19 crisis?

27 Mar 2020 - Andrea CicioneTS Lombard’s Head of Strategy Andrea Cicione recently published an extremely useful piece of analysis designed to answer four crucial questions for investors: Where are we in the Covid-19 crisis? How bad will it get?.

#Covid19 #Macro StrategyCovid-19 Crisis Roadmap

26 Mar 2020 - Oliver BrennanThis framework will shape our thinking about the evolution of the global economy over the next several months as we look for signposts and signals in the markets, economic growth and the progression of the virus. Where.

#Covid19World slump - weak rebound

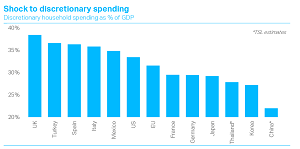

26 Mar 2020 - Charles DumasWidespread hopes for a V-shaped recovery from the impending recession will probably be dashed. And stock markets are only likely to rebound sharply if they fall a lot further from here – at Tuesday's Close the S&P index.

#Equities #Recession #Covid19 #Bear MarketSudden stop

13 Mar 2020 - Dario PerkinsIt has been clear for a while that the coronavirus posed a serious risk to the global economy. Yet the nature of this threat has changed dramatically. What looked like a temporary supply shock has morphed into a major.

#Covid19The bear and fear stalk the world

10 Mar 2020 - Charles DumasGlobal spread of the Covid-19 virus looks likely to cause a worldwide recession and bear market in stocks. Nobody knows how serious the disease is likely to be. But The Brookings Institution’s estimates suggest a.

#Equities #Recession #Covid19 #Stock Market #Bear Market Client Login

Client Login Contact

Contact