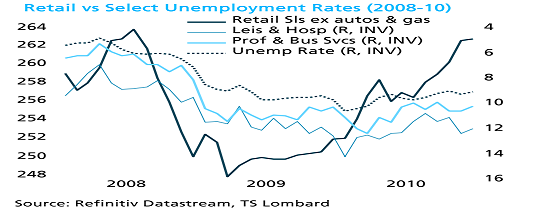

Retail boosted by equities, not $600

17 Aug 2020 - Steven BlitzThe $600 top-up in unemployment benefits is critical for those getting the funds, but its absence means less to overall retail spending than many opine. More critical to the revival in retail spending is the recovery in.

#Equities #Covid19 #Unemployment #Retail SalesRoad to inflation

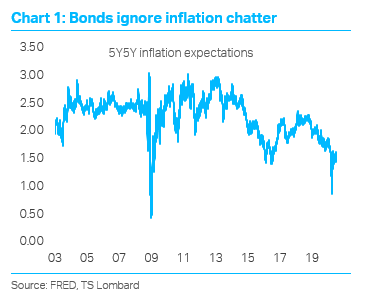

27 Jul 2020 - Dario PerkinsInflation remains an important theme for our clients. Perhaps this reflects supreme confidence in the policies governments and central banks have introduced to support their economies during the COVID-19 pandemic. With.

#Central Banks #Inflation #Equities #Covid19 #UnemploymentLessons from the lockdown

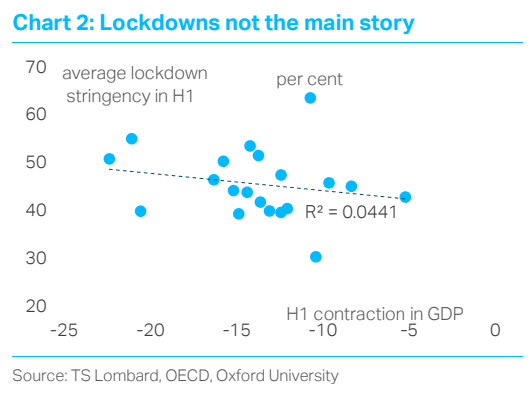

16 Jul 2020 - Dario PerkinsFor months, investors have been “looking through” macro data and focusing on the prospects for a global recovery, with aggressive policy support – both monetary and fiscal – bolstering their confidence. With the global.

#Covid19Can Europe outperform during America’s COVID-19 second wave?

09 Jul 2020 - Dario PerkinsWith every macro data point we are learning more about the economic consequences of the COVID-19 pandemic. What have we discovered so far? First, the contraction in activity – the largest in modern history – is.

#Eurozone #Recession #Covid19Investors can’t rely on central banks

24 Jun 2020 - Dario PerkinsThe bounce in global stock markets since March has been both spectacular and a bit puzzling. Despite widespread gloom among institutional investors about ‘fundamentals’ – concerning both the macro outlook and the.

#Central Banks #Federal Reserve #Liquidity #Equities #Fiscal Policy #Covid19 #Bear MarketWhy we remain bears

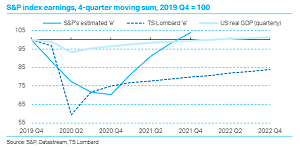

23 Jun 2020 - Charles DumasThis blog summarises our View on our bearish views about US stock prices. Steve Blitz’s analysis of the US economy in 2020-21 shows the policy context for the November elections. But our pessimism about stock-market.

#US Economy #Covid19 #Stock Market #Bear MarketCOVID-19 and secular stagnation - the next business cycle

16 Jun 2020 - Dario PerkinsCOVID-19 has resolved our most popular client question of the last five years – “when will this cycle end?’ Even as the number of infections slows and the lockdowns end, most economies will reopen to a serious global.

#Federal Reserve #Monetary Policy #Equities #Bond markets #Covid19Further stimulus needed

10 Jun 2020 - Dario PerkinsAs the global economy exits “lockdown”, improving macro data will provide a further boost to investors determined to look-through the deepest economic contraction they will see in their lifetimes. Yet the economic.

#Covid19Macro policy vs Covid-19 - Has policy done enough?

26 May 2020 - Dario PerkinsThe recovery in investor sentiment since March has been impressive (even puzzling...). Back then, as the global economy entered lockdown, a “flight-to-safety” rapidly became disorderly, leading to an outright.

#Central Banks #Balance Sheet #Fiscal Policy #Covid19The war on deflation

15 May 2020 - Dario PerkinsThe COVID-19 pandemic has forced governments and central banks to work together to support the economy. While most investors welcome these efforts – it is the reason global asset prices have recovered from their March.

#Central Banks #Monetary Policy #Inflation #Recession #Covid19 Client Login

Client Login Contact

Contact