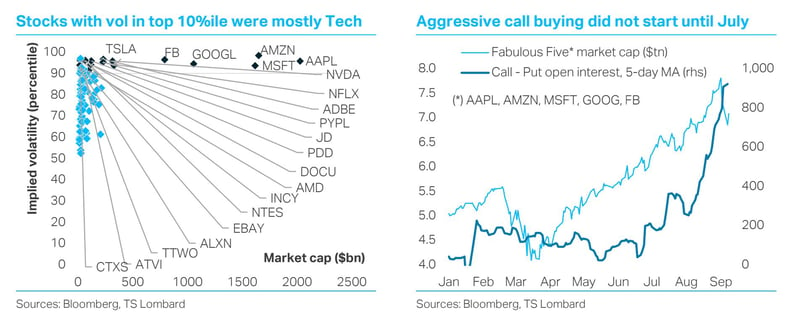

Tech selloff may soon be over – but for how long?

10 Sep 2020 - Andrea CicioneBubble behaviour is clearly visible in the marketplace… Calling the top of a bubble is as hard as winning the lottery. The signs of the mature stage of bubble formation are becoming increasingly evident – leveraged risk.

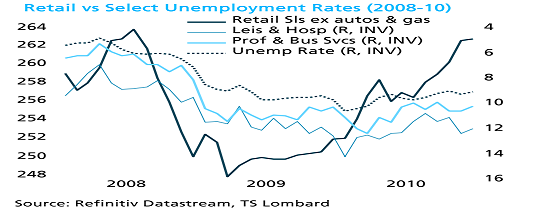

#Equities #TechnologyRetail boosted by equities, not $600

17 Aug 2020 - Steven BlitzThe $600 top-up in unemployment benefits is critical for those getting the funds, but its absence means less to overall retail spending than many opine. More critical to the revival in retail spending is the recovery in.

#Equities #Covid19 #Unemployment #Retail SalesBubbles, Covid-19 and digital disruption

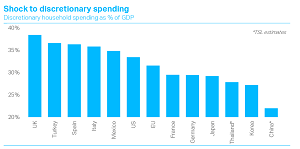

07 Aug 2020 - Dario PerkinsArguments about a bubble in equities continue, with US tech at the center of the dispute. Some are drawing comparisons with Dotcom in the 1990s. Yet the economic risks are greater this time. Big tech companies provide.

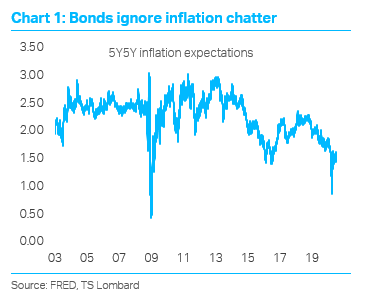

#Equities #Technology #BubbleRoad to inflation

27 Jul 2020 - Dario PerkinsInflation remains an important theme for our clients. Perhaps this reflects supreme confidence in the policies governments and central banks have introduced to support their economies during the COVID-19 pandemic. With.

#Central Banks #Inflation #Equities #Covid19 #UnemploymentWill Coronavirus collapse small banks?

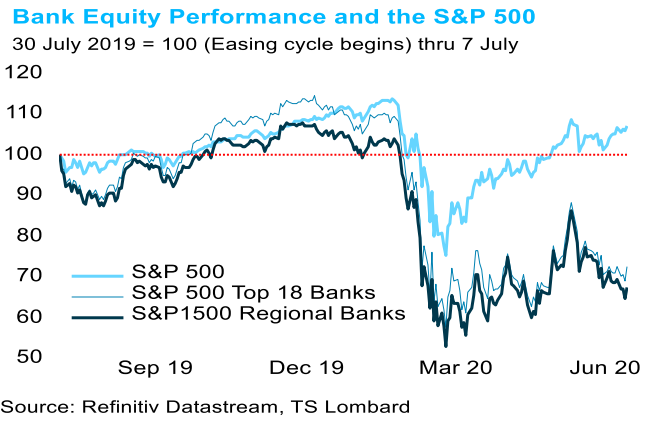

14 Jul 2020 - Steven BlitzEquity market participants are putting banks in the performance penalty box, likely figuring on stressed balance sheets becoming problematic later this year. The equity market has it right, in our view. Comparing the.

#Federal Reserve #Inflation #Equities #Balance SheetInvestors can’t rely on central banks

24 Jun 2020 - Dario PerkinsThe bounce in global stock markets since March has been both spectacular and a bit puzzling. Despite widespread gloom among institutional investors about ‘fundamentals’ – concerning both the macro outlook and the.

#Central Banks #Federal Reserve #Liquidity #Equities #Fiscal Policy #Covid19 #Bear MarketCOVID-19 and secular stagnation - the next business cycle

16 Jun 2020 - Dario PerkinsCOVID-19 has resolved our most popular client question of the last five years – “when will this cycle end?’ Even as the number of infections slows and the lockdowns end, most economies will reopen to a serious global.

#Federal Reserve #Monetary Policy #Equities #Bond markets #Covid19World slump - weak rebound

26 Mar 2020 - Charles DumasWidespread hopes for a V-shaped recovery from the impending recession will probably be dashed. And stock markets are only likely to rebound sharply if they fall a lot further from here – at Tuesday's Close the S&P index.

#Equities #Recession #Covid19 #Bear MarketThe bear and fear stalk the world

10 Mar 2020 - Charles DumasGlobal spread of the Covid-19 virus looks likely to cause a worldwide recession and bear market in stocks. Nobody knows how serious the disease is likely to be. But The Brookings Institution’s estimates suggest a.

#Equities #Recession #Covid19 #Stock Market #Bear MarketCredit Risk

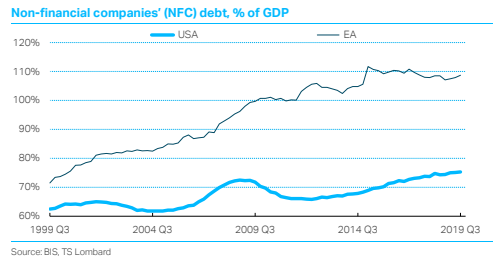

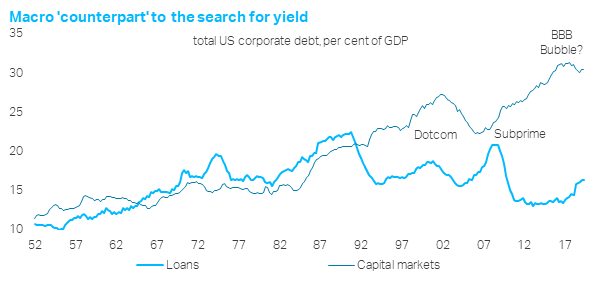

20 Dec 2019 - Dario PerkinsBack in 2018, we warned about what we called the ‘Buy-side Bubble’. To the extent we could identify vulnerabilities in global markets, the clearest danger involved a powerful search for yield. Investors had naturally.

#Equities #Yield curve #Stimulus #Capital Markets #Bubble Client Login

Client Login Contact

Contact