Commodities: burden of proof is with the bulls

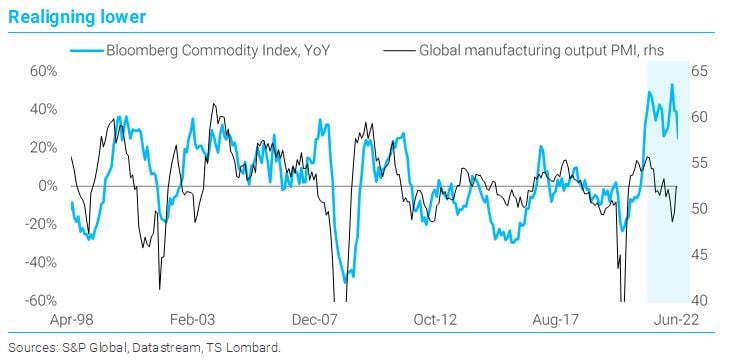

07 Jul 2022 - Konstantinos VenetisThe breadth of the commodity rally started narrowing in early March, when the dust from Russia-Ukraine shock began to settle. Industrial metals topped out first and rolled over decisively in April – around the same time.

#Federal Reserve #China #CommoditiesThe year of the payback

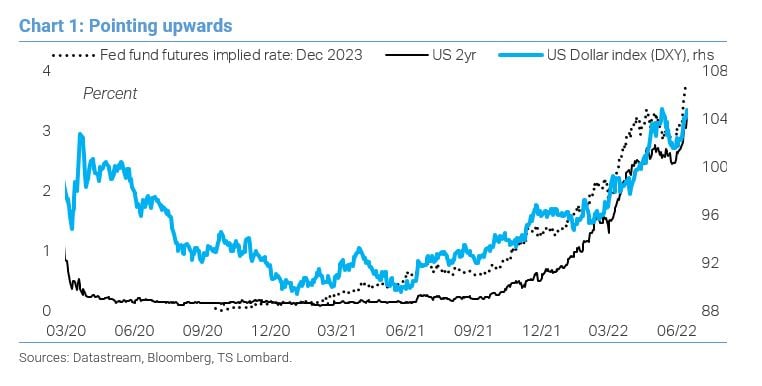

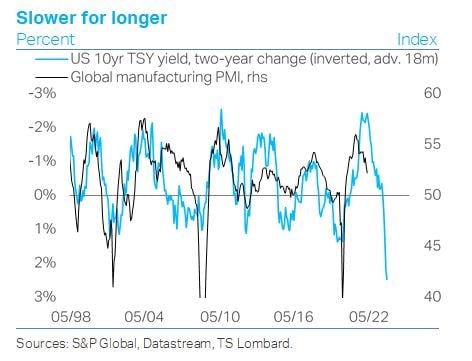

20 Jun 2022 - Konstantinos VenetisThe markets remain caught in the pincer movement between a hawkish Fed and slowing world growth: 2022 is “payback year” following the outsized gains of 2021. Inflation looks like it is about to peak but at the same time.

#Federal Reserve #Monetary Policy #Inflation #China #OPECFOMC commits to recession - are they late on this too?

16 Jun 2022 - Steven BlitzPowell told us policy is going to create a recession, but soft peddled it enough to leave markets to figure that out for themselves. After all, the FOMC is still very much in the clench of a dance between its objective.

#Federal Reserve #Monetary Policy #Recession #US EconomyAll eyes on oil as the commodity rally narrows

13 Jun 2022 - Konstantinos VenetisCommodity prices continue to trend higher but the breadth of the rally has narrowed: industrial metals have corrected lower in 2022 Q2, leaving energy prices to pull the cart. Where do we go from here? The case for a.

#Federal Reserve #OPEC #Commodities #OilA recession to tame inflation?

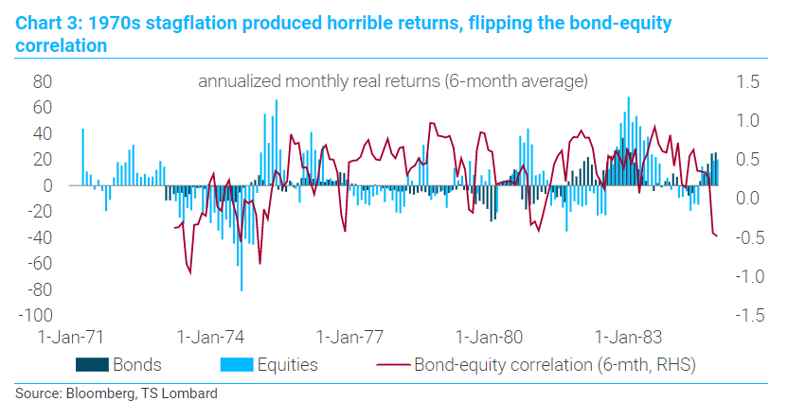

19 May 2022 - Dario PerkinsThere is currently a big debate about whether central banks will need to generate a recession in order to force inflation lower. For the doves, such action is not necessary – because the “cure for high prices is high.

#Central Banks #Inflation #Eurozone #RecessionFed funds target rate is >4%, if...

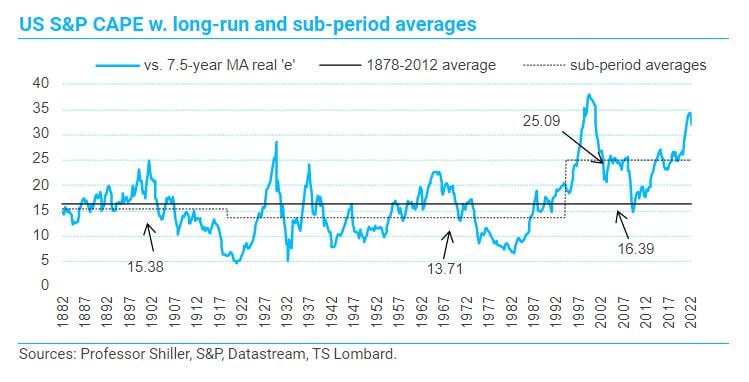

18 May 2022 - Steven BlitzThe shock of 2021, friction in global sourcing of capital and labour, brings back the output gap as a determinant of inflation and thus returns some slope to the Phillips Curve. This makes the “is inflation peaking”.

#Federal Reserve #Monetary Policy #Inflation #US EconomyThe cycle starts to bite

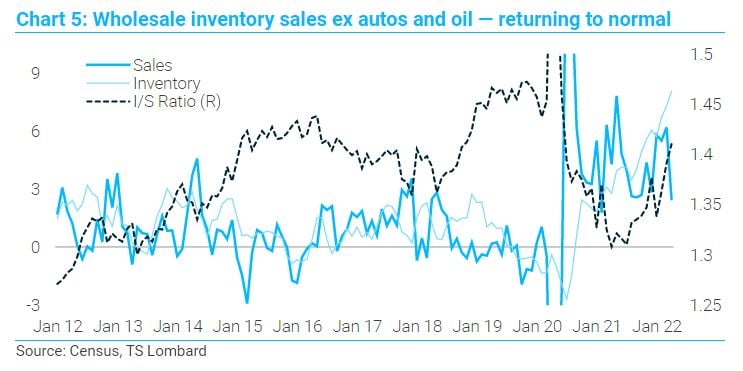

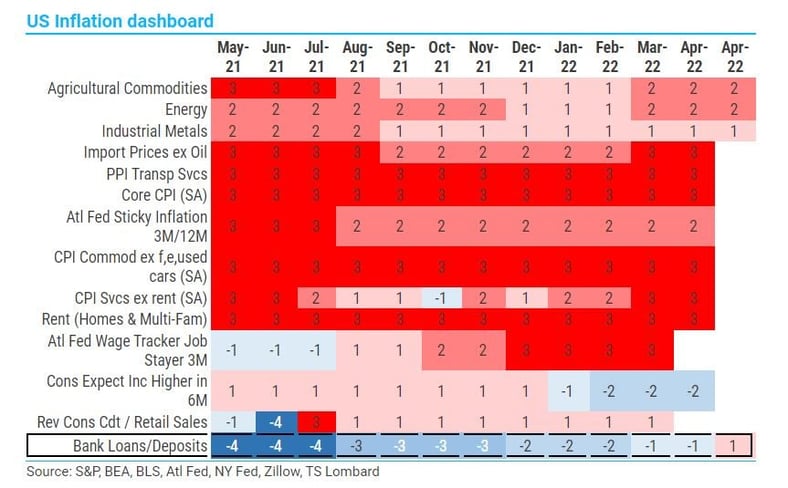

11 May 2022 - Konstantinos VenetisThe macro story of 2022 is “higher-for-longer inflation” that is forcing central bankers across the major DMs, led by the Fed, to tighten into slowing growth. Going into this year, a slew of high-frequency indicators.

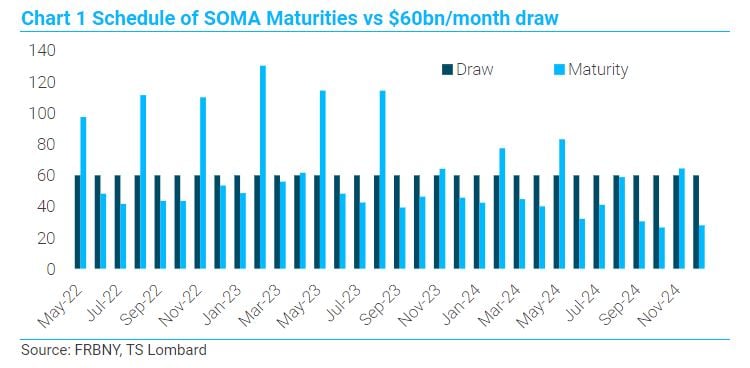

#Federal Reserve #Inflation #China #Bond marketsQT's inflationary potential is real

25 Apr 2022 - Steven BlitzMarkets will not truly consider the Fed serious about inflation until policy stresses markets by pulling up real yields to some critical level. The Fed turns serious once they recognize that deteriorating global.

#Federal Reserve #Monetary Policy #Inflation #US EconomyGet ready for the super-charging of US-China decoupling

21 Apr 2022 - Grace FanNearly two months into the Russia-Ukraine war, US policymakers – troubled by Beijing’s pro-Kremlin rhetoric – are forging ahead with robust plans to accelerate US-China decoupling. Of the five major decoupling pathways.

#Equities #China #Technology #DecarbonomicsUS CPI - Where to from here is what matters, not the "peak"

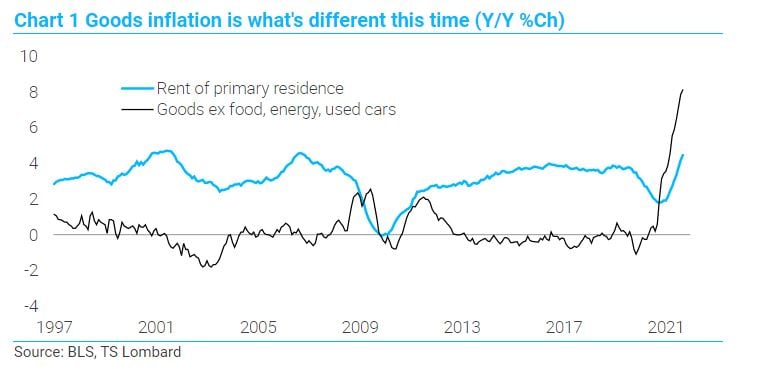

14 Apr 2022 - Steven BlitzMarch CPI data came in as expected, driven up by energy and a smattering of services – but goods prices ex food and energy fell 0.4% m/m, and this is key. The “secret sauce” of low core inflation for a generation has.

#Federal Reserve #Monetary Policy #Inflation #Recession #US Economy Client Login

Client Login Contact

Contact