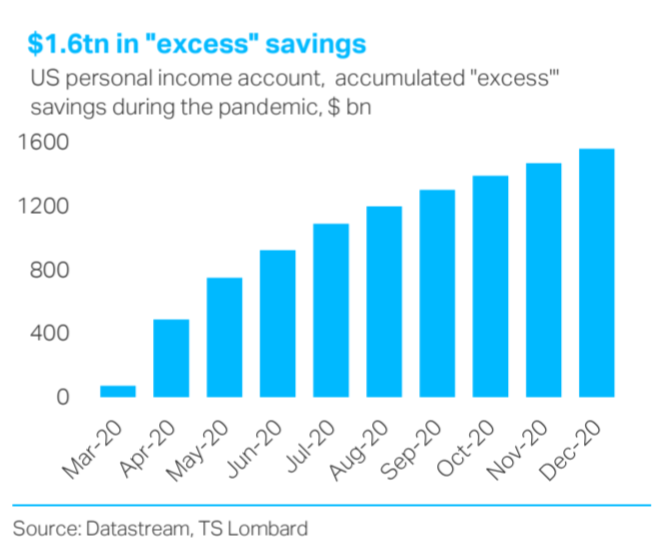

Households $1.6tn in “excess” savings, inflation to take off?

01 Mar 2021 - Shweta SinghHeadline figures overestimate the “excess” savings that households have accumulated since the outbreak of the pandemic. To be sure, the personal saving rate will fall as consumers spend more of their disposable income.

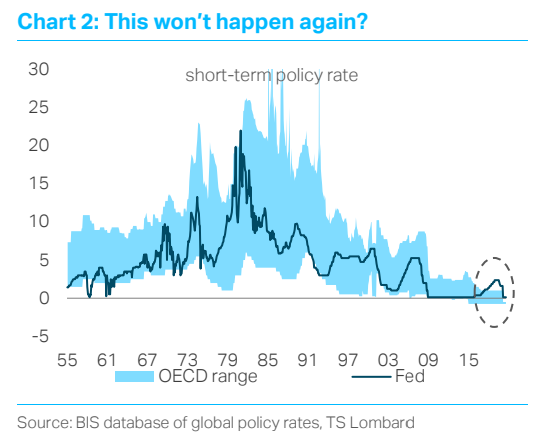

#Federal Reserve #Inflation #US EconomyThe Fed hits a wall

29 Jan 2021 - Steven BlitzThe Fed may not be out of ammo, but the ammo they have may be futile in curtailing the financial instability that policy is creating. Bitcoin, call-option vigilantes, SPACs and market hype generally were topics the FOMC.

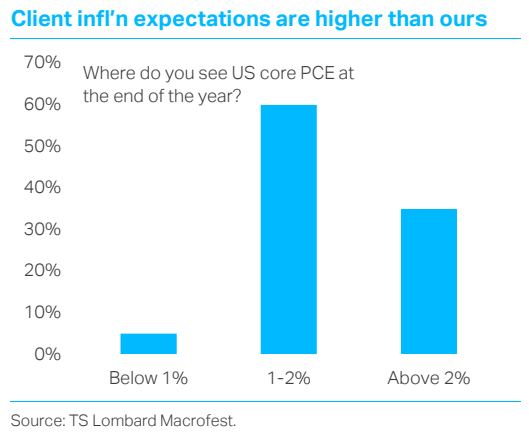

#Federal Reserve #Inflation #US Economy #Yield curve #BubbleWhat is normal anyway? Our clients respond

22 Jan 2021 - Oliver BrennanAt our MacroFest virtual event on 12th and 13th January, we discussed the outlook for global growth, global markets, energy, deglobalization and, of course, COVID-19, among many other topics. As a follow-up to the.

#Inflation #Eurozone #Emerging Markets #Covid19 #Currencies #USD #VaccineCentral Banks are changing

30 Sep 2020 - Dario PerkinsOnce upon a time, it was my job to advise the UK government on the Bank of England’s policy remit, which the Chancellor has the option of adjusting every year. I’m sure whoever is in that role today is spending much of.

#Central Banks #Federal Reserve #Monetary Policy #European Central Bank #InflationRoad to inflation

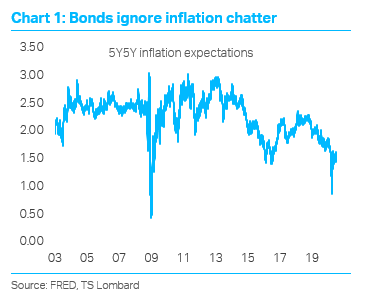

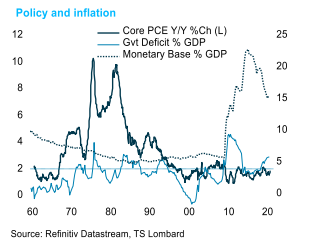

27 Jul 2020 - Dario PerkinsInflation remains an important theme for our clients. Perhaps this reflects supreme confidence in the policies governments and central banks have introduced to support their economies during the COVID-19 pandemic. With.

#Central Banks #Inflation #Equities #Covid19 #UnemploymentWill Coronavirus collapse small banks?

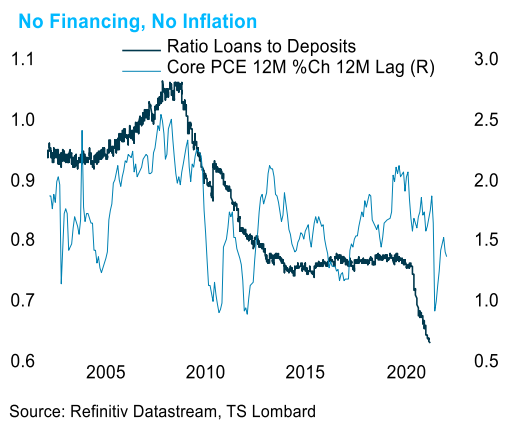

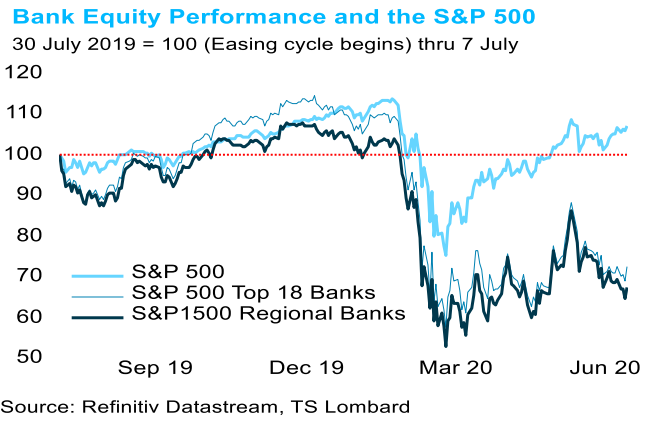

14 Jul 2020 - Steven BlitzEquity market participants are putting banks in the performance penalty box, likely figuring on stressed balance sheets becoming problematic later this year. The equity market has it right, in our view. Comparing the.

#Federal Reserve #Inflation #Equities #Balance SheetThe war on deflation

15 May 2020 - Dario PerkinsThe COVID-19 pandemic has forced governments and central banks to work together to support the economy. While most investors welcome these efforts – it is the reason global asset prices have recovered from their March.

#Central Banks #Monetary Policy #Inflation #Recession #Covid19Roadmap for US inflation

23 Apr 2020 - Steven BlitzThe near-term inflation outlook for the US economy is straightforward – there is none. Demand has collapsed, not supply, and there is no way that inflation will pick up until demand rises at least to meet supply. There.

#Inflation #US EconomyFire starter?

21 Apr 2020 - Dario PerkinsPolicymakers all over the world have responded forcefully to COVID-19, using war-time analogies to justify massive expansions in their budget deficits. With governments adding up to 20% pts of GDP to their national.

#Monetary Policy #Inflation #Debt #Covid19Is the consensus wrong?

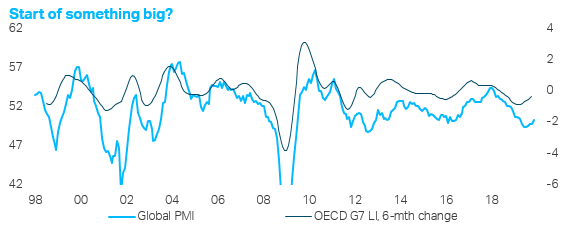

09 Jan 2020 - Dario PerkinsThis is the time of year when economists across the financial sector are busily marketing their chunky ‘year ahead’ volumes. There is an old joke that the savvy investor should take note of whatever consensus emerged.

#Central Banks #Inflation #2020 outlook Client Login

Client Login Contact

Contact