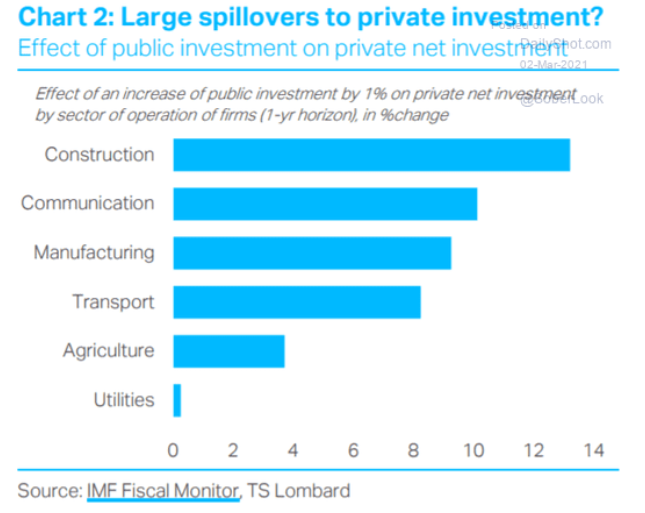

EU recovery fund – which sectors get the funds?

03 Mar 2021 - Davide OnegliaThe €750bn Next Generation EU Fund (NGEU, aka EU Recovery Fund) has been launched to prevent the asymmetric impact of the pandemic from exacerbating existing growth divergence across member states and to lift long-term.

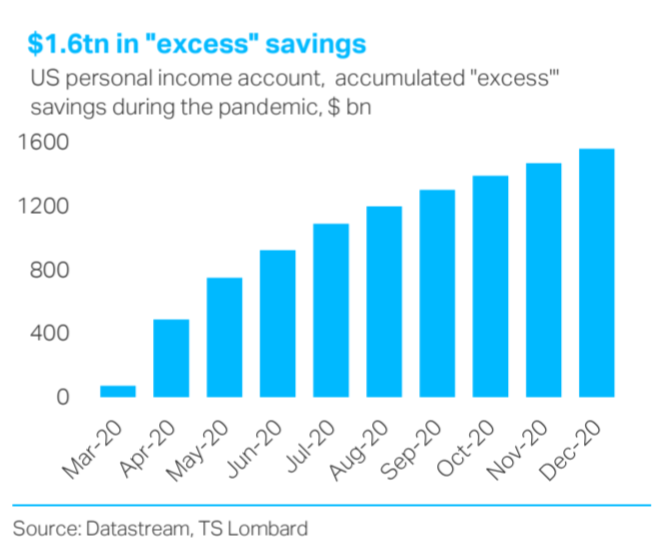

#Eurozone #Fiscal PolicyHouseholds $1.6tn in “excess” savings, inflation to take off?

01 Mar 2021 - Shweta SinghHeadline figures overestimate the “excess” savings that households have accumulated since the outbreak of the pandemic. To be sure, the personal saving rate will fall as consumers spend more of their disposable income.

#Federal Reserve #Inflation #US EconomyCommodity Supercycle now on? Potential is there

01 Mar 2021 - Konstantinos VenetisThere are two questions that the current debate on the commodity cycle tends to conflate. Does the rally that kicked off in spring 2020 have further to go? And are we in the early stages of a so-called “supercycle”,.

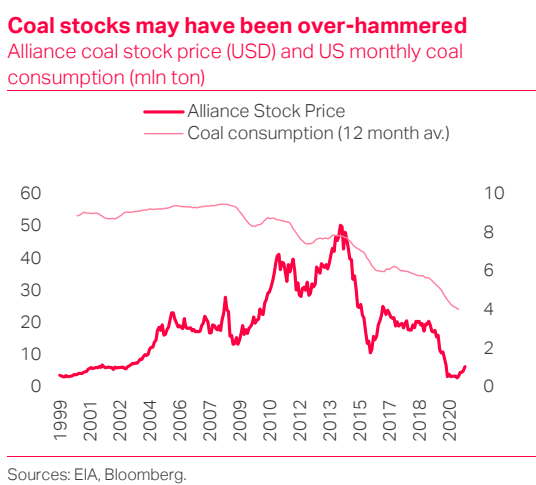

#Federal Reserve #Stimulus #Commodities #OilThe undead fuel

25 Feb 2021 - Marcus ChenevixThe disappearance of coal from the global energy mix follows a set pattern: precipitate decline from the peak leads not to swift terminal extinction but, for a prolonged interim, a zombified plateau. After good spells.

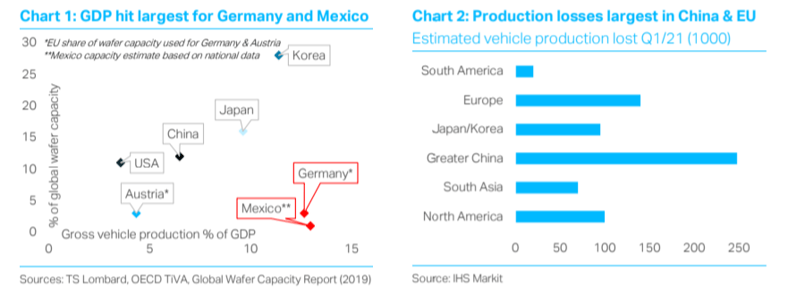

#Energy #Decarbonomics #Climate ChangeChip Famine and the new OPEC

19 Feb 2021 - Rory GreenSurging demand for semiconductors is putting pressure on vehicle production and US-China relations. Taiwan and Korea are the prime beneficiaries, insatiable demand for their exports and rising prices adds conviction to.

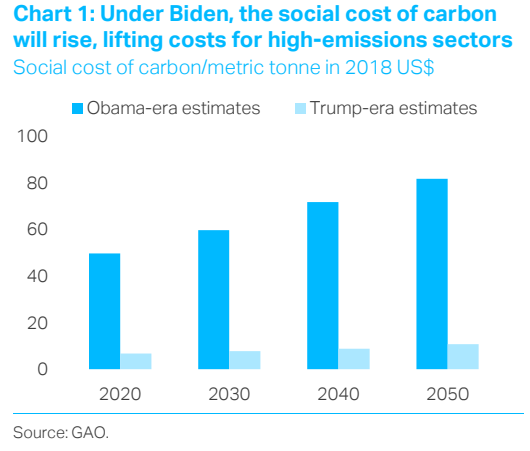

#Trade War #China #Technology #OPEC #Semiconductors #GeopoliticsBiden's first climate moves and GM blaze the trail

16 Feb 2021 - Grace FanWith his first string of executive orders, Biden has made clear that climate policy is core to his administration, as we anticipated. This sets the stage not only for coordinated global climate action but also concrete.

#Decarbonomics #Climate ChangeGeopolitical Spotlight shifts to semiconductors - the new oil

10 Feb 2021 - Rory GreenThe structural shift in demand for semiconductors moves the focus of global geopolitics and finance from the Persian Gulf to the South China Sea. The rapid acceleration of the “internet of things”, to-date and to-come,.

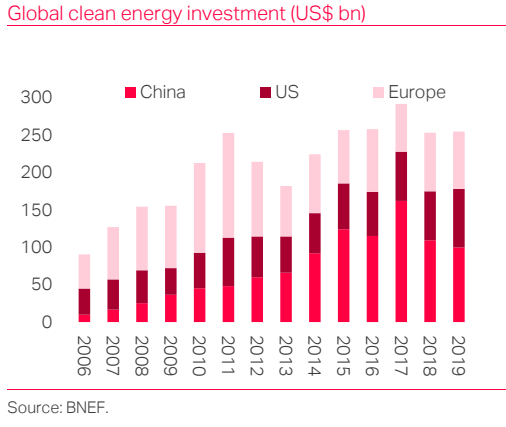

#China #Oil & Gas #OPEC #Semiconductors #GeopoliticsChina's green revolution

08 Feb 2021 - Eleanor OlcottThe expansion in coal power production towards the end of last year cast doubts on Xi Jinping’s pledge made at a UN summit in September for China to achieve carbon neutrality by 2060. The PRC’s overreliance on coal is.

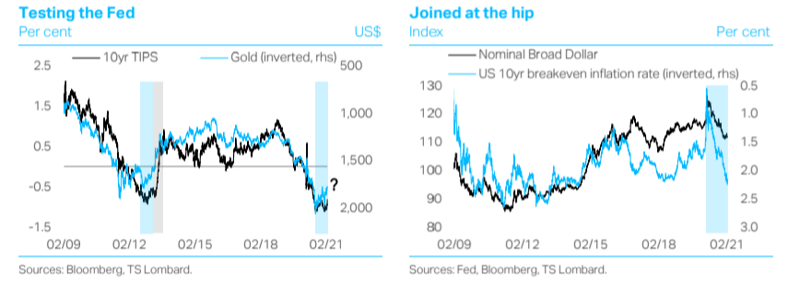

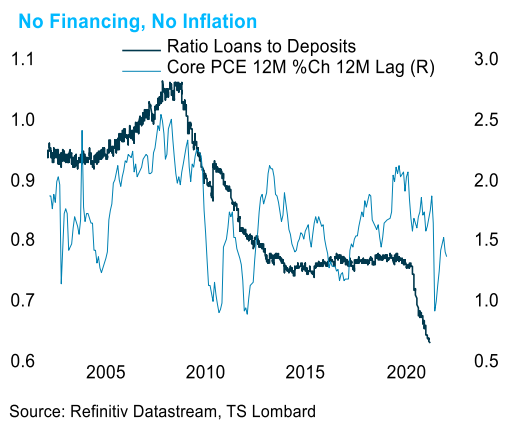

#China #Decarbonomics #Climate ChangeThe Fed hits a wall

29 Jan 2021 - Steven BlitzThe Fed may not be out of ammo, but the ammo they have may be futile in curtailing the financial instability that policy is creating. Bitcoin, call-option vigilantes, SPACs and market hype generally were topics the FOMC.

#Federal Reserve #Inflation #US Economy #Yield curve #BubbleOn the road in India with protesting farmers

29 Jan 2021 - Amitabh DubeyThe farmers remain determined despite protracted protests. At the farmers’ protest site at Ghazipur on Delhi’s eastern border with Uttar Pradesh, the atmosphere had been determined and upbeat when I visited 2 weeks ago..

#Emerging Markets #India Client Login

Client Login Contact

Contact